Despite a slowdown in China’s economy, a cut in the lending reserve requirement ratio (RRR), and the disruptive events around Evergrande, the Chinese exchange rate rose against most currencies in 2021. Reflecting the strength in China’s currency, China’s trade-weighted exchange rate index rose to its highest level since 2015 (see chart).

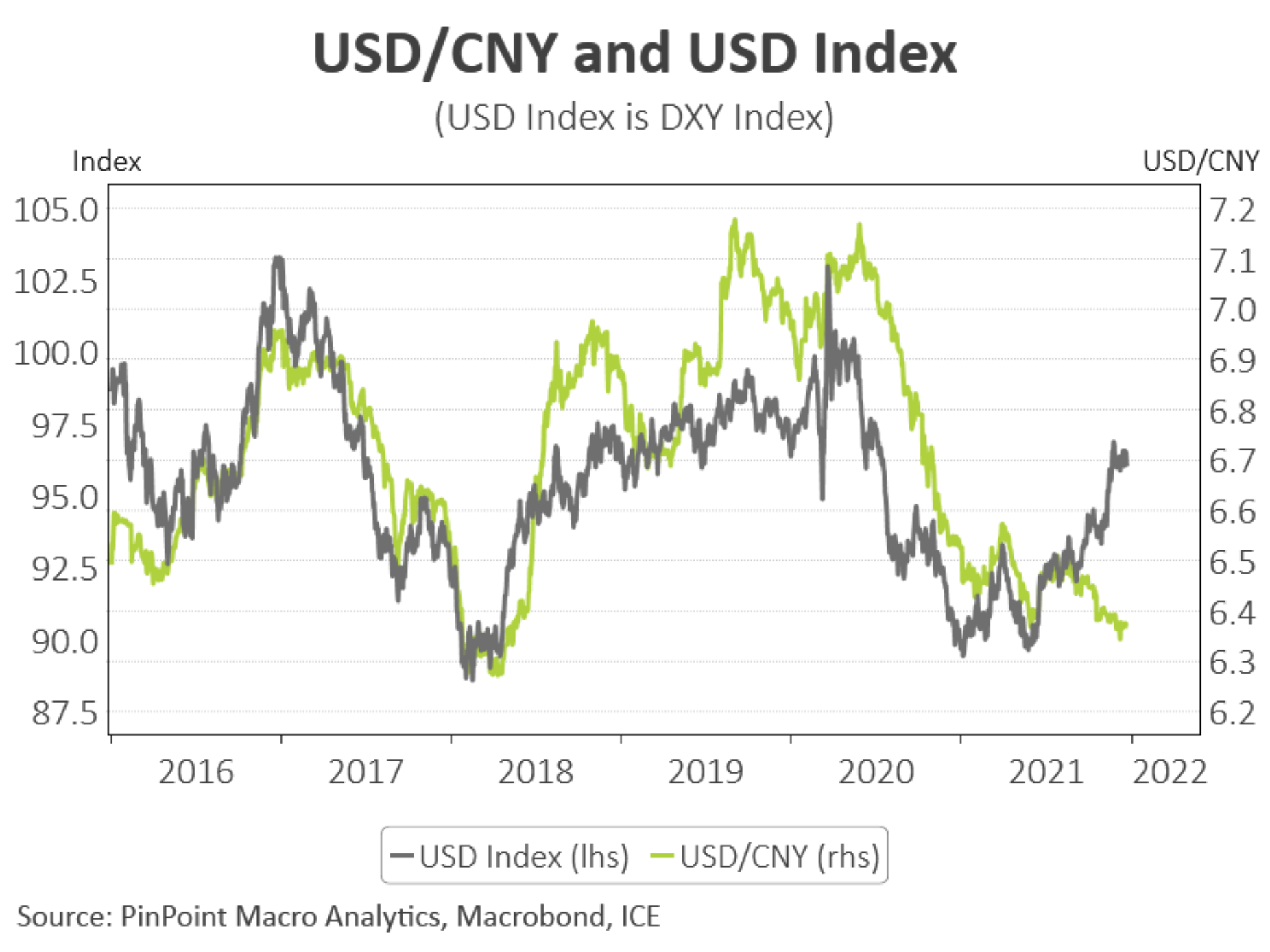

One notable feature of USD/CNH over the course of 2021, was the fact that mid-way through the year, USD/CNH diverged from its long-run trend with the USD Index. The USD index rose, but USD/CNH declined reflecting CNY strength (see chart).

The strength in China’s currency over 2021 partly reflects large bond inflows, and to a lessor extent, equity inflows into China. Foreign bond holdings of Chinese bonds lifted to their highest levels since 2007, equivalent to almost 4.0% of total Chinese government bonds on issue.

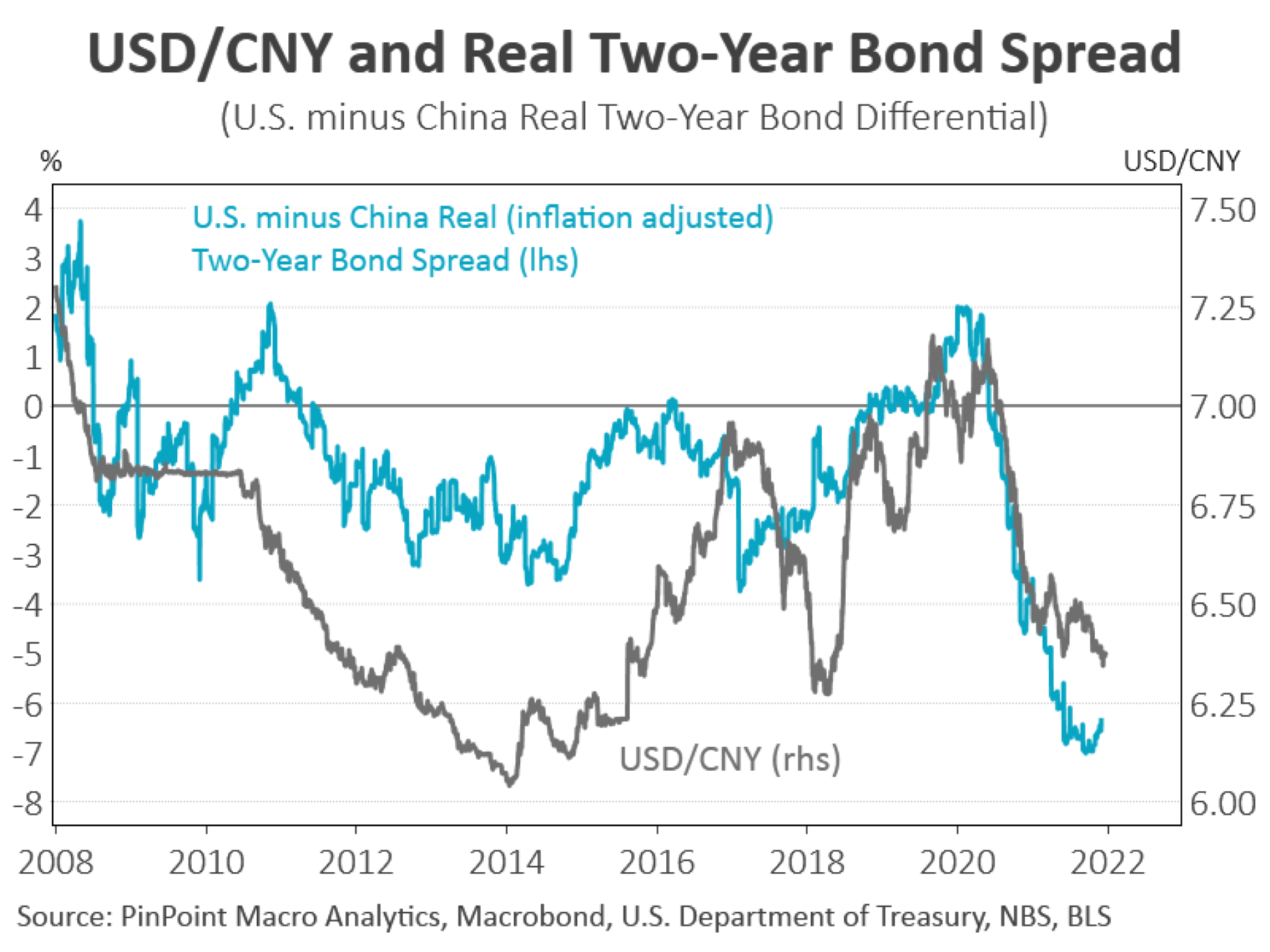

Foreign investors were attracted by the high rates of return on China’s real (inflation-adjusted) bonds. As the U.S real ten-year bond yield declined deep into negative territory reaching more than -6.0%, China’s real ten-year bond yield remained positive. The U.S. minus China ten-year bond differential declined to historical lows around -6.20%, guiding USD/CNH to 3.5 year lows by late 2021 (see chart).

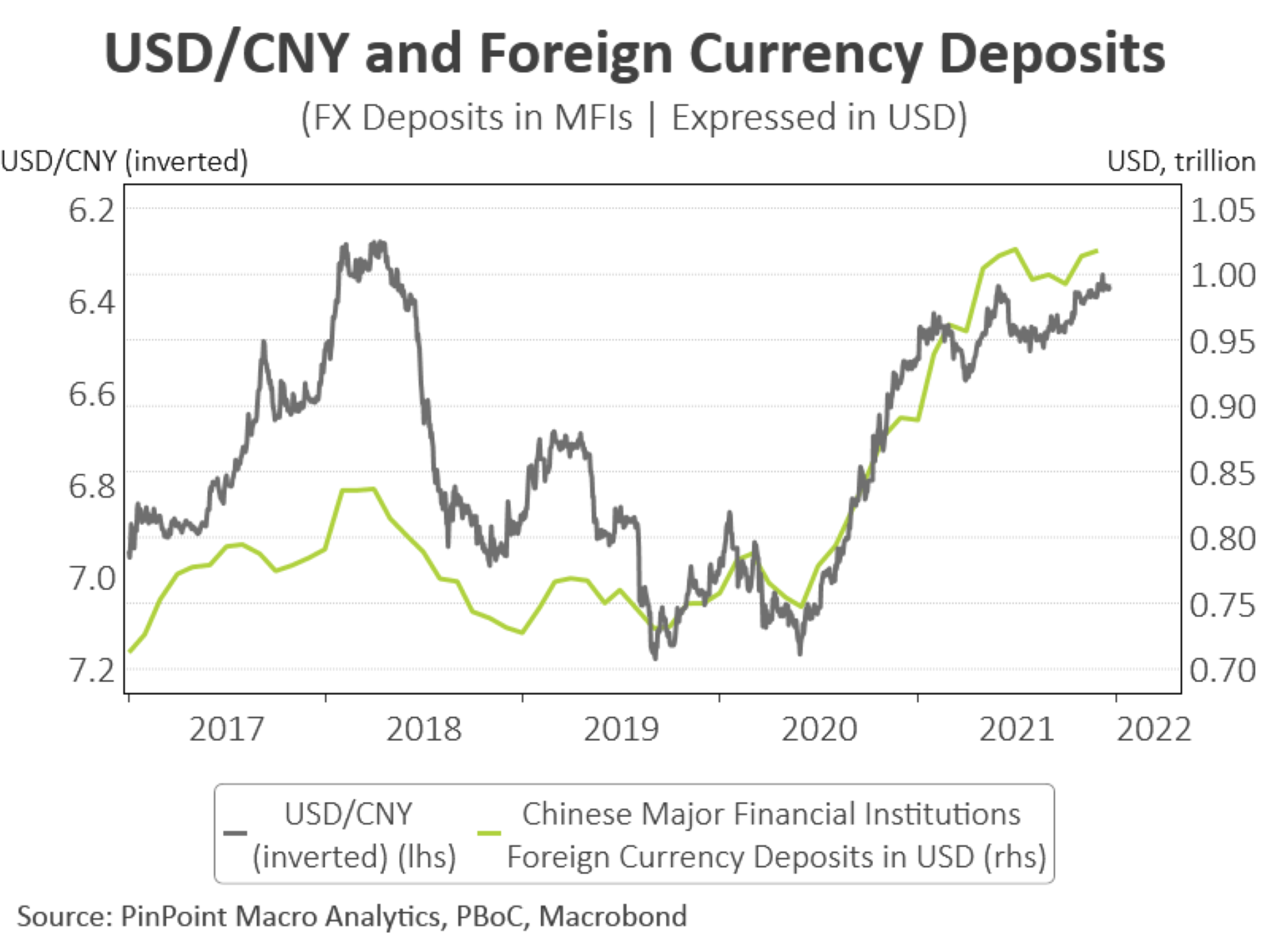

The depreciation in USD/CNH began to stabilise in late 2021 after two significant events occurred. First, the Chinese authorities lifted the reserve requirement ratio (RRR) for foreign currency deposits from 7% to 9%. This meant Chinese banks must hold 9% of their foreign currency deposits with the central bank (PBoC) rather than have those foreign currency deposits available for use in other areas, including in foreign investments. It was the second lift in the RRR by the Chinese authorities during 2021. The Chinese authorities appear to have made this policy decision on the foreign currency deposit RRR after foreign currency deposits in China lifted to a record high of US$1 trillion (see chart).

Secondly, USD/CNH also began to stabilise in late 2021 after the PBoC began to regularly set the USD/CNY daily reference rate higher. The higher USD/CNY daily reference rate implies the Chinese authorities may be using their discretion within the designed tolerance levels of the USD/CNY daily reference rate, to weaken the CNY vis-a-vis the USD. This does not guarantee USD/CNY will advance higher. However, in the past, such activities have sent a signal that the Chinese authorities do not want to see their exchange rate appreciate too much. Reflecting the possibility that USD/CNY may move higher, USD/CNH began to trade higher than USD/CNY, after trading below USD/CNY prior.

It is understandable that the Chinese authorities do not want their exchange rate to be too strong. China’s CPI inflation is not very high, especially compared to other major countries. China’s inflation is not proving to be a major concern. This means the Chinese authorities do not need a strong exchange rate to dampen local CPI inflation pressures. What would be more desirable from a policy perspective would be a slight weakening in China’s exchange rate to encourage stronger export growth, and firmer employment growth.

Calendar year 2022 will be an interesting one for USD/CNH. There are a number of factors suggesting the strength in CNH seen over H2 2021 and over much of 2021 will not persist in 2022. However, despite China’s real exchange rate being historically high, and therefore China’s export competitiveness being challenged, China’s current account surplus remains strong at 2.0% of GDP. A healthy current account surplus suggests it won’t be easy for China’s exchange rate to materially weaken, and for USD/CNY to advance significantly higher without a particular catalyst.

PinPoint Macro Analytics

IMPORTANT INFORMATION AND DISCLAIMER

Factual Information Only. No Investment Advice is Provided.

The information contained on this document is factual information only. We do not provide trade recommendations or investment advice. The information contained on this document is not opinion. Macro Analytics Pty Ltd, ABN 65 642 332 045, is trading as "PinPoint Macro Analytics".

The source of all content on this document is believed to be accurate and reliable. All content on this document is provided in good faith. However, PinPoint Macro Analytics takes no responsibility for errors in the content provided on this document.

Any content contained on this document is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a recommendation and/or investment advice. Before acting on the information contained in this document, you should consider the appropriateness and suitability of the information to your own objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice, including tax and legal advice.

PinPoint Macro Analytics will not accept liability for any loss or damage (including indirect or consequential damages) or costs which might be incurred as a result of the information being inaccurate or incomplete in any way and for any reason. This includes without limitation any loss of profit, which may arise directly or indirectly from content viewed on this document.

This document may contain hypertext links, frames or other references to other parties and their documents. PinPoint Macro Analytics cannot control the contents of those other sites, and make no warranty about the accuracy, timeliness or subject matter of the material located on those sites. PinPoint Macro Analytics do not necessarily approve of, endorse, or sponsor any content or material on such sites. PinPoint Macro Analytics make no warranties or representations that material on other documents to which this document is linked does not infringe the intellectual property rights of any person anywhere in the world.

PinPoint Macro Analytics are not, and must not be taken to be, authorising infringement of any intellectual property rights contained in material or other sites by linking or allowing links to, this document to such material on other sites.

If you have any concerns regarding the content of the document, please contact PinPoint Macro Analytics at info@pinpointmacroanalytics.com.au