The article is written by Tina Teng & Kelvin Wong, Markets Analysts, CMC Markets APAC & Canada

Facebook parent, Meta Platforms Inc., is set to report the second-quarter earnings on Thursday after the US closing bell. The world largest social media platform’s market value hit $ 1 trillion in November last year, but its share price has been halved year to date due to poor performance amid economic headwinds. After Snapchat’s share price spooky drop last Friday, a softened advertising demand environment and TikTok’s competition threat could have a similar negative impact on Meta’s earnings. However, its low earnings multiple of 13X may provide an opportunity for long-term investors.

A slowdown in the growth of active users, revenue, and EPS

In the first quarter, Meta Platform’s Daily Active Users (DAU) increased by 1.96 billion, its revenue came in at $27.91 billion, or 7% year on year, which was the first single-digit growth recorded in a decade, whereas the prior Q3 and Q4 revenue growth was 33% and 20% respectively. The company’s earnings per share came in at $2.72 for the first quarter. The major factors that caused the significant growth slowdown were Apple’s iOS privacy change, TikTok’s rapid expansion, and macroeconomic headwinds. The regulatory negatives, such as antitrust and user privacy issues also weighed on the share price’s performance. The recent resignation of its COO, Sheryl Sandberg also brings uncertainties to the business’s prospects.

Consensus estimates compiled by Zacks Investment Research have called for $28.82 billion, or a 0.87% drop in the revenue growth year-on-year, and $2.52 earnings per share, or a decline of 30% from a year ago vs. an 18% drop in the first quarter. But a beat on either of the number will be seen as a bullish factor for the stock based on a relatively low price-to-earnings ratio.

The double-edged sword of the Metaverse business

Apart from the above negatives, its new business segment, Reality Labs, including Metaverse which offers augmented, and virtual reality solutions, is seen as a long-run major revenue contributor. But before achieving the expected desired result, which requires a huge investment, and it is still operating at a loss. The segment’s revenue grew by 30% in the first quarter at a loss of $2.96 billion. But on the positive side, Meta has a very healthy cash flow of $43.89 billion by the end of the first quarter, which indicates the company is in a strong position to launch a massive share buyback program that may trigger a positive feedback loop to reverse the current dismal state of its share price’s performance. The new segment will be the key long-term future growth contributor, where sales for its Oculus Quest 2 headsets are expected to grow further in the second quarter, which allows Meta to take a leadership position in the marketplace for virtual reality wearables.

On the negative side, CEO Mark Zuckerberg has announced to reduce its hiring for engineering positions to 6,000-7,000 from 10,000 for the rest of 2022 due to uncertainties in the macroeconomic outlook.

Technical analysis – Potential residual down move for Meta Platforms

The major downtrend of Meta Platforms (META) has so far recorded a decline of -60% from its all-time high of 384.31 printed on 1 September 2021 to its recent 23 June 2022 low of 154.27.

Since 5 April 2022, the price actions of META have started to oscillate within a 3-month plus bullish reversal “Descending Wedge” configuration where the magnitude of the “lower lows” are getting lesser that the magnitude of the “lower highs” as depicted by the upper and lower boundaries of the “Descending Wedge” drawn on the daily chart of META. The appearance of the “Descending Wedge” configuration suggests that the major downtrend phase of META is coming to a tail end which may lead to a one to three months of corrective rebound phase thereafter.

However, Elliot Wave/fractal analysis suggests that META is likely to shape a residual down move sequence to hit an inflection/support zone before the potential corrective rebound takes shape. In addition, the daily RSI has just inched down lower from a key corresponding resistance at the 58% level which suggests that medium-term downside momentum remains intact.

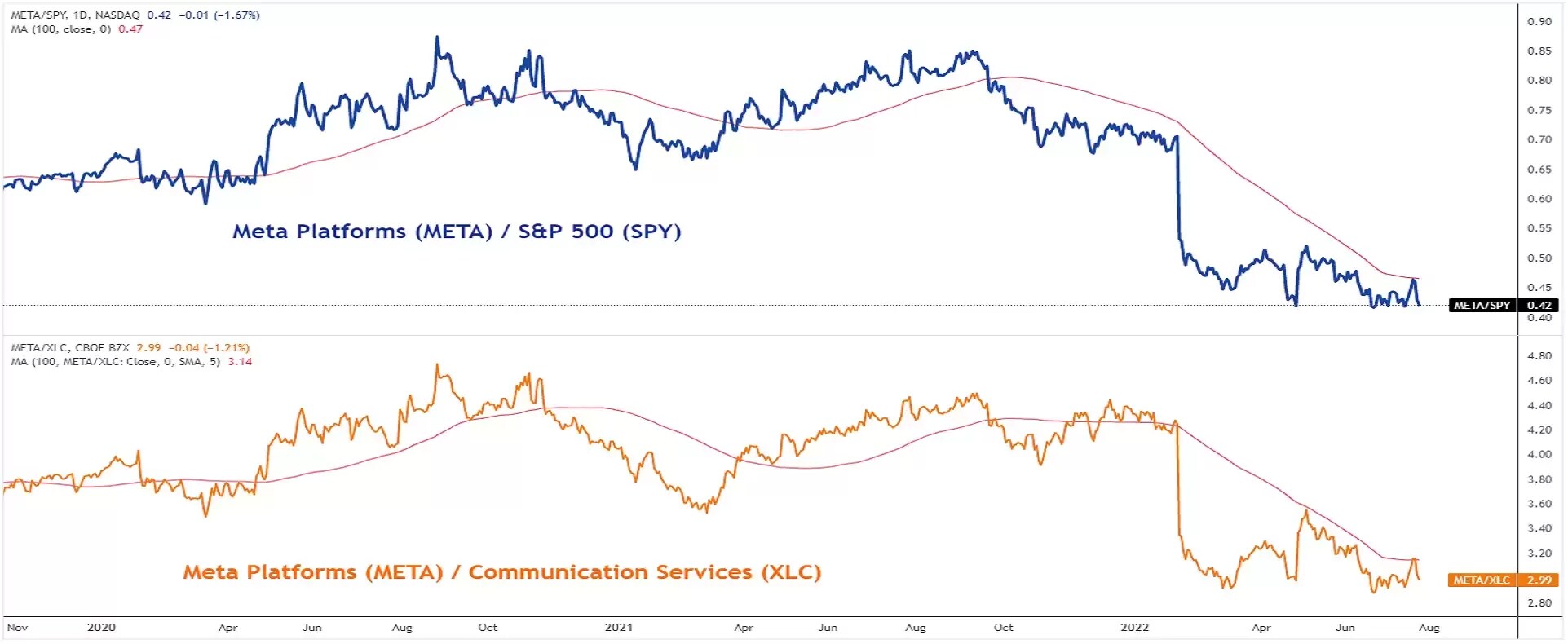

Also, the daily ratio charts of META against the S&P 500 and its sector, Communication Services are still indicating underperformance of META.

Watch the 186.20 key medium-term pivotal resistance for a potential residual push down towards the supports at 153.10 and 137.10/132.55 before the likely corrective phase kickstarts.

On the flip side, a clearance with a daily close above 186.20 invalidates the residual down move scenario for the start of a corrective rebound towards the next resistance zone of 236.80/248.00 (also the 200-day moving average).

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.