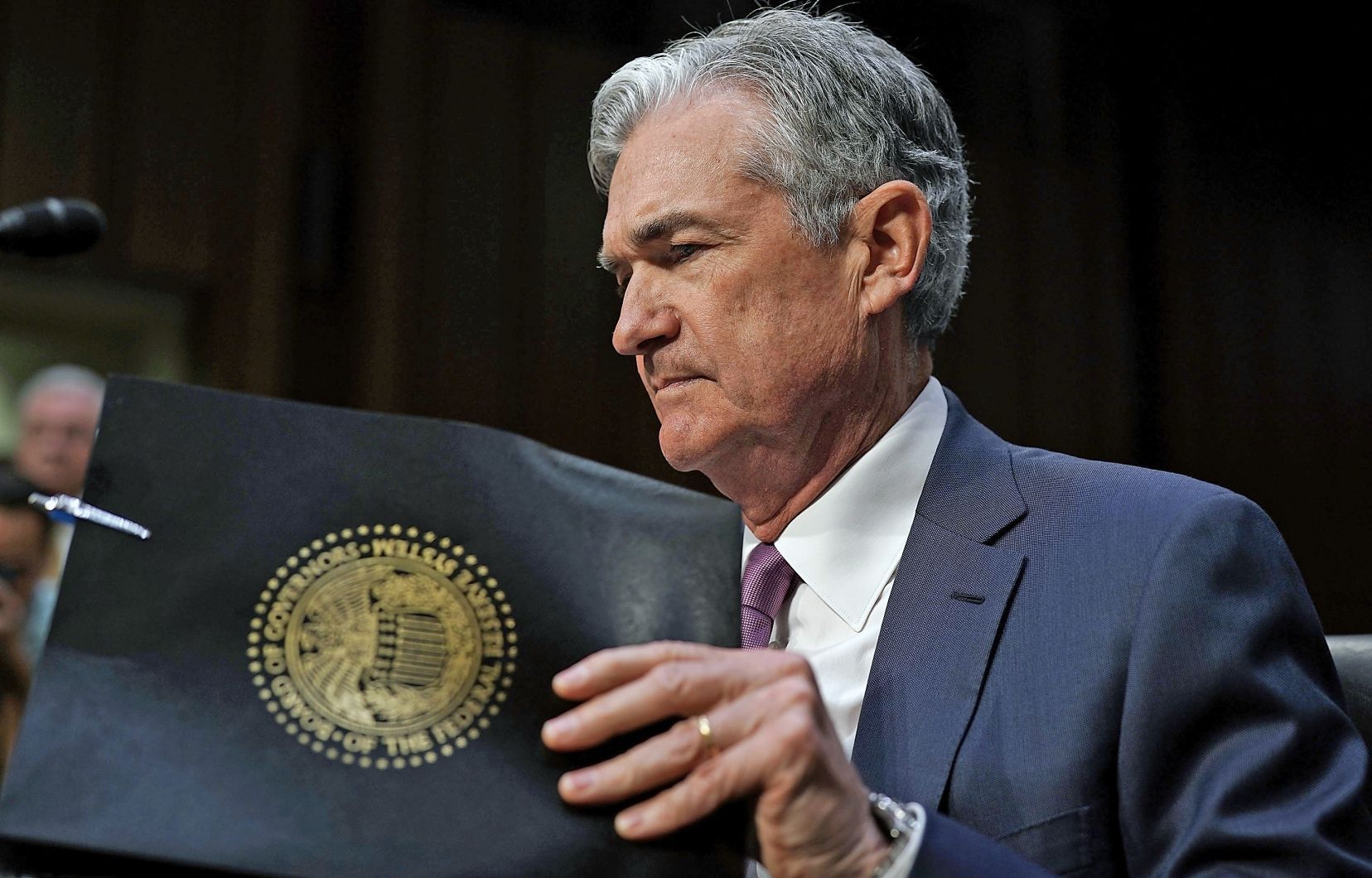

European markets have opened sharply lower, after last nights Fed minutes showed that US policymakers were concerned about the outlook for the US economy, in the absence of further fiscal support.

This less than dovish tone seemed to catch the markets unawares, prompting US markets to slide back from their new all-time highs, and put markets in Asia on the back foot as well.

This seems a rather surprising reaction, when you consider that this observation about the US economy seems a rather obvious one in light of recent events, and in particular why it needs to be spelt out by some central bank minutes that are three weeks old.

Some have argued that the absence of further detail about future unconventional measures, and other guidance mechanisms, as well as a lack of enthusiasm over yield caps and targets in the current environment spoke to a central bank that was reluctant to go down that particular road at this point in time.

That may well be true, but given the support the Federal Reserve is already giving the economy, it seems eminently sensible to keep something in reserve, and with the virtual conference replacing Jackson Hole due to start a week from now, there is plenty of time to think about further measures given that the topic next week is ““Navigating the Decade Ahead: Implications for Monetary Policy”

Nonetheless, investors have taken fright with European markets sharply lower in fairly thin trading, with financials and basic resource stocks leading the losses.

The latest numbers from Frasers Group, formerly Sports Direct has seen the shares rise sharply in early trade to their best levels since early July after the company revealed that full year reported profits after tax profits were down by 12.9%, at £101m.

Full year revenue rose 6.9%, to £3.96bn, helped by a big jump in Premium Lifestyle, which includes House of Fraser, as well as the acquisition of Jack Wills and sofa.com, which saw a 34.9% rise in revenue.

All in all, given the challenges facing the retail sector these numbers are much better than expected, with the range of brands under the Ashley umbrella helping to absorb some of the retail shocks, given that he also owns Evans Cycles and GAME Digital, which have broadly done better than most as a result of the pandemic. On the downside the company said it was likely going to have to close more stores as more and more business went online, though it was more optimistic about the outlook forecasting a 10% to 30% improvement in underlying earnings, despite the challenges being posed by the pandemic.

AO World is another winner today, with its latest trading update pointing to a 59% rise in UK revenue growth to £401.3m, and rise of 91.5% in Germany to €74.3m.

On the downside Premier Oil shares are sharply lower after the company announced it was looking to raise $530m of new equity at the same time as announcing a first half loss of $32m. $230m of the new equity will be used to buy BP assets in the North Sea, while the rest will be used to refinance the company’s debt facilities.

The rebound in the US dollar has also sparked a fresh bout of weakness in gold prices which sold off sharply and are now testing support at the $1,920 an ounce, and the renewed uncertainty over the pace of further monetary stimulus from the Federal Reserve.

US markets look set to continue the weakness we saw into the close last night with a weaker open, ahead of the latest weekly jobless claims numbers. These have remained remarkably resilient since the fiscal stimulus program ended at the end of last month.

Weekly claims have fallen below the 1m mark, while continuing claims have also continued to fall. Whether this trend can continue remains the topic of much contention, with expectations of a fall to 920k on the weekly number, while continuing claims expected to fall to 15m. In the absence of further fiscal measures from US policymakers this trend is likely to reverse, with the only question being around the timing. It could happen today, or it could start to happen in the next few weeks, but when it does this could be the catalyst that nudges US policymakers into action, along with further weakness in equity markets more broadly.

Apple shares are also likely to be in focus after it became the first ever $2trn US company yesterday, almost two years to the day it first passed the $1trn market cap level.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.