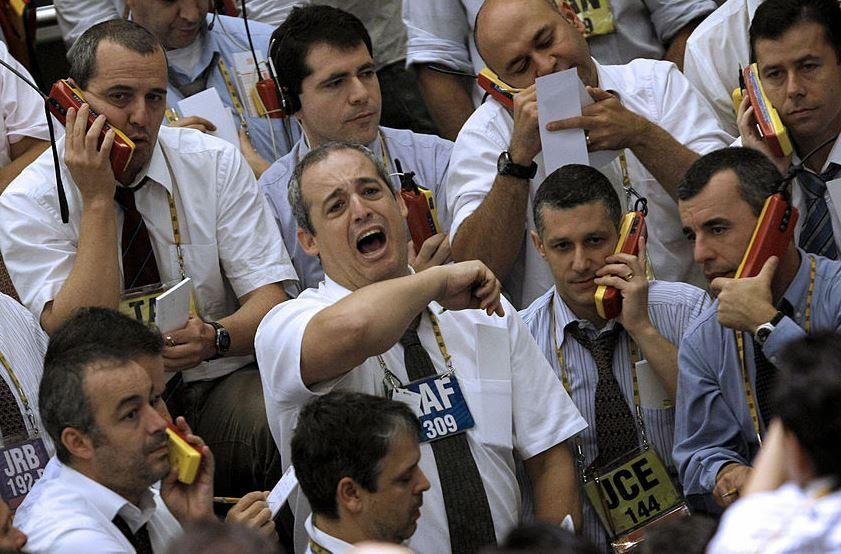

Stocks in Europe and the US endured a painful sell off yesterday.

The bearish sentiment was fuelled by the health crisis as Covid-19 cases and hospitalisations increased, and to add insult to injury, governments tighten restrictions. When the pandemic set in, medical experts warned that even if the virus is controlled during the summer months, the crisis is likely to pick-up in severity as winter approaches. That is exactly what we’re are seeing at the moment. The fear in the markets is nowhere near as bad as it was back in February and March, but the mood music is the worst it has been since spring.

The DAX 30 lost over 4% while the FTSE 100 and the CAC 40 fell by 2.5% and 3.3% respectively. During the day it was announced that Germany will reintroduce tougher restrictions for one month. A few hours after the close of trading in Europe, it was revealed that France is also going down the route of tougher restrictions. The US has its own coronavirus issues too and the absence of a stimulus was also a factor in the negative move. There was a big decline on Wall Street as the S&P 500 fell just over 3%, while the NASDAQ 100 dropped 3.9%.

Overnight, the Bank of Japan kept interest rates on hold at -0.1%, meeting forecasts. A few adjustments were made to its economic predictions, as the growth forecast for the current fiscal year is now -5.5%, down from -4.7%, but next year’s prediction was upped to 3.6% from 3.3%. The new core consumer price forecast is -0.6%, down from -0.5%. Stocks in Japan are a little lower, while large losses have been incurred in Hong Kong and Australia – the fallout from the negative move seen in the Europe and the US yesterday. Equities in mainland China are bucking the trend by pushing higher. US index futures have recouped some ground and European stock markets are poised to rebound, broadly speaking.

The US dollar index hit its highest level in over one week as dealers turned their backs on assets that are deemed to be riskier – stocks and commodities. Dealers have been seeking out the greenback lately whenever the mood in the markets turns sour. The greenback is likely to remain popular in the near term as fear surrounding the health crisis appears to be spreading.

Commodities took a beating yesterday. The performance of metals and energies are typically tied to the perceived health of the global economy, and traders took the view that the tougher restrictions are likely to chip away demand. Copper, silver, platinum and palladium, all registered large declines. Gold took a knock too on the back of the surge in the dollar. Historically, the commodity has attracted safe haven flows, but more recently the greenback has become a risk-off play, and that seems to be overriding any increase in demand that gold might see. Oil was under pressure during the session on account of the broader bearish sentiment. The energy information administration update showed that US oil stockpiles surged by 4.3 million barrels, which was way above the 1.25 million barrels forecast. The report suggests that demand is weak.

The ECB meeting is likely to be an uninteresting event as no changes to the monetary policy are expected. The refinancing rate and the deposit rate are tipped to remain on hold at 0.00% and -0.5% respectively. In light of the deteriorating health situation and tougher restrictions, it is likely that Christine Lagarde, ECB’s chief, will caution that the downside risks have increased. In June, the pandemic emergency purchase programme (PEPP) was upped by €600 billion to €1.35 trillion, so the central bank has already mapped out an extensive plan to try and tackle the health crisis, and they are unlikely to ramp up the PEPP, unless there is a sharp fall in economic activity in the region. Central bankers like to wheel out the line that they are monitoring the situation, and that they will act if necessary, so Lagarde will probably say something along those lines. The interest rate announcement will be made it 12.45pm (UK time) and the press conference will follow at 1.30pm (UK time).

The German unemployment rate for October is tipped to hold steady at 6.3% and the unemployment change report is expected to drop by 5,000. The reading will be published at 8.55am (UK time).

At 9.30am (UK time), the Bank of England credit report will be published and the September reading is still tipped to be £750 million, and that would be an increase from the £300 million registered in August. The mortgage lending report is tipped to be £3.79 billion, and mortgage approvals are expected to be 76,110.

The US advance GDP reading for the third quarter is expected to be 31%, and keep in mind the economy contracted by 31.4% in the second quarter. The initial jobless claims reading is expected to fall from 787,000 to 775,000, and the continuing claims report is tipped to be 7.7 million, which would be a fall from 8.37 million in the last week. The reports will be published at 12.30pm (UK time).

The preliminary reading for German CPI will be posted at 1pm (UK time). Economists are predicting the reading to be -0.3%, and keep in mind the September reading was -0.2%.

EUR/USD – has been moving higher since late September and if the positive move continues it might retest the 1.2000 area. A move below 1.1684, should put 1.1612 on the radar.

GBP/USD – recently retreated from a six week higher and while it holds above the 100-day moving average at 1.2871, the uptrend should continue. 1.3269 might act as resistance, and a move beyond that mark, could put 1.3515 on the radar.

EUR/GBP – while it holds above the 0.9000 mark, it might look to retest the 0.9157 area. A break below 0.9000 could see it target 0.8864.

USD/JPY – remains in the wider downtrend and if the negative move continues it could target 104.00. A rally might run into resistance at the 50-day moving average of 105.50 and a move above that, could see it target 107.00.