Check out our daily ASX pre-market and AU macro outlook below!

Content Summary

- APAC Daily Report

- Market Snapshot & Highlights

- Global Markets Headlines

- ASX Economic Calendar

- Trading Idea of the Day

- Economic Calendars

APAC Daily Report

Click here to access our CMC APAC Morning Report, prepared by my fellow market analyst @TinaTeng_CMC

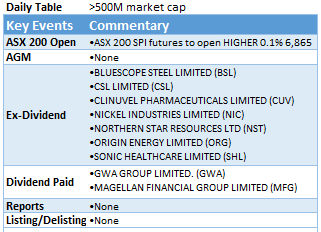

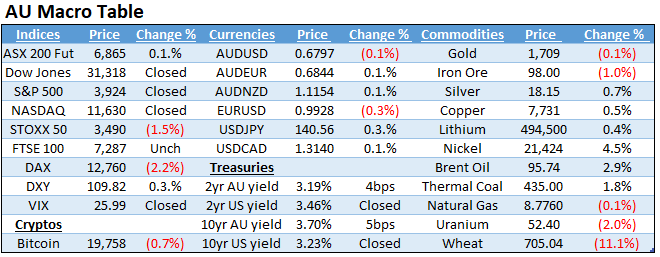

Market Snapshot & Highlights (as of 7 am AEST)

Energy expected up & Materials expected up

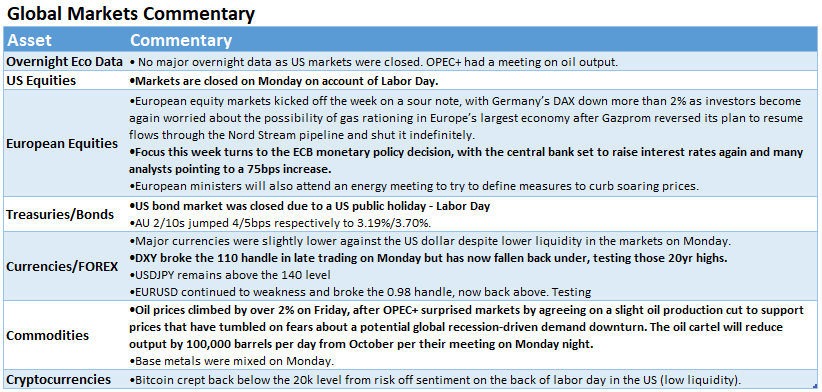

Global Markets Headlines

- Liz Truss to become Britain’s next prime minister, replacing Boris Johnson (CNBC)

- India says it will look carefully at Russian oil price cap, rejects moral duty to boycott Moscow (CNBC)

- Oil producer group OPEC+ surprises energy markets with a small production cut (CNBC)

- Euro slides below 99 cents after Russia halts gas supplies to Europe (CNBC)

- European markets close lower as Russia halts gas flows; autos stocks fall nearly 5% (CNBC)

- Global X Uranium ETF rallies as more nations consider nuclear energy (OPTO)

- A U.S recession will likely hurt Asia. Here are the countries that are most vulnerable (CNBC)

Click on the hyperlink for further information on the headlines, check out our insights panel on the CMC Markets NextGen platform or you can follow us on Twitter @Azeem__Sheriff & @CMCMarketsAUSNZfor up-to-date market news.

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO)

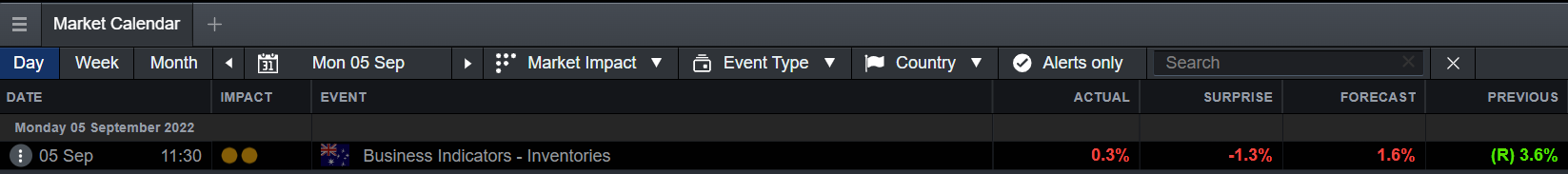

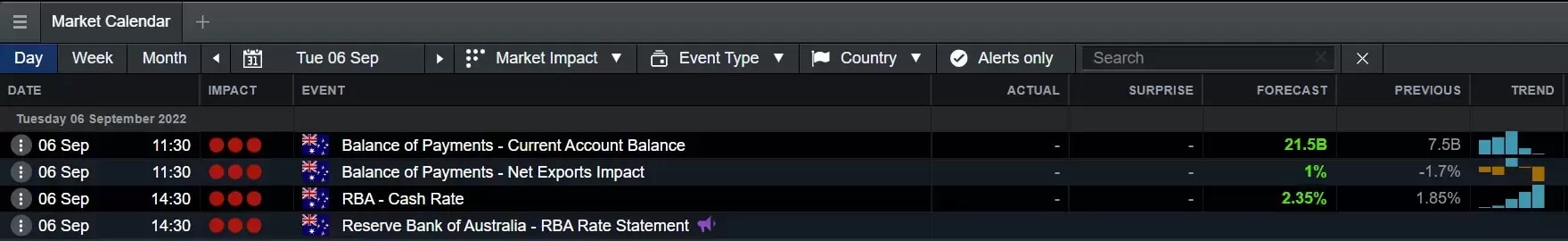

ASX Economic Calendar

Trading Idea of the Day

(NIC – Nickel Industries)

- Potential BUY

- Key levels on chart - consider taking trades from key support/resistance levels

Macro-Economic Calendar

Economic Calendar (TODAY)

Economic Calendar (YESTERDAY)