2016 turned out to be a bit of a shocker for the pound which had its worst year since 2008, falling 16% against the US dollar and 11.5% against the euro, as a result of the outcome of the Brexit referendum vote.

The pound had already been under pressure heading into 2016 having been on the slide against its major trading partners since the Scottish referendum in 2014, only managing to post a positive performance against the euro and Australian dollar in 2015 largely as a result of further easing from both the ECB and the RBA.

Additional pressures came from expectations that the US Federal Reserve was building up to raise rates further, a fact that swiftly came to pass at the end of last year.

Sentiment surrounding the pound wasn’t helped by the hysteria that followed the referendum vote. There was no limit to Private Frazier predictions of “we’re doomed” from across the mediums of academia, media and politics about the risks of the referendum vote and any possible negative outcomes if article 50 were to be triggered.

Those concerns aside, the triggering of article 50 saw the pound rise, while the final GDP numbers showed that the UK economy grew by 1.6% in 2016, slightly down from the 2.1% in 2015, and 3.3% in 2014, with 2017 likely to come in at 1.5%.

This figure of 1.5% GDP growth is not without its concerns given a build-up of consumer credit, though it certainly wasn’t unreasonable to surmise that a lot of the hysteria from both sides was slightly over the top towards the end of last year and beginning of this year.

Taking this into account,we warned last year of the risks of thinking too much in one dimensional terms when it came to assessing the outlook for sterling and the risks of further declines.

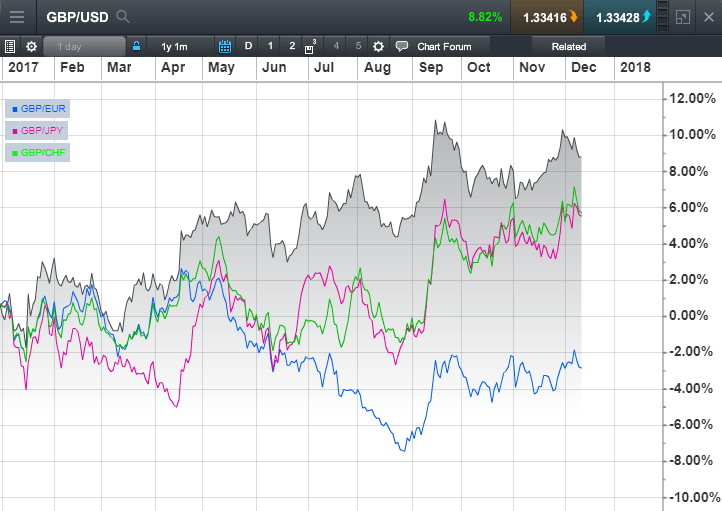

The calls for parity against the US dollar and euro may have made all manner of headlines but as we stated at the time currencies don’t operate in a vacuum. We can see this from events in the US and Europe, as while the euro has made some gains, the US dollar has struggled despite three interest rate rises.

While the political situation in the UK remains fraught, even more so after Prime Minister May’s unfortunate decision to call an early election backfired, the pound has held up well so far this year, helped by the Bank of England’s decision to reverse last year’s rate cut. It has lost ground against the euro, as economic conditions have improved throughout Europe, prompting speculation that the European Central Bank will step back from its currently easy monetary policy.

The recent agreement to move on to trade talks having apparently settled the question of citizens’ rights, the divorce bill and the Irish border, only opens up the prospect of more political brinkmanship throughout the next 12 months, as the question of the future relationship gets thrashed out.

On the outlook for central banks, barring any political intervention, the risk is that the market is under-pricing the risk of a further rate rise from the Bank of England in the near future. Inflation is already at five year highs of 3.1% and could well move higher, despite the persistent claims that we are close to peaking. We continue to hear the persistent narrative that the reason for current elevated levels of rising inflation is all as a result of the June 2016 Brexit vote.

It’s imperative to underline how misleading that claim is. While it is true that the decline in sterling as a result of the vote did push inflation up as the pound slid back, the Bank of England exacerbated the inflation shock by not only its reaction to that vote in August 2016, but also in its September 2016 forward guidance when it stated that it was prepared to cut rates further.

To pretend otherwise is sophistry of the worst kind and can be borne out by the chart below, in the context of an additional 8% decline in the value of the pound against the US dollar, the aftermath of the August vote, and the dovish September follow-up.

Source: CMC Markets

As a result the pound only started to find a base in the early part of this year, suggesting that current levels of inflation might only start to turn back lower during the first quarter of next year.

It is therefore even more important that we see evidence of wages edging higher. This process may well improve if today’s average earnings numbers (which saw a rise to 2.3% in the three months to October) are indicative of an improving trend. If this trend continues and inflation starts to fall back in the next three months, then the pound could find further support if wages start to move above CPI.

Source: CMC Markets

This in turn could see expectations of further interest rates rises start to gain traction as we look ahead to 2018. Having said that the currency situation remains much less clear since the lows of $1.2000 earlier this year, when the risks were more tilted to the upside.

The technical break of 1.3600 last year, the previous 35 year low was, and remains a negative development, and thus far the rebound we’ve seen this year has been capped here, with solid support at the lows between 1.1900 and 1.2000.

Source: CMC Markets

While the political situation in Europe has improved having navigated the various elections, we still have the small matter of an Italian election on 4th March next year, while we still don’t have a functioning German government a full three months after the September vote.

This vacuum could complicate the pace of Brexit talks over the next twelve months, as could the reaction function of the European Central Bank as it tapers its bond buying program. Plus the outlook for US rate policy is not as clear as it once was given that the US Federal Reserve board could have a completely different look and feel under the new leadership of Jerome Powell.

Add in the possibility that we might see the current government fall, plus the prospect of a new election which could augur in an anti-business Labour government and the risks for the pound are evenly split, between a retest of the 1.3600 level and a move up to $1.4000, against a sharp drop below 1.3000 towards the lows this year.

The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.