Over the course of this week, government responses to omicron case numbers, and the subsequent performance of global stock markets, are likely to be the biggest influences on AUD/USD, rather than Tuesday’s RBA board meeting.

If governments around the world take the view that the covid variant is much less harmful than earlier variants of the virus, and government lockdowns are therefore not necessary, then equity markets can recover and AUD/USD will finish the week higher than where AUD/USD began the week, which was around 0.7000.

However, the medium-term AUD/USD outlook is much more supportive for USD currency strength, than strength in AUD. Implying AUD/USD will likely struggle to undertake much of a convincing lift this week. The US economy has expanded beyond its pre-covid slump, and the US unemployment rate at 4.2%, is edging closer to its pre-covid low of 3.5%.

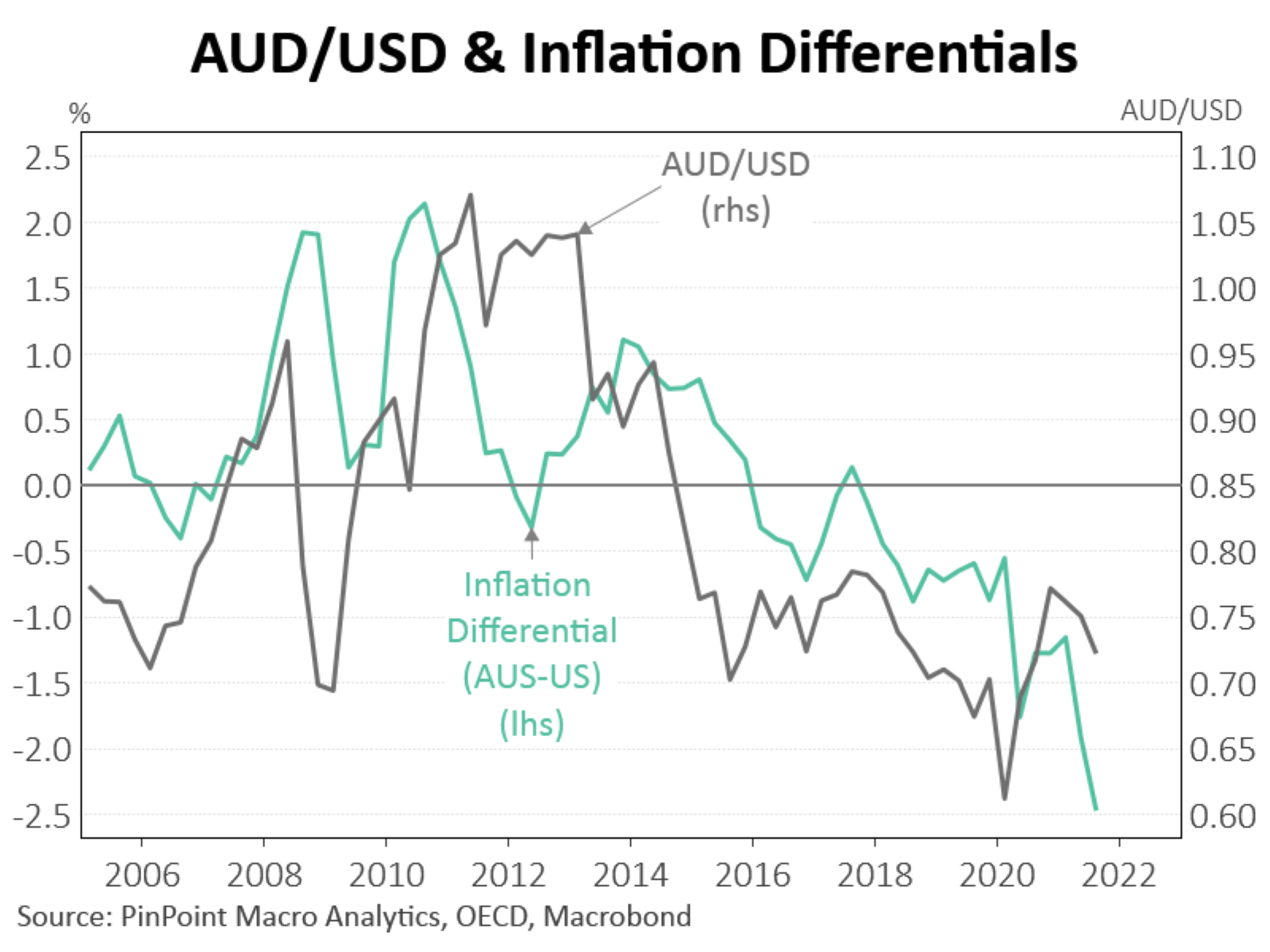

According to last week’s comments by Fed Chairman Jay Powell, the Fed is likely to accelerate its tapering of asset purchases. Market pricing for the first rise in the Fed funds rate this cycle centers around mid-2022. It will be difficult for AUD/USD to convincingly lift when in contrast to the Fed, the RBA is set on leaving interest rates unchanged because Australian inflation pressures are relatively low, and wage growth remains modest.

https://assets.cmcmarkets.com/images/AUDandInflationDiff.png

This week’s RBA meeting on Tuesday 7th December is the last RBA meeting of the year, and the last meeting until 1 February 2022. The RBA doesn’t meet in January. We are unlikely to get any significant policy changes by the RBA at this Tuesday’s meeting. Hence, the RBA board meeting is not likely to be a major moving event for the AUD/USD.

Last month there were more significant policy changes when the RBA decided to discontinue the target of 10bp for the April 2024 Australian government bond. More importantly for AUD/USD, the RBA affirmed that it “is prepared to be patient” and reinforced its commitment “to maintaining highly supportive monetary conditions to achieve a return to full employment in Australia and inflation consistent with the target”.

In combination with the RBA deciding to maintain the policy of purchasing government securities at a rate of $4 billion per week, these events applied immediate downward pressure on the Australian three-year bond yield, the Australia-US two-year bond spread, and the AUD exchange rate.

https://assets.cmcmarkets.com/images/AUDand2YearSpread.png

In tandem with the strengthening in the USD, and concerns on what the new omicron variant might mean for lockdowns and hence slower global economic activity, AUD/USD subsequently declined some 5 cents since the last RBA board meeting in early November.

Future reassessments of global economic activity, and hence the immediate outlook for AUD/USD, will be largely dependent on the actions governments around the world take regarding lockdowns.

https://assets.cmcmarkets.com/images/AUDandGlobalTrade.png

PinPoint Macro Analytics

IMPORTANT INFORMATION AND DISCLAIMER

Factual Information Only. No Investment Advice is Provided. The information contained on this document is factual information only. We do not provide trade recommendations or investment advice. The information contained on this document is not opinion. Macro Analytics Pty Ltd, ABN 65 642 332 045, is trading as "PinPoint Macro Analytics".

The source of all content on this document is believed to be accurate and reliable. All content on this document is provided in good faith. However, PinPoint Macro Analytics takes no responsibility for errors in the content provided on this document. Any content contained on this document is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a recommendation and/or investment advice.

Before acting on the information contained in this document, you should consider the appropriateness and suitability of the information to your own objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice, including tax and legal advice. PinPoint Macro Analytics will not accept liability for any loss or damage (including indirect or consequential damages) or costs which might be incurred as a result of the information being inaccurate or incomplete in any way and for any reason. This includes without limitation any loss of profit, which may arise directly or indirectly from content viewed on this document. This document may contain hypertext links, frames or other references to other parties and their documents. PinPoint Macro Analytics cannot control the contents of those other sites, and make no warranty about the accuracy, timeliness or subject matter of the material located on those sites.

PinPoint Macro Analytics do not necessarily approve of, endorse, or sponsor any content or material on such sites. PinPoint Macro Analytics make no warranties or representations that material on other documents to which this document is linked does not infringe the intellectual property rights of any person anywhere in the world.

PinPoint Macro Analytics are not, and must not be taken to be, authorising infringement of any intellectual property rights contained in material or other sites by linking or allowing links to, this document to such material on other sites. If you have any concerns regarding the content of the document, please contact PinPoint Macro Analytics at info@pinpointmacroanalytics.com.au