US inflation data for September will be out later today, Wednesday during the US session at 1230 GMT. This set of data will be pivotal for US central bank, the Fed in terms of setting up its monetary policy framework as it forms a part of the significant economic variables input to determine the start and the pace of the interest rate hiking cycle. The Fed has already decided to taper its quantitative easing programme by reducing the quantum of its $120 billion monthly bond purchases before 2021 ends and expects to end them by middle of 2022.

Next up, the Fed is expected to normalise its zero-interest rate policy; based on CME FedWatch tool (as of 13 October), Fed funds rate futures has recorded a jump in the odds of the first interest rate hike to occur in the first half of 2022, 30.4% probability of a 0.25% hike to take place on the 15 June 2022 Fed FOMC meeting, an increase from a probability of 19.3% seen a month ago. Hence, the pendulum on the expectation for first Fed funds rate hike seems to have swung forward from an earlier consensus that has centred around Q3 or Q4 of 2022.

Consumer inflationary pressures have been on the rise since the start of 2021, it recorded an inflation rate of 1.4% year-on-year in January and spiralled up to a 13-year high of 5.4% In July before it eased off slightly to 5.3% in August but has remained elevated due to the persistence global supply chain disruptions and now higher energy prices due to shortages of energy supplies.

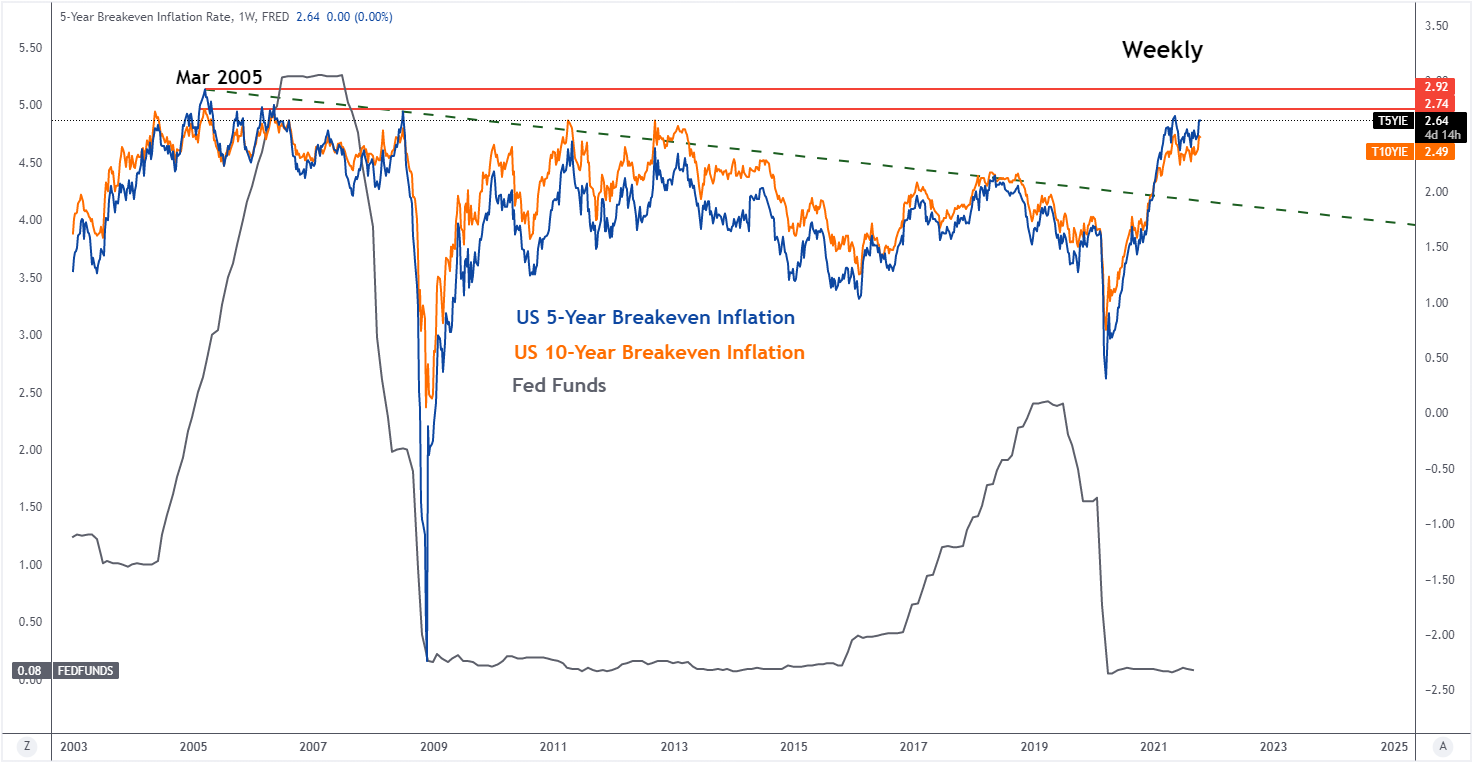

Several key Fed officials have been reiterating that the current inflationary pressures are transitory in nature, but market based inflationary expectations inferred by movement in the US Treasuries do not seem to buy into such guidance. Both the 5-year breakeven inflation (a gauge of expected inflation in the next 5 years) and 10-year breakeven inflation have broken above their three-month ranges in place since July and now traded at 2.64% and 2.49% respectively as of 12 October.

Since 2003, the movement of the Fed funds rate has moved directly in line with the 5 and 10-year breakeven inflation rates in general amid several occasions of either leading or lagging in nature. Both the 5 and 10-year breakeven inflation rates have surged significantly in the past four weeks, and they are coming close to a 16-year high of 2.92% and 2.74% respectively (see chart below). Thus, a higher US inflation rate is likely to support the current upward trending breakeven inflation rates which in turn increase the odds of the first Fed funds rate hike to occur in the first half of 2022.

Fed funds movement with US 5 & 10-year breakeven inflation

Next up, we will examine the latest inflation and government bond yields differentials between the US, several key G20 members and New Zealand to determine its potential impact on the foreign exchange movements for EUR, GBP, JPY, CHF, CAD, AUD and NZD.

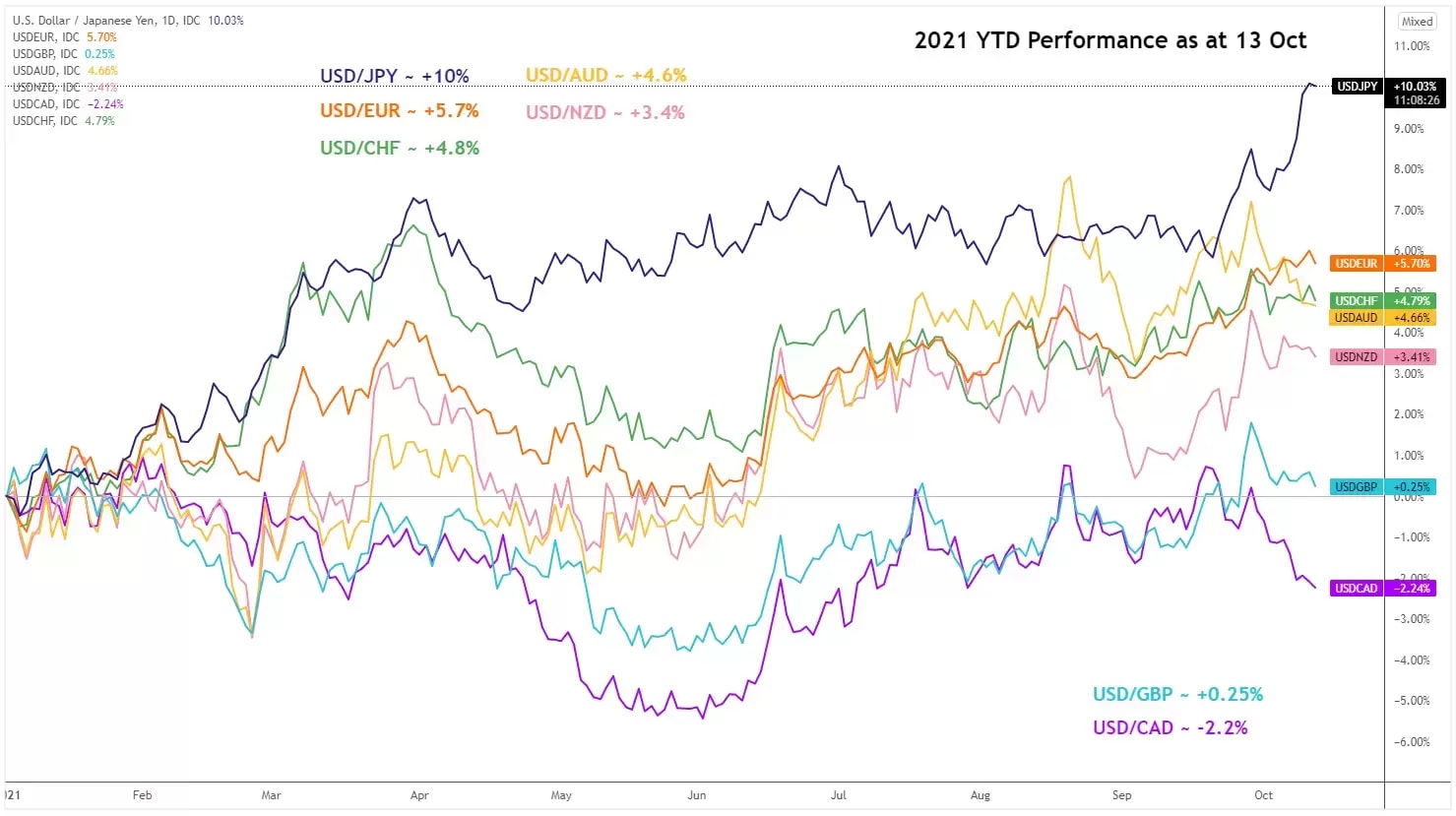

The US dollar has performed the best so far against the JPY with a year-to-date gain of 10% as of 13 October, next in the pecking order is against the EUR (+5.7%) and CHF (+4.8%). On the other end of the spectrum, the US dollar has underperformed against the CAD (-2.2%) and GBP (+0.2%). Overall, there is still no clear US dollar strength across the board at this juncture.

US Dollar 2021 YTD Performance

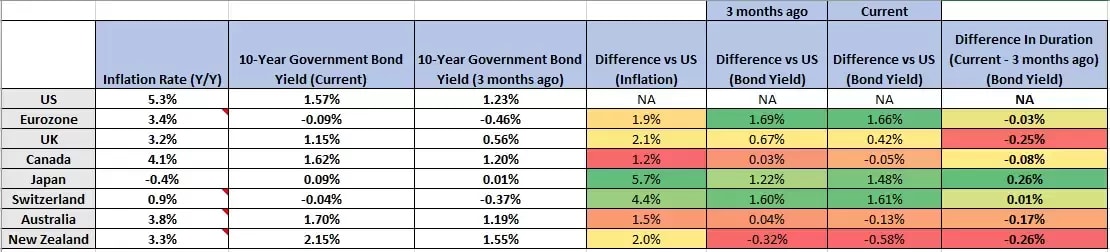

Inflation & government bond yields differentials

The strong performance of USD against the JPY and CHF has been in line with the highest inflation premium seen in the US versus Japan and Switzerland (5.7% & 4.4% respectively). On a side note, the premiums of the US 10-year Treasury yield over the 10-year government bond yields of Japan and Switzerland are the highest as well in terms of the change in their yield premiums over three months (0.26% & 0.01% respectively).

In contrast, the weak performance of USD against the CAD and GPP has been supported by the lowest US inflation premium over Canada at 1.2% and a narrowing of the US-UK government bond yield premium over three months to -0.25%.

Therefore, if the latest US inflation print for September exceeds consensus estimate of 5.3% year-on-year, the USD/JPY and USD/CHF may see further potential upside while current USD weakness against the CAD and GBP may be narrowed.