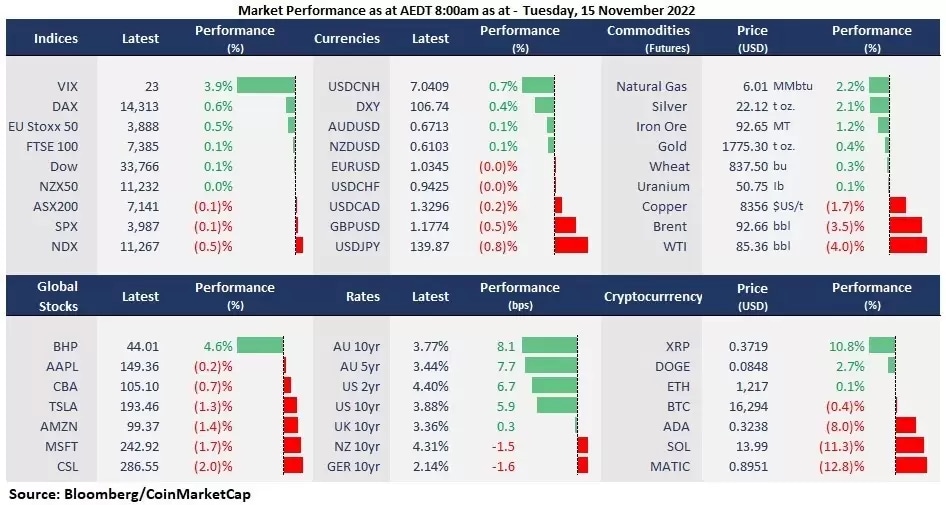

US stocks gave up early gains as bond yields climbed again and pressed on equities, while investors may have reassessed the inflation outlook after the cooler-than-expected US CPI data last week. Risk sentiment was buoyed in the early session by Fed’s Vice Chair Lael Brainard’s comments regarding a slowdown in rate hikes. In the meantime, the Chinese stock markets continued the rebounding frenzy due to Beijing’s further stimulus measures to its property sector. Also, US President Joe Biden and China President Xi Jinping’s meeting ended with positive results, implying a relaxing tension between the two nations. However, the 10-year US bond yield rose to 3.88% from 3.81% last Friday, with the US dollar index strengthening slightly, weighing on resource and energy prices. In addition, Cryptocurrencies stabilized around the recent lows as Binance’s CEO, Zhao twitted to build “an industrial recovering fund” aiming to save the broad liquidity crisis that was triggered by FTX’s fallout.

- All three US benchmark indices test key resistance levels, with Dow stabilizing above the 200-day MA. 10 out of 11 sectors in the S&P 500 finished lower, with Real Estate leading losses, down 2.7%. Healthcare is the only sector that closed in green but only gained 0.05%. Most Mega-cap companies were down, with Amazon and Microsoft both falling more than 2%. While Meta Platforms Inc. and Netflix rose 1% and 3%, respectively.

- Amazon’s shares were under pressure as the company is planning to lay off about 10,000 employees starting this week, which will be the biggest in history, representing less than 1% of its global workforce.

- European equity markets continued to soar, with Dax up 20% from its September low following Wall Street’s comeback, and China reopening optimism. The pharmaceutical stocks lifted the regional market overnight, AstraZeneca and GSK rose 2.2% and 3%, respectively.

- Hong Kong stocks extended the rebounding frenzy on Beijing’s further stimulus policy to its property sector. Hang Seng Index rose 1.7%, buoyed by its property shares, with Country Garden shares soaring 47%, China KWG Living Group Holdings and China Overseas Land & Investment jumping 12% and 9%, respectively.

- Bitcoin stabilized above the recent low of 15,500, which is pivotal support. Bitcoin fell to as low as just under 16,000 before bouncing back to 16,360 at AEST 8:30 am after Binance signalled to form a recovery fund amid the industrial liquidity crisis.

- Asian equity markets are set to open mixed. ASX futures were down 0.52%, Nikkei 225 futures were flat and Hang Seng Index futures rose 0.54%.

- Gold bounced off the session low of 1,753 but finished flat for the session. A sharp decline in the US dollar has boosted the surge in gold. The precious metal jumped nearly 10% from its November low.

- Crude oil tumbled 4% amid record-high Covid cases in China’s major cities. Despite Beijing’s efforts to stimulate the economy, a surge in the country’s Covid cases gloomed resource and energy demand outlooks, suggesting uncertainties are still around amid its Zero-Covid policy.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.