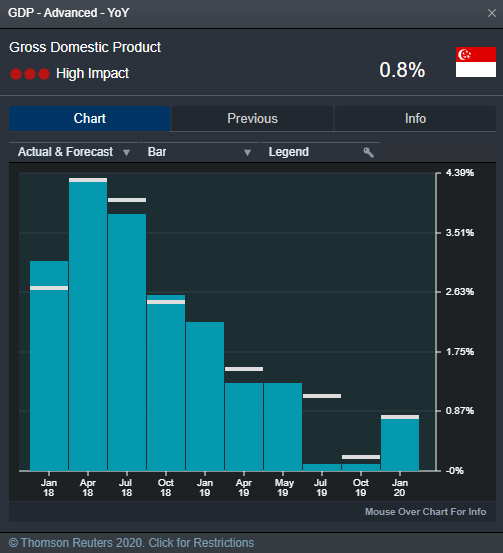

Singapore’s economic growth swings up 0.8% year-on-year in the last quarter of 2019; successfully defying a ‘technical recession’ and may boost trading sentiment in local shares today.

The data was released by the Ministry of Trading and Industry (MTI) and it is widely within market expectation.

The manufacturing sector remained a lagging component of the overall GDP, extending contraction by 2.1 percent year-on-year in the fourth quarter. Output declines in the electronics, chemical and transport engineering clusters were more than offset by the expansion in precision engineering, biomedical and general manufacturing clusters, according to the MTI.

Construction and service sector were the key drivers of economic growth, primarily supported by public sector construction, finance, and insurance services. Construction and service industries grew at 2.1 percent and 1.4 percent respectively in the fourth quarter. On the other hand, weakness in the wholesale and retail sales sector points to soft business environment, and a solid rebound in demand may take more time to appear.

Overall, the GDP data reaffirms market’s expectation for an economic bottoming up, but a deeper look suggests that a cyclical upswing is not here yet without a strong rebound in manufacturing and retail sales activities. The outlook for 2020 remains positive as external demand is set to pick up and China’s manufacturing sentiment improves.

Yesterday, the People’s Bank of China (PBOC) unexpectedly announced a decision to cut the Reserve Requirement Ratio (RRR) for financial institutions by 50 bps, in an attempt to support economic growth and free up some 800 billion yuan (US$ 114.6 billion) of long-term liquidity and reduce social financing cost. This move also aims to offset impacts of higher cash demand ahead of the CNY holiday.

In the past, cutting RRR stimulated the Chinese stock market most of the time, in particularly the financial sector. The FTSE China A50 future is set to open higher today.

Singapore GDP - Advanced

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.