Compared to previous years, 2017 was fairly steady for the UK banking sector despite increasing concerns about a rise in consumer credit, the effect of low interest rates, as well as the emergence of further legacy issues for Royal Bank of Scotland.

When we looked ahead to 2018 a year ago, it was always optimistic to assume that we’d see similar outperformance from a sector that was always going to be vulnerable to Brexit concerns, a possible slowing of the global economy and yield curve differentials that were always likely to struggle to move higher against a weak interest rate outlook.

A lot of the Brexit pessimism in the aftermath of the June referendum was overdone, and the performance of the UK economy since then has borne that out. However, the UK economy still faces a myriad of problems that continue to remain unaddressed, while the problems that have bedevilled the banking sector remain far from resolved.

Across Europe, the problem of bad loans still remains unresolved, with the budget stand-off between the European Commission and the Italian government likely to rumble into 2019. This is already creating ripple out effects elsewhere, with the banking system in Greece struggling to find ways to recapitalise itself, without wiping out its capital buffers.

Germany’s biggest bank, Deutsche Bank, continues to stagger from one crisis to the next. Having replaced its CEO Jon Cryan in the summer with a retail banker, Christian Sewing, it’s also trying to extricate itself from various scandals involving money laundering, as senior board members come under scrutiny from regulatory officials.

The share price for Deutsche has fallen back to new multi-year lows as management look to cut costs further in order to return the bank to a sustainable business model. There has been further talk of a possible merger with Commerzbank, however this still remains a tall order given the size of the two banks. In essence you’d be creating one huge problem as opposed to two big ones. It would be like two drunks propping each other up at the bar, and wouldn’t resolve the underlying problem of a German banking sector which remains hamstrung by negative rates, as well as too many banks and too many branches.

On the plus side, wage growth does appear to be picking up, particularly here in the UK at precisely the time that inflationary pressures are starting to diminish. The big problem for UK banks has been one that has been looming large for several months now – the outcome of the Brexit negotiations – along with uncertainty about the strength of the global economy, which has started to show signs of misfiring.

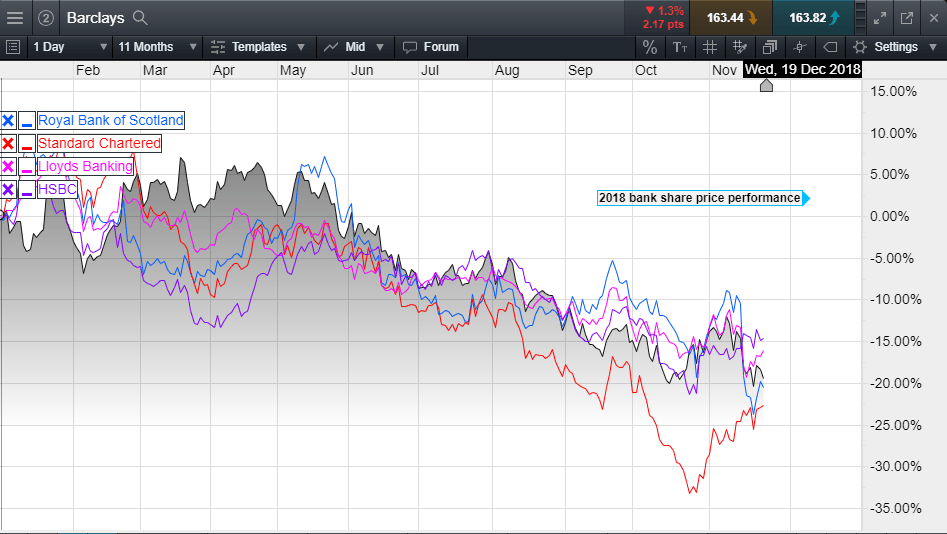

The post referendum rally in the FTSE 350 bank index ran out of steam in January this year, slightly exceeding the peaks seen in 2015, and has been in a slow decline since then due to a combination of factors. These aren’t particularly related to how well the banks have actually been doing in their day-to-day business.

Source: Bloomberg

One of the things that has held UK bank share performance back has been the insistence of the Bank of England that they hold more regulatory capital in respect of recent rises in consumer credit, particularly in car loans and credit card debt, as well as making sure they have adequate buffers for a disruptive Brexit.

While the UK economy has slowed quite a bit from the levels we saw in 2016, it hasn’t done anywhere near as badly as many forecasters predicted. What appears to have held the banks back is the continuing uncertainty over the Brexit negotiations which has seen this progress stall and go into reverse, as can be seen from this year’s price performance in contrast to 2017 when only Barclays share price underperformed, declining over 10%.

This year the price performance of all the major banks has been unambiguously negative, and while RBS was the best performer in 2017, rising over 20%, this year it has given up all of those gains.

Judging by the performance year-to-date, you’d be forgiven for thinking that the banks have had a bad year for profitability, and in some areas you would probably be correct. However, in terms of market volatility and business activity, 2018 hasn’t been that bad a year.

Royal Bank of Scotland

Royal Bank of Scotland has certainly had worse years, and when you look at the numbers it’s been a good year, returning to profit for the first time since it was bailed out, while they’ve managed to draw a line under a whole series of legacy issues.

It settled with the US Department of Justice for $4.9bn in respect of subprime loans from 2007, which were described as “total f***ing garbage” by one US official.

The bank also escaped action for the behaviour of its senior management around the dubious practices of its GRG restructuring group, despite reams of evidence that the bank had deliberately mistreated thousands of small businesses.

On the profit front, pre-tax profit for Q3 came in at £961m, up 10% on the same quarter the previous year, putting it on course to finish this year with profits of over £3bn.

The bank also announced that it would pay an interim dividend of 2p a share, a welcome payback for the UK government of about £150m, given that it is the majority shareholder at 62%. Nonetheless, the amount is but a flea bite when set against the billions of pounds of losses over the last ten years.

The only dark cloud was a rise in bad debt and PPI provision, which took the gloss off the numbers as management set aside sums in respect of the Carillion collapse earlier this year.

Lloyds Banking Group

Lloyds, of all the UK banks, is particularly exposed to the UK economy and a messy Brexit outcome. This helps explain its continued poor performance despite posting record half-year profits of £3.1bn in June, even after another £550m provision in respect of PPI, bringing the total bill to £19.2bn since the financial crisis. In Q3 the bank added another £1.8bn to its pre-tax profit number, with quarterly revenue of £4.69bn, while at the same time boosting its resilience to any economic shocks as a result of any disruptions caused by Brexit.

The bank has also been cutting jobs as it embarks on a digital shake up, but it also said it would be looking to create 8,000 new roles over the next few years to replace some of those it was shedding.

The latest Bank of England stress tests did note that Lloyds was still the most vulnerable to a Brexit induced shock, however concluded that it was well placed to ride out a disorderly scenario. The findings also kept open the prospect that management would be able to increase the dividend at the end of this financial year.

Barclays

CEO Jes Staley’s attempts to turn around the fortunes of Barclays has been mixed at best. The worst performer last year, it has fared no better this year, though profits and revenues do appear to be starting to show signs of life.

Its investment banking division showed a 19% rise in income in Q3, increasing to £1.2bn after a difficult first half of the year, which had raised speculation that activist investor Edward Bramson might pressure management to sell off the business, due to its continued underperformance. The first half of the year saw a £1.4bn fine from the US drag on its profits there, pulling them down to £1.6bn in H1, however Q3 profits came in at £1.5bn up £400m from the year before.

Without the various fines, profits would be currently well above £5bn, however the improvement in Q3 raises optimism that we might see a catch up in Q4.

The performance from HSBC has been disappointing given that of all the UK banks, it is probably one of the more resilient given its geographical diversity. Most of the gains in profit have been driven out of its Asia business in the most recent quarter, however, given concerns about a China-US trade war share price performance appears to have suffered with simular underperformance affecting Standard Chartered’s share price as well.

HSBC revenues saw a rise of 6% to $13.8bn in its latest Q3 update, with pre-tax profit of $5.9bn. New CEO John Flint has been cutting costs, however, it appears that shareholders remain concerned at the progress of streamlining the business at a time when geopolitics in the region could impact profitability.

Conclusion

Having made modest gains in 2017 the UK banking sector has not been a good bet this year, with all UK banks coming under pressure. However, UK banks haven’t been unique in this regard with European banks similarly underperforming.

Despite seeing another rate rise this year, inflation expectations have stayed fairly low, even as wages start to rise sharply from where they were at the beginning of the year.

Were it not for Brexit uncertainty, it seems likely we would have seen an additional rate rise this year, but given the current backdrop markets don’t have a great deal of confidence that interest rates will rise particularly sharply over the next few years. Either that, or they think that inflation is likely to remain subdued.

For example, at the beginning of 2017 the difference between UK 10-year gilts and 2-year gilts was at 1.15%, whereas now it’s sitting at 0.6%, despite having seen two rises in interest rates since then.

This narrowing of yield differentials reflects low market expectations about the prospect of a further rise in rates against an uncertain economic backdrop.

The next few days and weeks are likely to be a key pre-determinant of the next move up or down, with a positive Brexit outcome likely to prompt a strong rally in bank share prices.

Continued uncertainty is likely to keep prices in the doldrums, along with a weak retail environment. The prospect of an election and a Labour government could also drive share prices lower, particularly in the case of RBS which is already 62% tax-payer owned.

Shadow Chancellor John McDonnell has already raised the possibility of fully nationalising the bank if Labour gets into power, in order to help fund improvements in tech and infrastructure, a move that could cost billions.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.