Flexigroup (FXL) is in the “new” consumer finance space. It offers technology enhanced payment systems and solutions across a diverse range of industries. Earnings over the past few years faltered as the company dared to innovate. Taking risks means sometimes getting it wrong. The 66%+ slide in the share price since 2013 indicates many investors thought FXL got it wrong.

The share price slide brings FXL to lows not seen since 2011. Earnings fell from a peak 29 cents per share in 2015 to last year’s 24 cents. Forecasts show a consensus 23 cents for 2018, before a return to growth in 2019.

However at it’s AGM on Monday the company highlighted its success with payment cards. Key commercial relationships with traditional consumer credit channels and newer industries such as travel could have analysts re-cutting their estimates.

Admittedly a number of FXL’s woes stem from self-inflicted injuries. Its arguable that in the past FXL’s product suite was too diverse and unfocused. There are also questions over the company’s ability to deliver, and prove up what look like sound business ideas into reliable earnings.

In my view the share price is encouraging investors toward a higher risk / higher potential reward scenario. The volume growth in card business suggests to me FXL may have found a winner. Despite the lower estimates of earnings for 2018 the PE ratio is around seven times. The dividend yield at current constrained earnings is over 5% with franking.

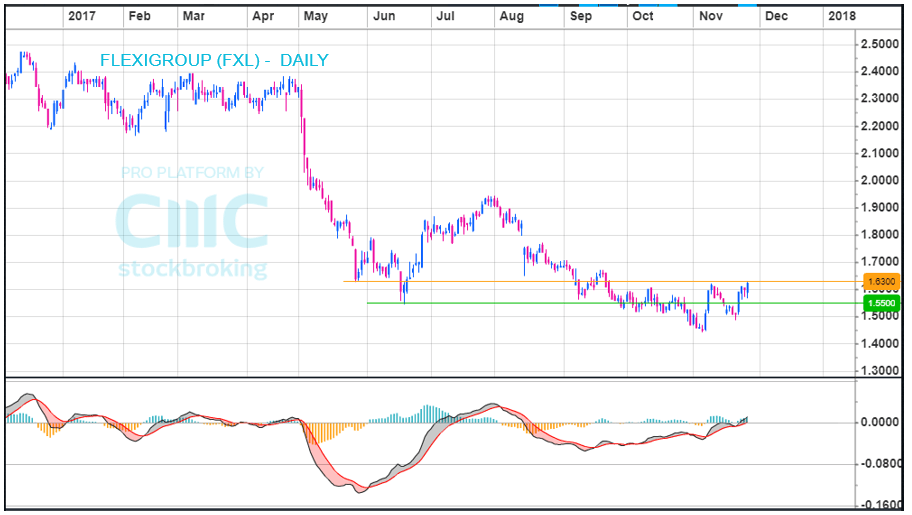

The technical picture is also supportive. A double bottom formation is in place. The share price has moved above the 1.55 support level, and is testing the $1.63 resistance. A break above this level would signal a new uptrend. The MACD indicator at the bottom of the chart adds to the positive picture. The leading black line has crossed the lagging red line, and both moved up through the zero line, indicating a postive outlook with momentum.

For investors FXL may represent a long term hedge. A portfolio full of banks is common in Australia. They are all potemntially vulnerable to disruption in the paymenmt space. Owning a disruptor like FXL may offset some of the risk. And a lower share price for FXL is the right time to examine the risks.