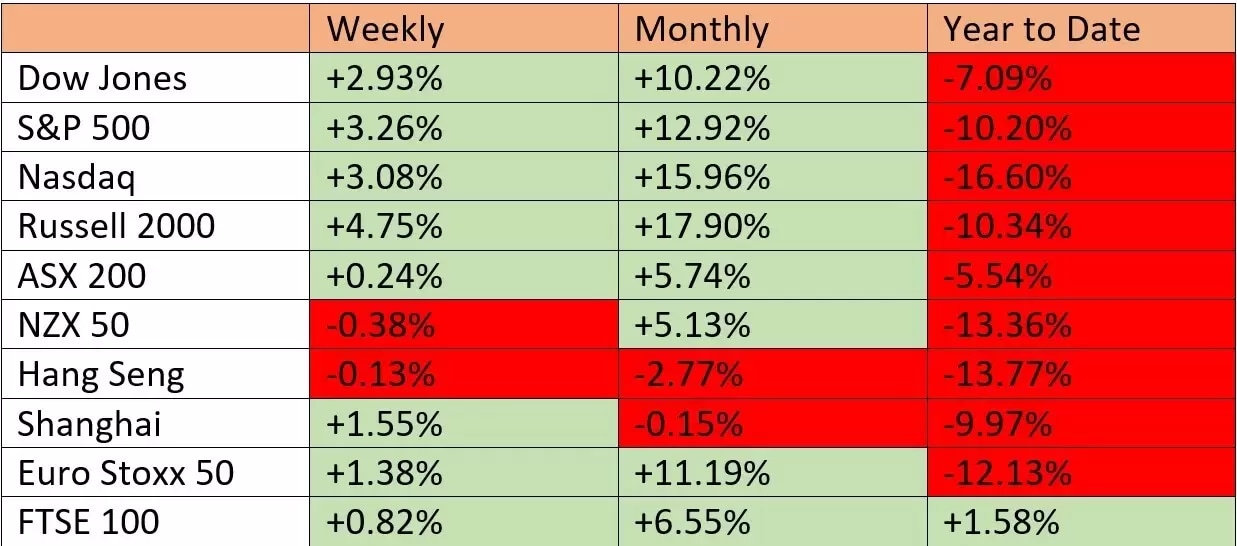

With the hardest beaten index, Nasdaq, bouncing off a bear market, we can almost confirm the US stocks’ rebound is no longer a bear market rally, or we could call it a bull market rally. The cooled inflation data increased odds for a “peak Fed”, which may continue to lead the bullish bets this week.

In the first half of the month, US markets outperformed other major exchanges amid better-than-expected company earnings and policy optimism, with growth stocks prominently leading broad gains. Notably, the small-cap, Russell 2000’s 18% jump in August may suggest that the risk-on-dominated markets will not stop upside movement just yet.

This week, apart from the influential economic data, we will continue to monitor the Australian big-cap earnings reports, with BHP Group and CSL reporting the half-year results on the 16 and 17 August respectively.

What we're watching

- Nasdaq officially bounced off a bear market last week due to strong performances in the tech shares. And the “Peak Fed” bets may give a further lift to the index.

- The US bond yields’ swings will continue to keep the US dollar’s volatility. With the yields on the long-dated bond notes falling, further weakness may be seen in the king dollar. And the recent jump in the New Zealand dollar could suggest the RBNZ will not change its stable pace of 50 bps rate hikes soon.

- A major bullish break-out in gold may make the precious metal fly again since pressure from the bond markets is lightened, along with a softened USD.

- Ethereum topped above the 2,000-mark over the weekend, and the mounting risk appetite could take the digital coin to outperform its peer bitcoin further.

- Will the Australian largest market-cap company, BHP, reverse a multi-month downtrend if the miner can beat expectations in its half-year result? ASX may take a further rebound tailwind if rosy earnings give it a push.

Economic Calendar (15 – 19 August)

US – FOMC meeting minutes, retail sales (July)

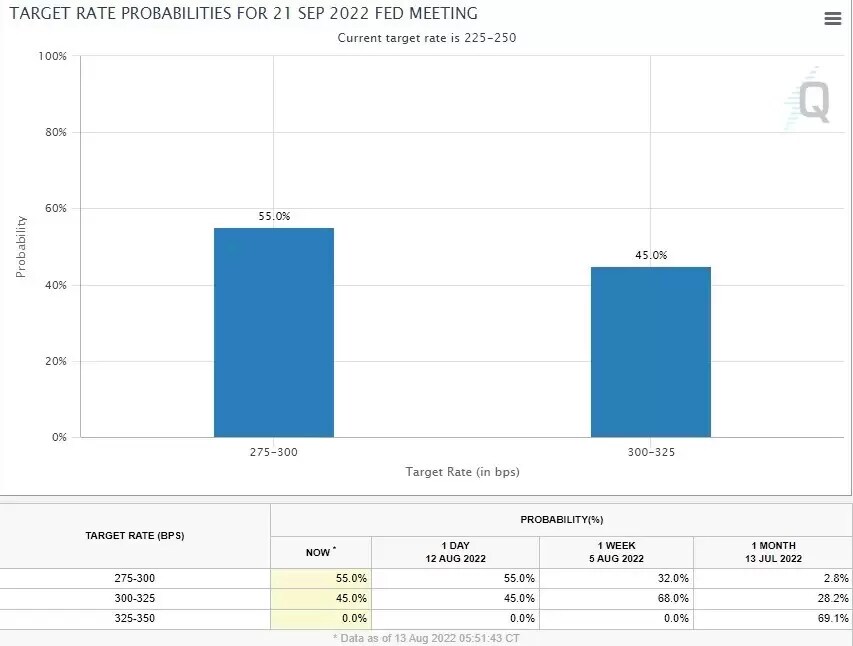

Despite reiterations of hawkish stances from several Fed members, the odds for the reserve bank to raise interest by 50 basis points are still higher than a 75 basis points hike, according to the CEM FedWatch Tool. However, this now becomes a 50-50 guessing game, given last week’s cooled inflation data, which brings more debate about the current economic trajectory. Nonetheless, the bond market is pricing for a 3.7% interest rate by the year-end, suggesting an aggressive rate hike path has been done from here.

The US retail sales data for July is expected to grow 0.1% m/m, slowing down from 1% the prior month. While the control group change is forecasted at 0.6%, down from 0.8% in June, the inflation gauge, PCE, may also cool. Therefore, it seems all the economic data around inflation points to an improved cost-of-living situation.

China – retail sales, industrial production, and fixed asset investment (July)

Recent economic data shows China is on the pace of recovery from its covid-lockdowns in April and May. July retail sales are expected to improve to 5% y/y from 3.1% in June after a 2-month contraction. Industrial output is also forecasted to grow by 4.6% y/y, faster than 3.9% the prior month. However, the country is facing challenges of softened consumer demands and weakened business confidence due to the “Zero-covid” policy with slow growth in its new loan amounts, despite government stimulus measures.

Australia – RBA minutes, wage price index, and employment change (July)

With a prediction Australian inflation could hit 7.75% by the year-end, the RBA will most likely keep its 50 basis points pace on rate hikes. However, the statement of the RBA meeting early this month shows further policy will depend on the upcoming economic data, which hints that a “peak hawkishness” may have been reached if inflation offers relief to the economy.

Both wage growth and employment data are expected to keep strong momentum. The wage index is forecasted to rise 2.7% y/y from a 2.5% growth the prior month. And consensus calls for 25,000 new jobs that have been added in July, with the unemployment rate staying low at 3.5%.

New Zealand – RBNZ policy meeting

The New Zealand Reserve bank is almost certain to raise the interest rate by 50 basis points for the fourth time in a row since April, to 3%. The domestic inflation printed at 7.3% in the second quarter, the highest since 1990. But data is expected to cool down in the third quarter due to a drop in fuel prices and housing prices, which may lead to a scale back in rate hikes from October.

Canada – CPI (July)

Canadian inflation rose to 8.1% in June, the highest since 1983. The Bank of Canada aggressively increased the interest rate by 1 full percentage in July. Softened consumer demands and a drop in the fuel price may have slowed down the price increase, with forecasting at 7.6% y/y in July.