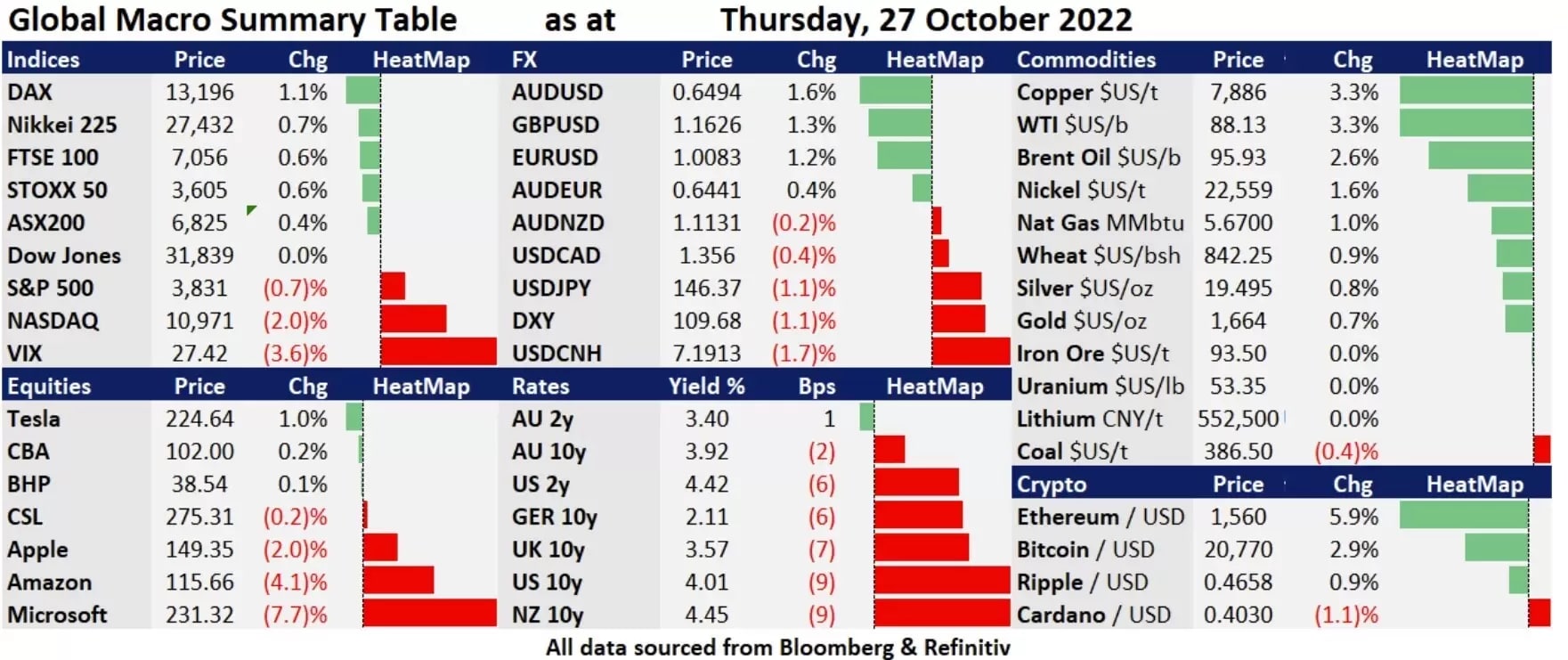

Both S&P 500 and Nasdaq paused a three-day winning streak due to a sharp retreat in big techs amid Microsoft and Alphabet’s disappointing earnings, both of which shares were down 7% and 9%, respectively. Meta Platforms’ earnings also fell short of expectations, with the shares tumbling 13% in after-hours trading. On the other hand, a further decline in bond yields continued to support broad sentiment, offsetting some losses in equities, with Dow finishing slightly up, while the US dollar extended losses and boosted the other major currencies and commodity prices. The market participants now might be bidding on a Fed's turnaround on its stance for aggressive rate hikes after both RBA and BOC dialled back on their pace of interest increase. For the rest of the week, Apple and Amazon’s earnings reports will continue to drive volatilities, and investors will also eye on the ECB and BOJ policy meeting later today and on Friday.

- Selloff resumed in tech shares due to awful companies’ earnings, with Nasdaq slumping 2%. 6 out of 11 sectors in the S&P 500 closed in green, but all the growth sectors, including Communication services, Technology, and Consumer Discretionary, finished in red, down 4.7%, 2.2%, and 1%, respectively. While Energy stocks gained the most, up 1.4%.

- Meta Platforms’ shares plunged 13% in after-hours trading due to a miss on EPS and weak guidance towards the fourth quarter. The social platform’s third quarter EPS is at $1 64 vs the $1.89 estimated, though it beat the revenue expectation, which came to $27.71 billion, or a 4% decline year over year. The company expected that the slowdown in sales will continue in the fourth quarter.

- Mobileye’s shares soared 38% on the debut day after spinning off Intel. The Israeli self-driving car technology company’s IPO price was at $21, with a valuation of $17 billion, trading under MBLY. The shares’ price rose to $28.98 at the close on its debut day.

- Elon Musk is due to take Twitter private on Friday. Tesla CEO Elon Musk changed his profile descriptor to “Chief Twit” on Twitter, sending a video about him carrying a kitchen sink to Twitter’s office.

- Both Chinese stocks and the Chinese Yuan sharply rebounded amid Chinese authorities’ pledge to support its financial markets, with all the US-listed Chines tech shares, including Alibaba and JD.com jumping more than 8%, while NIO and Baidu were up 2% and 3%, respectively. The Chinese Yuan also soared after major Chinese state-owned banks sold US dollars in both onshore and offshore markets, with USD/CNH plunging 1.8% to 7.18 from nearly 7.32 at the day high.

- BOC dallied down on rate hikes to 50 bps, bringing the interest rate to 3.75% amid recession worries. Governor Tiff Macklem said the country’s economy is “just about as likely” to fall into a short-lived recession in the coming quarters.

- US dollar continued to slide against the other major currencies due to a futher decline in US bond yields, with EUR/USD rising back to the parity level, and USD/JPY falling to just above 146 from above 148. Traders will be all eyeing the upcoming BOJ policy meeting on Friday.

- Asian markets are set to open higher due to a drop in broad bond yields. ASX futures were up 0.38%. Nikkei 225 futures were flat and Hang Seng Index futures were slightly up 0.09%. Hong Kong Stocks rose 2.13%. Australia’s third-quarter CPI printed at 7.3%, well above an estimated 7.0%, but it is unlikely to change the RBA’s dovish stance on rate hikes, with expectations for 25 bps increases for the rest of the year.

- Crude oil jumped more than 3% on a record high in US exports and a fallen US dollar. According to EIA’s report. The US petroleum exports increased to 11.4 million barrels a day last week. Chinese shares’ comeback also aided the optimism.

- Cryptocurrencies extended gains for the second straight day, with Bitcoin topping 20,700, well above the 50-day MA, approaching 22,670 for the next potential technical resistance.