Apple’s share price advanced 1.25% in after-hours trading, following a 2.83% jump seen yesterday as the company booked record quarterly profits on strong iPhone demand in the holiday season.

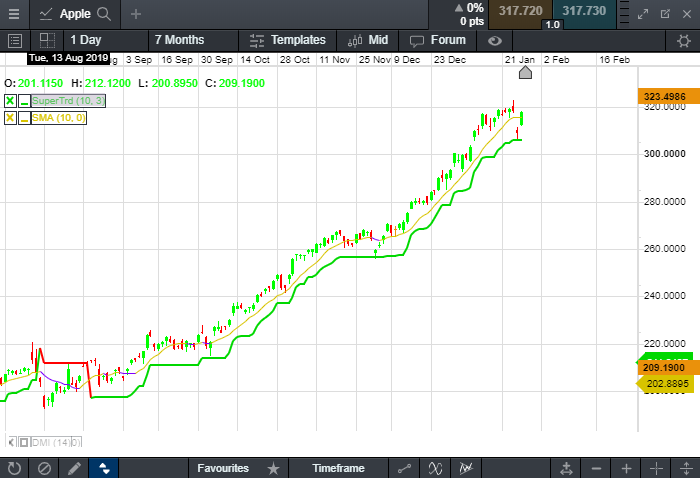

Apple’s revenue increased 9% year-on-year to US$ 91.8 billion and its net profit grew 11% to US$ 22.2 billion. Earnings per share climbed 19% to US$ 4.99. Strong Q4 results helped to justify the company’s current price to earnings ratio of 25 times, as its share price has more than doubled over the last 12 months.

With a market cap of US$ 1.39 trillion, Apple is worth more than twice as much as Singapore’s entire stock market cap (0.49 trillion).

Last night’s US durable goods and US consumer confidence reading both beat expectations, which suggest continuous improvement in the US economy. The dollar index retraced from recent high as demand for safety receded. Similarly, gold and Japanese yen both came off from recent highs.

All S&P 500 sectors were up last night, led by information technology (+1.87%), communications (+1.18%), financials (+1.13%), consumer discretionary (+0.98%), showing a ‘risk on’ pattern.

Currency wise, AUD and SEK lead gains in G10 peers, whereas Yen and Dollar let go earlier gains. A stronger-than-expected Australian CPI reading (1.8% vs. 1.7% forecast) signals higher inflation, which may not support an immediate interest rate cut to be carried out by the RBA. As a result, AUD/USD rebounded mildly from recent low to 0.677 area.

On the other hand, as the novel coronavirus continue to spread across Asia-Pacific and inhibit business activities and travels within and out of China, Australia’s economy is likely to face adverse headwind as well. This may add to the odds of more monetary and fiscal stimulus to be carried out by central banks across Asia Pacific, should the epidemic last for a long period of time.

In Singapore, the stock market rebounded mildly on Wednesday and SGD stabilized against the USD. More measures were implemented by the Singapore government to prevent the importing and spreading of novel coronavirus locally as the number of confirmed cases rose to 7 yesterday. These measures are welcomed by the stock market.

Hong Kong market reopens today and the futures market point to a lower opening towards 27,000 points.

Apple

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.