US approval of a Hong Kong (HK) bill that supports protesters received strong dissent from Beijing, and is likely to complicate the trade outlook.

According to a Reuters source, a ‘phase one’ US-China trade deal may slide into next year, as Beijing demands for more extensive tariff rollbacks, while the Trump administration counters with heightened demands of its own.

Yesterday, Chinese state-owned media expressed strong opposition against the HK bill approved by the US Senate, saying its act is ‘nonsensical, and self-damaging’. They warned that China would come up with ‘equivalent countermeasures’ if Washington enforces the measure’.

The consequence of enforcing this Act is it will review HK’s condition of autonomy annually that relates to the city’s special trade status, and would sanction Chinese officials found ‘suppressing HK’s democracy, human rights or citizen freedoms’.

As a result, market participants have sufficient reason to stay off the fence today and buy into safe-heavens such as gold, yen and treasuries. USD/CNH – a key barometer of the trade talk – has spiked up to 7.05 this morning, suggesting that the situation is deteriorating and uncertainties are rising.

US equity indices came off the peak for a third day as trade risk escalated over the HK bill. Traders might take it as a good reason to take profit, realising huge profits in the long positions accumulated in the past few months.

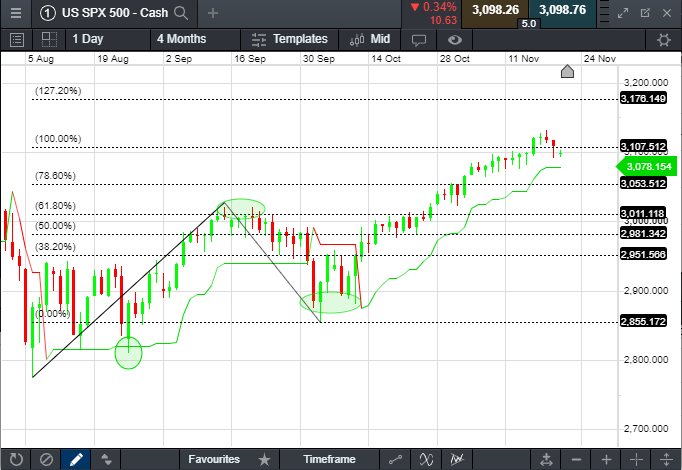

Technically, the S&P 500 index hit a key resistance level at 3 107 and since entered into consolidation phase. Immediate support level can be found at 3,078 (SuperTrend 10,2) and then 3,053 (78.6% Fibonacci Extension). A healthy pullback from here won’t change the overall uptrend of the US market.

Asian markets set to open broadly lower, dragged by Greater China markets. Hang Seng Index is perhaps most susceptible to political headwinds, and thus may suffer heavy profit-taking today.

Singapore’s economy expanded at a faster-than-expected pace in the third quarter. The 3Q GDP growth came in at 0.5%, higher than previous quarter’s revised 0.2% and earlier forecast of 0.1%. These figures helped Singapore to avoid a ‘technical recession’. The Ministry of Trade and Industry (MTI) has narrowed the 2019 full year economic forecast to between 0.5 to 1.0 percent.

US SPX 500 - Cash