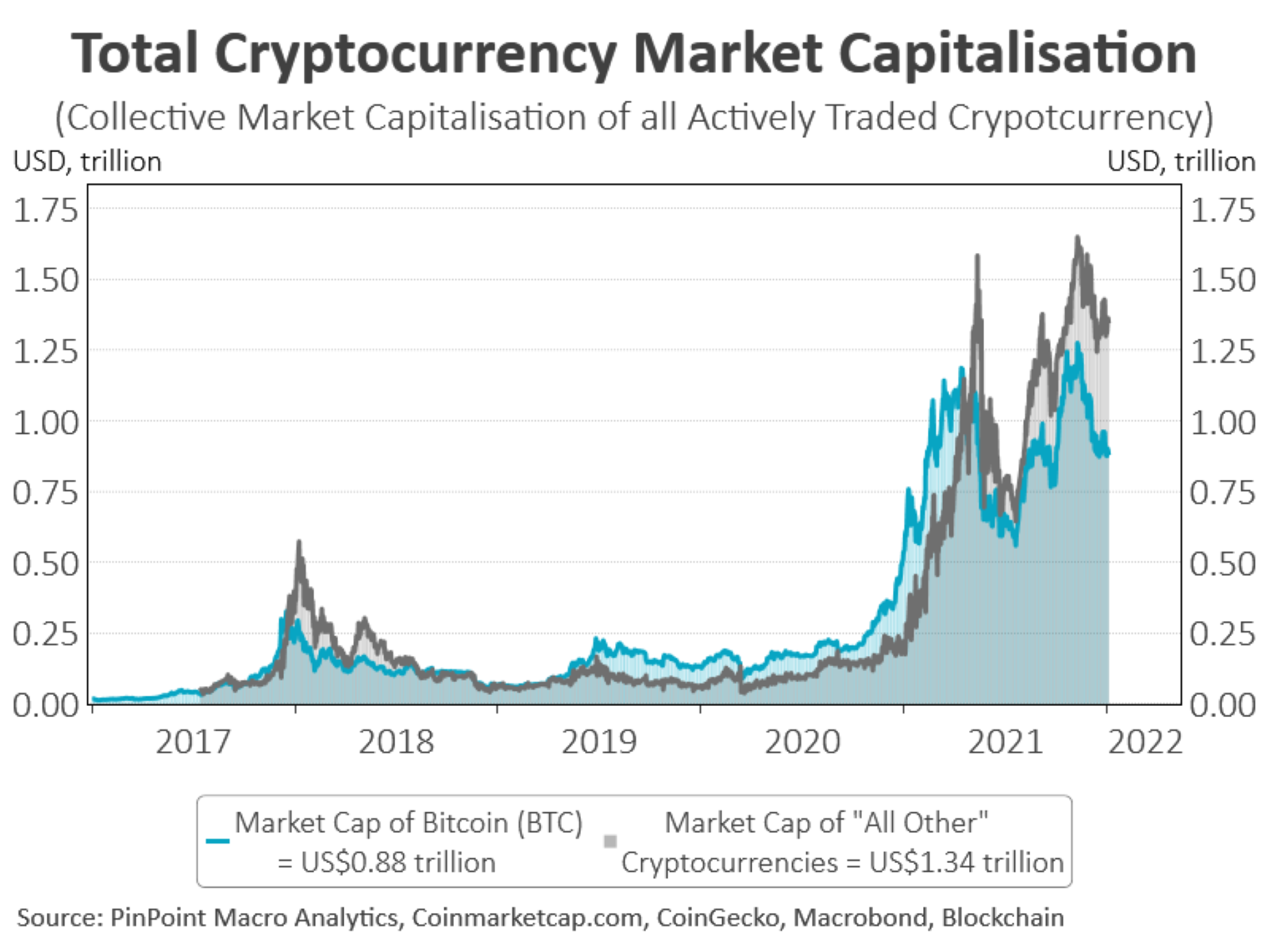

Cryptocurrencies emerged as a legitimate asset class in 2021, gaining acceptance amongst traditional investors and financial institutions globally. The increase in crypto prices was driven by a combination of increasing user adoption, loose monetary conditions, and crypto finding real use cases for the first time - with Decentralized Finance (DeFi), Non-Fungible Tokens (NFT’s) and Blockchain/crypto gaming, all gaining popularity.

The total number of crypto users is now estimated to have exceeded 300 million people globally, approximately the same amount of people that were using the internet in 1998. The growth of crypto users appears to be growing at the same rate of growth as early internet adoption grew.

Decentralized Finance (DeFi)

- Total value locked in Decentralized Finance Applications on Ethereum increased to US$100 billion by December 2021, up from US$25 billion in January 2021 (+300%).

Non-Fungible Tokens (NFT’s)

By December 2021, the total value of NFT’s on Ethereum increased to US$8.7 billion, up from US$56 million in January 2021 (+15,435%).

Crypto (play to earn) Gaming

- Crypto-based games grew exponentially in 2021. Crypto-based games allow users to generate income by completing missions, and collecting in-game NFT’s which they can then trade.

- Axie Infinity, the leading crypto game in 2021, attracted 8 million players in less than a year. Axie’s token is up 13,500% in the past year. Axie Infinity reached an all-time market cap high of $10b in November.

Key Crypto Industry Developments and Highlights of 2021:

January / February

- On the 8 February, Tesla announced a US$1.5 billion purchase of Bitcoin (BTC) and that it will commence accepting BTC as a payment in 2022. This led to a 50% increase in the BTC price ($59k up from $38k) in the 2 weeks following the announcement.

March

- Visa & MasterCard announce it will begin supporting cryptocurrencies.

- PayPal announces that U.S. customers can use crypto currency.

- Goldman Sachs launches a crypto trading desk for its private clients.

May

- On 12 May, Tesla announced it will stop accepting BTC payments due to concerns over the Bitcoin network’s excessive energy usage. The announcement led to a 48% correction in the price of BTC, which declined as low as US$30k in the following 2-week period. Tesla also stated that they will recommence accepting BTC as payment once the network derives greater than 50% of its energy from renewables.

June / July

- Citi and JP Morgan announce it will roll out crypto services to its high net-worth clients.

September

- El Salvador became the first nation to adopt BTC as legal tender and commenced purchasing BTC as a treasury reserve asset.

- On the 24 September China banned all crypto related activities including BTC mining, driving BTC mining operations into other jurisdictions, including into the U.S, Kazakhstan, Russia, and Canada.

November

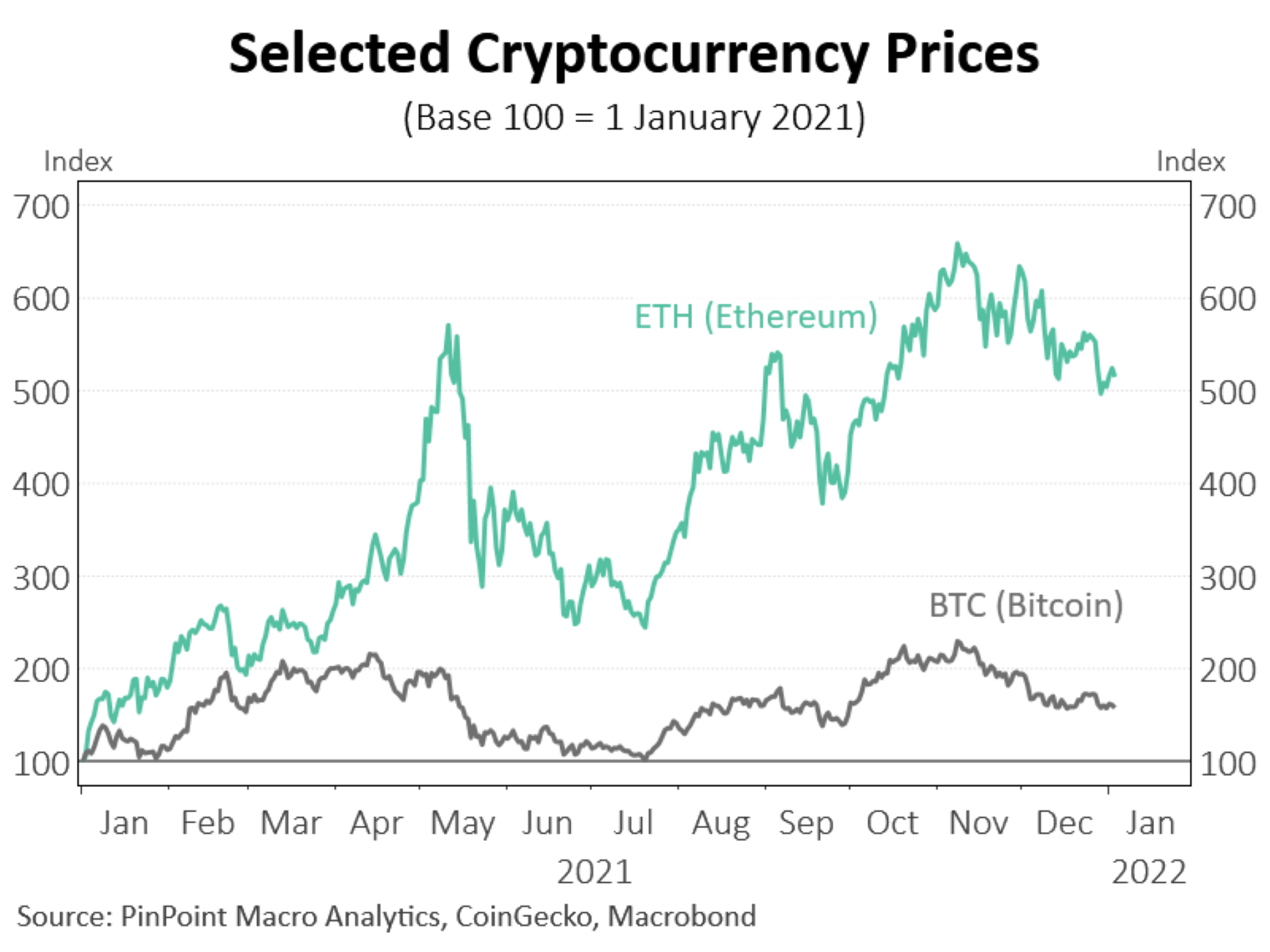

- On the 10 November 2021, the total crypto market valuation hit an all-time high of US$3 trillion. BTC and Ethereum (ETH), hit all-time highs of US$69K (+137% from 1-Jan) and US$4.9K (+563% from 1-Jan) respectively.

2022 Outlook

Despite the recent correction in crypto prices, the following on-chain metrics suggest that the mid-term outlook for crypto appears stable to somewhat bullish:

- Long-term BTC and ETH holders appear not to be selling.

- BTC and ETH continue to leave exchanges at record levels, implying they are being put into long-term “cold storage”.

- BTC miners are not increasing their sales of surplus BTC, indicating their expectation that price increases will continue in 2022.

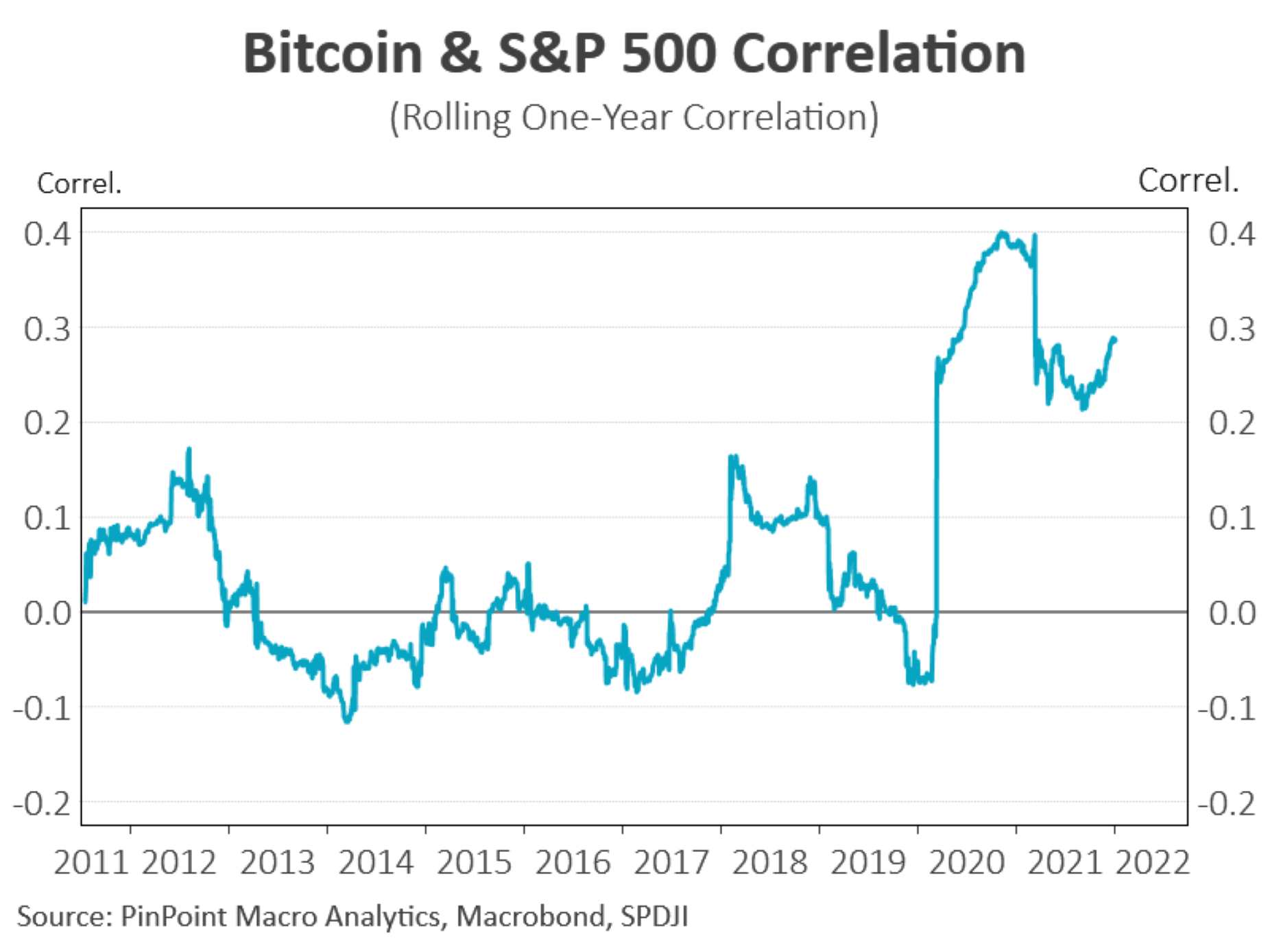

- The continued development in blockchain technology, NFTs, crypto gaming, and growing user adoption globally, supports an optimistic outlook for crypto as we enter 2022. However, the key risk for crypto in 2022 is a broader sell off in equity markets, and a rise in unfavorable government regulations in key jurisdictions, such as in the U.S. and EU. As we enter 2022, BTC has an almost 30% correlation to annual movements in the S&P 500. This may indicate BTC is taking on more mainstream asset class characteristics, as opposed to alternative asset class characteristics.

- Over calendar year 2021, ETH outperformed BTC by 3.2 times. Will 2022 deliver the same outcome?

PinPoint Macro Analytics

IMPORTANT INFORMATION AND DISCLAIMER

Factual Information Only. No Investment Advice is Provided.

The information contained on this document is factual information only. We do not provide trade recommendations or investment advice. The information contained on this document is not opinion. Macro Analytics Pty Ltd, ABN 65 642 332 045, is trading as "PinPoint Macro Analytics".

The source of all content on this document is believed to be accurate and reliable. All content on this document is provided in good faith. However, PinPoint Macro Analytics takes no responsibility for errors in the content provided on this document.

Any content contained on this document is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a recommendation and/or investment advice. Before acting on the information contained in this document, you should consider the appropriateness and suitability of the information to your own objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice, including tax and legal advice.

PinPoint Macro Analytics will not accept liability for any loss or damage (including indirect or consequential damages) or costs which might be incurred as a result of the information being inaccurate or incomplete in any way and for any reason. This includes without limitation any loss of profit, which may arise directly or indirectly from content viewed on this document.

This document may contain hypertext links, frames or other references to other parties and their documents. PinPoint Macro Analytics cannot control the contents of those other sites, and make no warranty about the accuracy, timeliness or subject matter of the material located on those sites. PinPoint Macro Analytics do not necessarily approve of, endorse, or sponsor any content or material on such sites. PinPoint Macro Analytics make no warranties or representations that material on other documents to which this document is linked does not infringe the intellectual property rights of any person anywhere in the world.

PinPoint Macro Analytics are not, and must not be taken to be, authorising infringement of any intellectual property rights contained in material or other sites by linking or allowing links to, this document to such material on other sites.

If you have any concerns regarding the content of the document, please contact PinPoint Macro Analytics at info@pinpointmacroanalytics.com.au