Many investors like the idea of contrarian investment. Bravely standing against the consensus to buy when others are selling seems courageous, even noble. However when it comes to pulling the trigger, and buying that fallen stock, there are sudden bouts of paralysis by analysis. Just one more day, the next price level down, the next earnings announcement…

In the worst case scenario there is an announcement and the stock rockets higher. The opportunity is gone. Shareless investors either give themselves a mental ticking off or, perhaps worse, jump in at a higher price while saying, “I knew it”.

So today’s challenge is to consider Incitec Pivot (IPL). The explosives and fertiliser manufacturer is hard to love, at least on current fundamentals. The commodities cycle may have turned positive but miners, and their investment plans, remain cautious. Quarries in the US are one of IPL’s biggest buyers of explosives at the moment. The drought affecting most of Australia is holding back the fertiliser business. And despite these problems, IPL’s shares are trading on around twenty times earnings.

However this is exactly the point. More cautious investors will wait for concrete signs of a turn around. Drought breaking rains. Expansion plans for major projects from global miners. It will be too late by then. IPL’s share price could start moving well ahead of these developments.

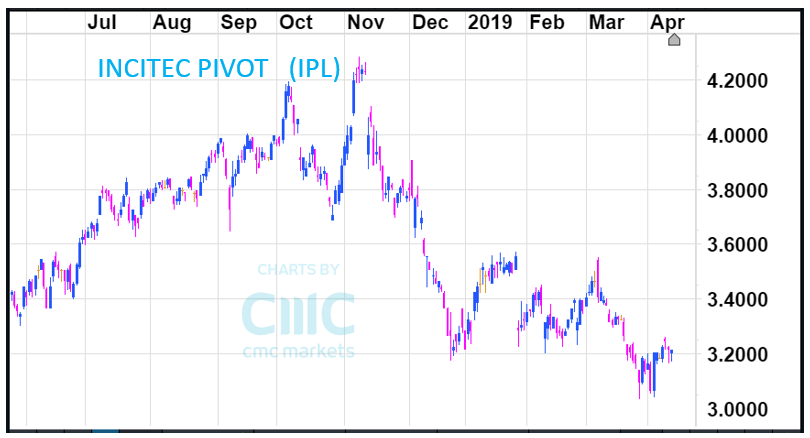

The chart above tells the story. IPL dropped more than 25% in just six months. A decision to close a Victorian fertiliser plant early this month knocked the share price to two-year lows. Yet the effect was temporary, and the stock bounced back to levels around $3.20.

This share price resilience may be a sign of underlying strength. The share price may drop further, particularly given the grim fundamental outlook. But this also could be the ideal contrarian entry point.

Investors must decide for themselves whether IPL is a good choice in light of their existing portfolio and circumstances. Those who consider themselves contrarians may already have IPL on their radar. For those who’d like to try contrarian approaches, IPL may offer a good opportunity.