The UK banking sector will be in the spotlight tomorrow as investors digest the latest Bank of England stress test results, as well as delivering their latest financial stability report.

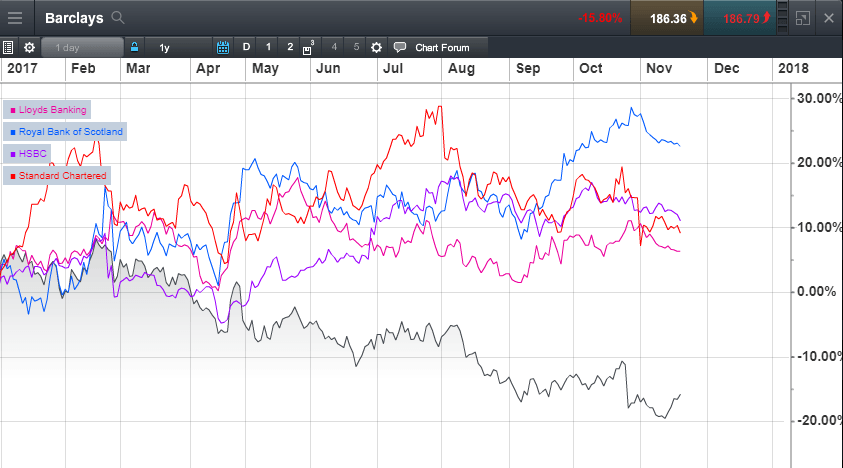

Last year’s tests saw Royal Bank of Scotland come up short, and it could well do so again, given that it still has to settle its multibillion dollar dispute with the US Department of Justice. Despite last year’s stress test failure the bank has still seen the best share price performance year to date outperforming all its peers, its share price up over 20%.

There has been rising concern in recent months over the build-up in consumer credit levels, which prompted the Bank of England to insist in the summer that UK banks set aside extra capital in response to this rise. According to Bank of England figures it is estimated that total UK credit card debt is around £67bn, while car finance is just below £60bn, across the whole of the UK.

This is bound to be a concern at a time when consumer incomes continue to remain under pressure. Under the test scenario the bank will be testing a fall of 4.7% in UK GDP, along with a 4.7% rise in unemployment to 9%. Alongside this the bank has modelled a 33% decline in house prices and a quick rise in interest rates to 4%.

On an international basis the test also models a global slowdown of 2.4% of GDP from current levels

On a number of measures this is a significantly tough scenario, even though the rise in interest rates would only take us back to just below pre-financial crisis levels.

The tests will also analyse the effects of sustained low interest rates and weak global economic conditions, over the next seven years.

While it can be argued that the tests may not be strict enough they are certainly more credible than the ones set down by European regulators, where the banking system still remains undercapitalised.

Barclays has been the worst performer year to date and it is likely to come under scrutiny, along with Lloyds due to its exposure to the UK given both banks exposure to the UK mortgage and credit card markets.

Earlier this year Lloyds increased its impairment provisions in Q3 to £270m, a wise decision given the banks purchase of the MBNA credit card business from Bank of America.

Barclays has also come to rely much more on its UK operations at a time when its investment bank has been performing poorly, and probably explains why it has been the worst performer this year of UK banks, its shares down over 10%.

This year’s focus is once again likely to be on RBS given its failure last year, but it should also be remembered that even if the other banks pass the tests they may well have to raise extra capital or submit revised capital plans which in turn could impact any future potential dividend payout.

This is likely to be particularly true of Lloyds which passed last year’s test quite easily, however given the rise in domestic lending the bank may not have so much headroom this time around.

The UK government will also be hoping that the results of the tests don’t derail its plans to look at resuming the sell-off of the remainder of its 70% stake in RBS, even though it is likely to return a substantial loss.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.