G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff - @Azeem__Sheriff

CMC Markets - @CMCMarketsAUSNZ

Trading Idea of the Day

NYSE:DUOL - Duolingo Inc - BULLISH BIAS (long term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Nearly 50 million monthly active users engage with Duolingo since Q2 2022. The company made its IPO in 2021, and management has set a goal to make learning available and fulfilling via their technology.

- The total language market is estimated to be $60b per year, and is still mostly taught offline. However, management expects to see a shift to online learning in the future.

- The company has recently re-entered the Chinese market, which is the largest English language learning opportunity. Although the Chinese market present difficulty in monetization and the possibility of change in the current political climate, if Duolingo is able to penetrate deep into the Chinese market, it opens up opportunity for a large increase in paying subscribers.

- With 3.3 million paying subscribers, the company has made $306 million in the last 12 months, and expects around $365 million in revenue for 2023.

- The company will be focused on language in the next 3 to 5 years, but is testing their Math app as a new opportunity. The new app is estimated to be put in beta sometime in 2022.

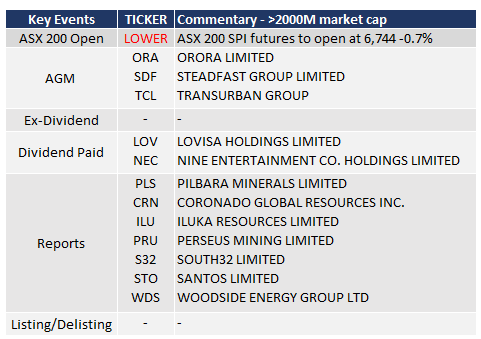

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

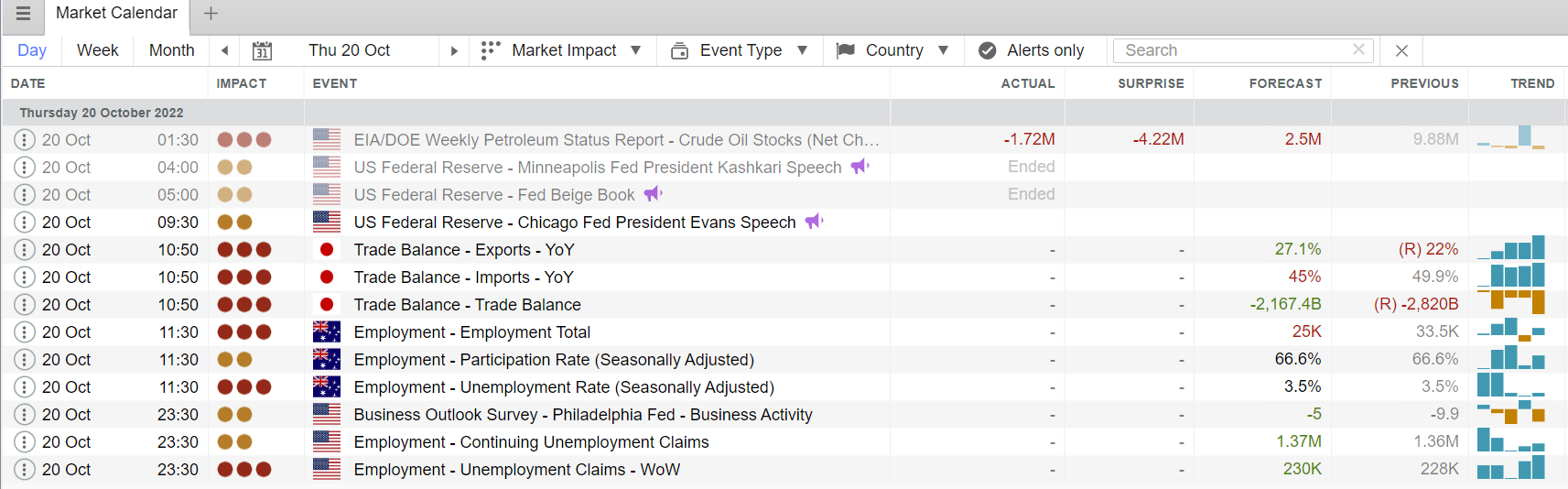

Economic Key Events (TODAY)

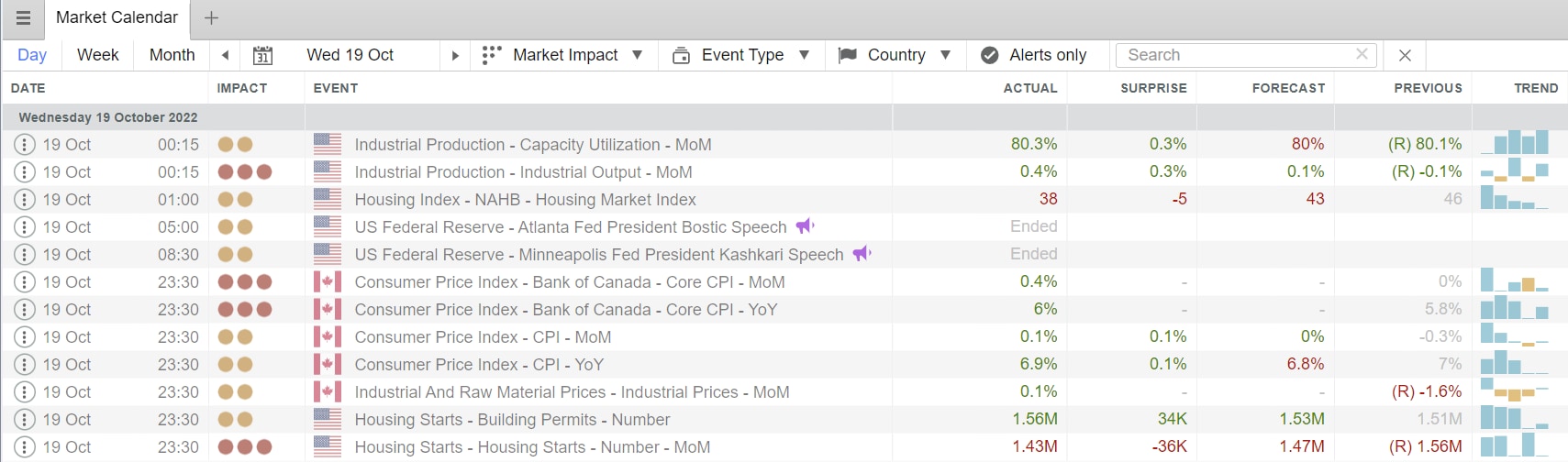

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Cannabis reform lifts Amyris, Jazz Pharma and Innovative Industrial

Podcast of the Day: Market strategist Kiril Sokoloff’s thematic investment radar

APAC Daily Report

Click here to access our daily APAC report, prepared by my fellow market analyst @TinaTeng_CMC

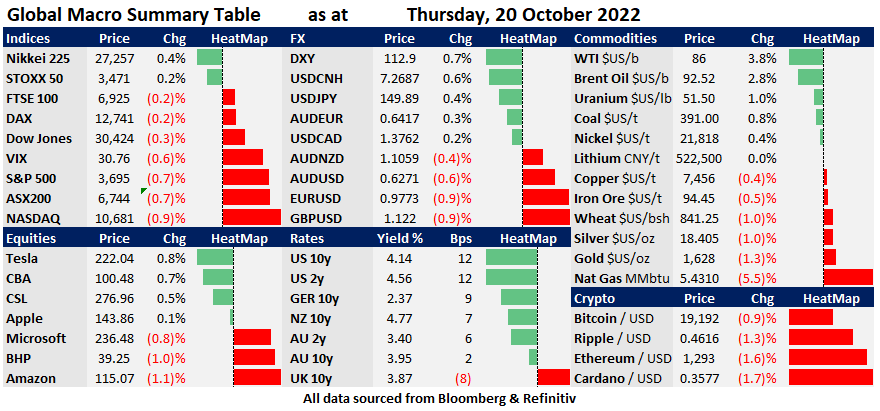

Market Snapshot & Highlights as of 8am AEDT

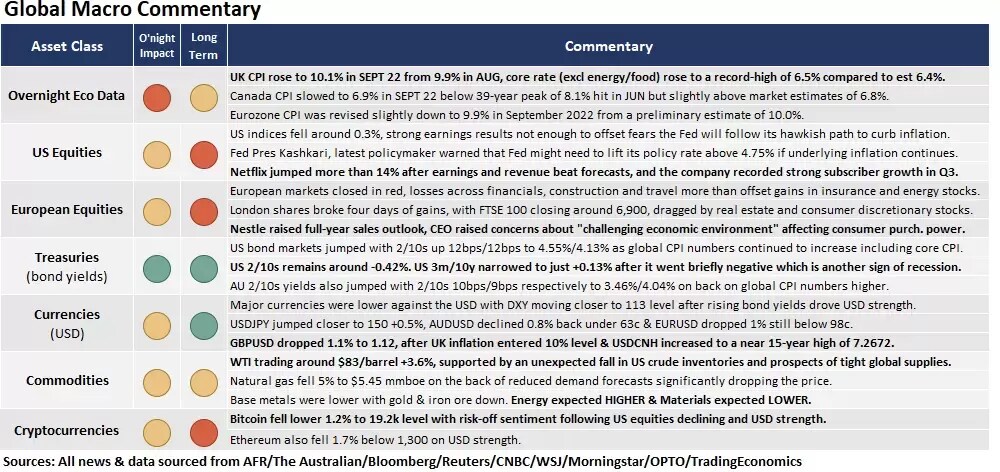

EXPECTATIONS: Energy HIGHER (higher oil) & Materials LOWER on overall base metal prices.

Global Markets Headlines

- Jeff Bezos is the latest to warn on the economy, saying it’s time to ‘batten down the hatches’ (CNBC)

- UK PM Liz Truss says she’s a ‘fighter not a quitter’ as lawmakers plot to oust her (CNBC)

- Putin introduces martial law in illegally annexed Ukrainian regions (CNBC)

- Biden: Oil companies should ramp up production and cut gas prices, not buy back stock, pay dividends (CNBC)

- UK inflation moves back up to 40-year high as Brits battle cost-of-living crisis (CNBC)

- Globally critical chip firm ASML jumps 6% after earnings; sees limited impact from U.S. China curbs (CNBC)

- BMW plans to invest $1.7 billion in U.S. to produce electric vehicles (CNBC)

- Apple chipmaker TSMC reportedly considers Japan expansion as China tensions continue (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)