Wall Street snapped a two-day winning streak as bond yields climbed again amid recession fears after the Minneapolis Federal Reserve president Neel Kashkari confirmed a continuation in rate hikes until there is clear evidence of a cooling in core inflation.

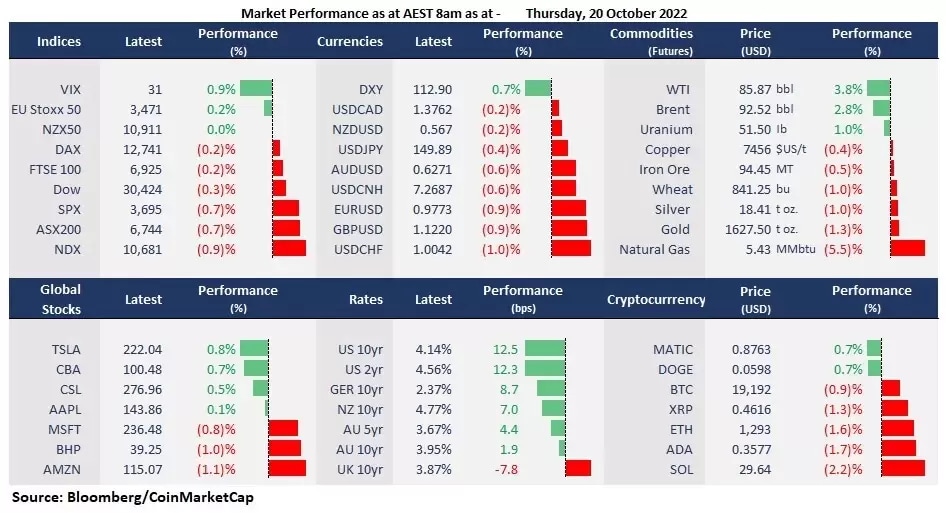

The US 10-year bond yield jumped to 4.13% from just under 4% a day ago, causing a pullback in equity markets, despite a surge from Netflix and United Airlines, amid strong earnings reports. However, Tesla’s shares fell 3% in after-hours trading due to a miss on revenue expectations. Elsewhere, the UK also reported 40-year high inflation of 10.1%, back to the peak in July, due to a jump in food and non-alcoholic beverages prices.

- Tesla’s shares slumped 3% after-hours as the EV maker missed sales revenue expectation, but beat the EPS estimate in the third quarter. The company’s Q3 revenue is at $21.45 billion vs the $21.96 billion expected, or 55% growth from a year ago, down from 57% the prior year. EPS is $1.05 vs the $0.99 estimated. The result sparks demand concern amid global headwinds, especially China’s slowdown.

- Energy is the only sector in the S&P 500 that closed in green, up 2.9%, while real-estate suffered from high rates and led broad losses, down 2.6%. Mega-cap tech shares were mixed, with Apple marginally up, but both Alphabet and Amazon down more than 1%. Netflix surged 13% amid positive earnings

- IBM’s shares jumped 5% in the after-hours trading on a beat of both EPS and revenue estimates. The company’s third-quarter revenue was reported at $14.1B vs the $13.7B expected, and the EPS came at $1.81 vs the $ 1.78 estimated.

- The UK prime minister Liz Truss’s Conservative party wins votes on the fracking ban motion. However, the UK’s September CPI came in higher-than-expected, back to the 40-year-high level after a slight drop in August. The British pound fell 0.9% against the USD, to just above 1.12, due to a drop in the UK 10-year gilt yield.

- USD/JPY approaches 150, a fresh 32-year high as the US dollar regained strength on a spike in the US bond yields, which increases traders’ bets on further intervention by the BOJ to back the Yen at such a crucial physical level.

- The offshore yuan hits a record low against the US dollar again, with USD/CNH soaring to nearly 7.27. Hong Kong stock markets fell 2.4% on the new chief executive John Lee’s plan to reverse Expat Exodus.

- Asian markets are set to open lower following Wall Street’s negative close. ASX futures were down 0.69%. Nikkei 225 futures fell 0.66% and Hang Seng Index futures declined 1.62%.

- Crude oil rebounded despite President Biden’s call to increase the US’s release from the SPR by 15 million barrels in December, as supply issues again become traders’ focus amid sticky global inflation.