In the last five years, awareness on the negative and adverse impacts on climate change via excessive carbon emissions have gained significant traction in line with the acceptance and popularity on sustainability investing in the financial markets; ESG (Environmental, Social and Governance) where carbon emissions come under the “E” category of ESG. In addition, the heightened regulatory push seen in the past year for corporations to accept and embrace ESG principles has been reinforced by the influence of the current progressive Democrats in the US Congress.

Another magnificent boost to accelerate the pace of achieving net-zero carbon emissions has been the finalisation of standardised rules and global oversight in carbon markets trading for offsets in the recent concluded 26th UN Climate Change Conference (COP26) in Glasgow, Scotland in November 2021.

Mechanics of carbon markets

Carbon markets can be mandatory or operate as voluntary programmes with the aim of helping countries and corporations to reach their climate goals which form an integral part of acceleration towards net-zero carbon emissions in the fight against global climate change.

As an introduction, the function of carbon markets allows price discovery and turn carbon dioxide emissions into a commodity by giving it a price. Trading of such emissions fall into either one of the two main categories: carbon allowances or carbon offsets.

Carbon allowances work like permission slips for emissions. For example, when a corporation buys a carbon allowance usually from a government regulator, it gains permission to generate one tonne of carbon dioxide emissions (greenhouse gas). Allocation of carbon allowances allow carbon revenue to flow vertically from corporations to government regulators. Corporations that ended up with excess carbon allowances where they emit fewer tonnes of carbon dioxide than forecasted can sell such excess allowances to other corporations that exceeded their emission targets, thus creating a trading market for carbon allowances; cap-and-trade programme. Hence, carbon allowances are considered as mandatory programmes.

A carbon offset also represents one tonne of carbon dioxide but carbon revenue via offsets flows horizontally between corporations. When one corporation removes a unit of carbon dioxide from the atmosphere as part of its normal business activity such planting of tress or adopting renewable energy, they generate a carbon offset. Other corporations can purchase that carbon offset to reduce their own respective carbon footprint. Carbon offsets are generated by projects with clearly defined objectives such as building solar farms, reducing methane, or preserving of forests. Thus, carbon offsets are considered as voluntary programmes that require strict verification and validation checks to be certified as genuine that allow them to be traded anywhere in the world.

How are carbon allowances and offsets created?

Carbon allowances are issued by national or international government agencies and the previous climate change agreements; the Kyoto Protocol of 1997 and Paris Agreement of 2016 kickstarted the first international carbon markets.

The number of allowances issued annually is based on emission targets and allowances are issued under a cap-and-trade programme. Regulators of respective countries set a limit on carbon emissions which is defined as the “cap”. In addition, the “cap” will slowly decrease over time, thus making it tougher for corporations to stay within the cap which in turn “force them” to reduce their carbon footprints.

Canada, the European Union (EU), United Kingdom (UK), China, Australia, New Zealand, South Korea, Tokyo, and California have implemented some form of cap-and-trade programmes.

Hence, corporations are incentivised to reduce their carbon emissions and stay under their respective “caps”.

Carbon offsets are created on a different approach; corporations that have managed to reduce certain amount of carbon emission via reforestation programmes or investing in renewable energy can issue carbon offsets. The purchase of such carbon offsets is voluntary and corporations that brought these carbon offsets can measurably reduce the amount of their respective carbon emissions.

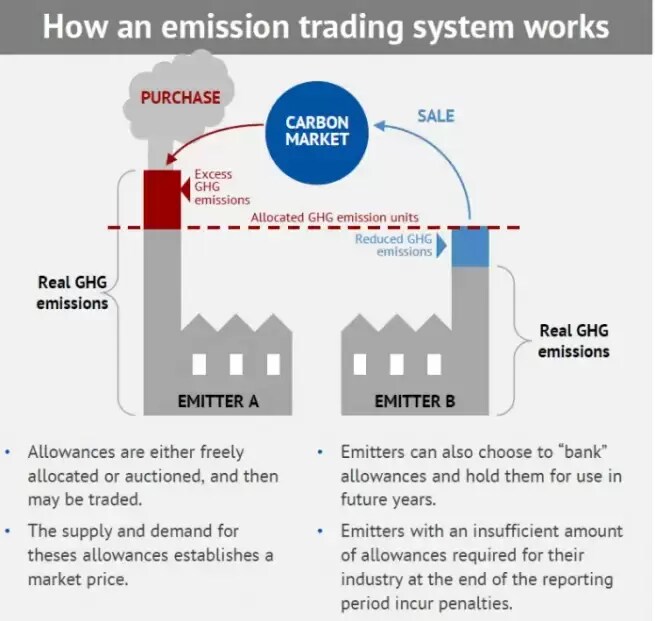

Emission trading system

Cap-and-trade programmes are regulated, and the purchase and sale of carbon allowances are operated under an emission trading system.

Each corporation that comes under a cap-and-trade programme is issued a certain amount of carbon allowances annually. Corporations that are able to produce less carbon emissions than the amount of carbon allowances being issued to them initially; created a surplus of carbon allowances.

On the other hand, some corporations with lesser climate friendly operations produce more carbon emission than the number of allowances they receive initially can purchase the available surplus of carbon allowances to offset the excess level of emissions that goes beyond the permitted level.

Our newly launch CFDs on carbon emissions forward contracts are derived based on the ICE European Union Allowance (EUA) futures that comes under the European Union Emissions Trading System (ETS) which is based on the principles of cap-and-trade programmes for carbon allowances.