Microsoft’s [MSFT] share price has climbed 31.74% YTD to close at $211.60 on 20 July, outstripping the performance of the Nasdaq which only rose 21.78% in the same period.

While the COVID-19 pandemic was in full swing and people were sheltering at home, Microsoft’s share price benefited from an increased use of cloud services and remote working tools.

Since March’s pandemic market sell-off, Microsoft’s share price rose 29% in the three months to the end of June. Momentum has slowed down in July, however, with Microsoft’s share price up by just 3.4% so far this month (through 20 July’s close).

Will the company’s Q4 fiscal 2020 earnings report, due on 22 July, help Microsoft’s share price regain momentum?

Minimal impact from COVID-19 in Q3

For its Q3 2020 earnings report, Microsoft posted total revenue of $35bn, which marked a 15% year-over-year increase. It also surpassed the $33.66bn expected by analysts polled by Refinitiv, according to CNBC.

Personal computing revenue was $11bn — a 3% year-over-year increase — and productivity and business processes accounted for $11.7bn — a 15% increase on the same period a year ago.

$35billion

Microsoft's Q3 revenue - a 15% YoY rise

The company’s intelligent cloud was the best performing segment, rising 27% year-over-year to $12.3bn. One of its biggest products in the intelligent cloud segment is Azure, which saw its revenue for the quarter rise by 59% from the same period a year ago.

Growth in these segments was key to Microsoft’s share price success in Q3, although the company had yet to see any real impact from COVID-19 in this quarter.

For Q4, the company expects intelligent cloud revenue to be between $12.9bn and $13.15bn, while revenue for productivity and business processes is set to reach between $11.65bn and $11.95bn, figures which suggest Microsoft’s share price could be set for a boost.

As of 20 July, the average analyst estimate for Q4 revenue is $36.5bn, with the average earnings estimate, pegged at $1.38 a share, according to data from Yahoo Finance.

$36.5billion

Microsoft's estimated Q4 revenue

Indications are that the company is on track to meet its guidance, spurred on by the number of people transitioning to working from home and relying on virtual meetings. If the tech giant does achieve these figures, a drop in Microsoft’s share price would be surprising.

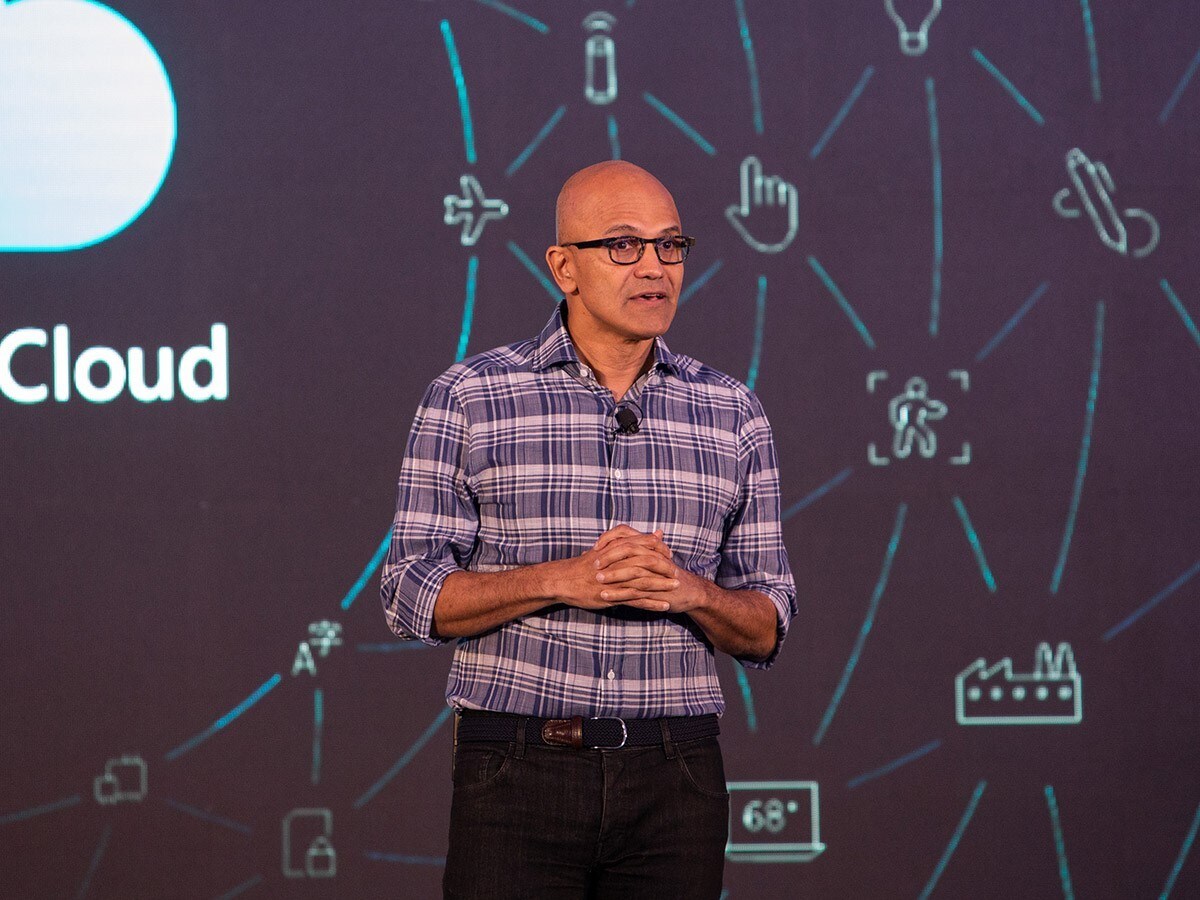

During the Q3 earnings call, Satya Nadella, CEO of Microsoft, noted that on its video-messaging platform Teams, 4.1 billion meeting minutes had been generated by 200 million meeting participants in a single day in April. “Teams now has more than 75 million daily active users,” Nadella said.

Missing earnings predictions may not be detrimental to growth

High user growth, coupled with an increase in the number of subscriptions being taken out for other products, such as Azure, signifies “relatively strong cloud deal activity,” wrote Dan Ives, analyst at Wedbush, in a note to clients. He recently reiterated an outperform rating and raised his price target from $240 to $260.

“In many cases, we are seeing enterprises accelerate their digital transformation and cloud strategy with Microsoft by six to 12 months, as the prospect of a heavily remote workforce for the foreseeable future now looks [on] the cards,” he wrote, as reported by MarketWatch.

“In many cases, we are seeing enterprises accelerate their digital transformation and cloud strategy with Microsoft by six to 12 months, as the prospect of a heavily remote workforce for the foreseeable future now looks [on] the cards” - Dan Ives, analyst at Wedbush

Keith Weiss, an analyst at Morgan Stanley, is also bullish on the stock. He reiterated an overweight rating, raising the price target from $198 to $230, according to The Fly. Weiss said that although IT budgets have been contracting marginally, Microsoft has clearly benefited from companies who are prioritising virtual collaboration and cloud computing.

Going into fiscal 2021, even if the company were to miss the Q4 2020 earnings guidance, things do look positive for Microsoft’s share price. Microsoft’s greater focus on hardware, software and services over advertising revenues may prove to be its biggest advantage over other big tech stocks.

Of 33 analysts polled by CNN, 29 rate Microsoft’s share price a buy, two outperform and three hold.

| Market Cap | $1.605trn |

| PE ratio (TTM) | 35.25 |

| EPS (TTM) | 6.00 |

| Quarterly Revenue Growth (YoY) | 14.6% |

Microsoft share price vitals, Yahoo Finance, 21 July 2020

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy