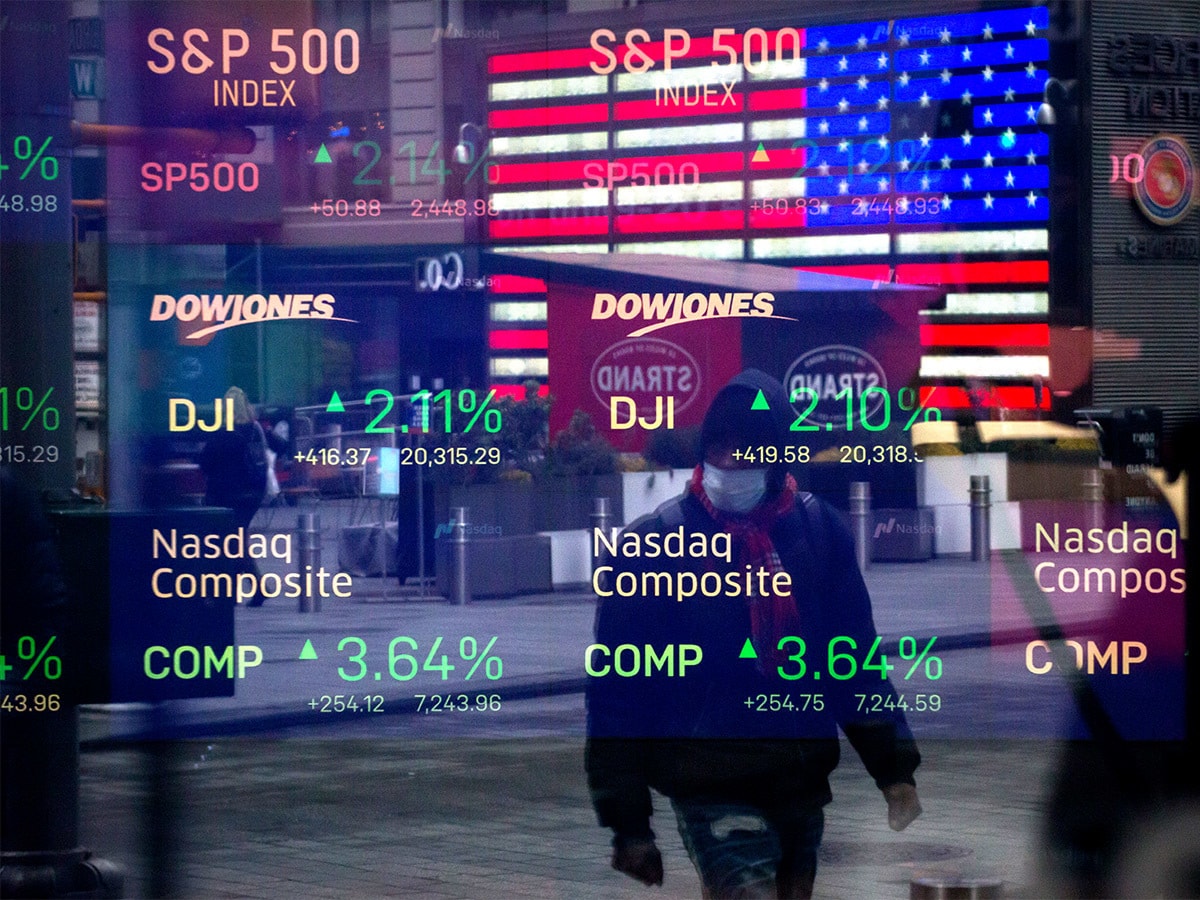

Last year, the three main stock market indices in the US recorded stellar performances.

The S&P 500, comprising the 500 largest companies listed in the country, rose 28.9% in 2019 while the Nasdaq gained 35.2%, representing the best one-year gains since 2013 for both. The Dow climbed 22.3%, its biggest rise since 2017. Furthermore, all of the indices beat the 24% surge experienced by the global focused MSCI World Index.

US stock markets were boosted by a bounce-back in corporate earnings, a stronger economy and a series of rate cuts by the US Federal Reserve.

28.9%

Rise of the S&P 500 in 2019

The start of 2020, however, has looked different. The longest-ever US stock market bull run has been blindsided by the Coronavirus pandemic, and the prospects of a global economic downturn have increased.

The Dow Jones dropped 23% in the first quarter and the S&P was off 20%, both recording their worst ever first-quarter performance. Despite this, there are strong, longer-term, fundamentals underpinning US stock markets that offer some hope to beleaguered equity traders.

American influence

US stock markets are home to many of the world’s largest and most innovative companies such as Apple [AAPL], Amazon [AMZN], Google (and parent company Alphabet [GOOG]) and established giants such as General Motors [GM].

What happens in the US markets influences others around the world. Even though they open after those in Europe and Asia, major economic or corporate news impacting the US market can often dictate how an international market either ends its day, or begins the next.

There is also blanket and dedicated newspaper, internet and TV coverage swirling around US stock markets, making it easy to research what is happening in the economy, and how major industry players are performing.

On a practical level, trading in the US is beneficial to European traders as the markets continue into their evenings. For part-time investors and traders, this provides an opportunity to scratch their trading itch and build up skills and capital before taking the plunge and trying their hand at full-time day trading.

What can we expect in 2020 and beyond?

A recession does seem inevitable in the US. Goldman Sachs economists recently predicted a 24% quarter-on-quarter annualised contraction in US GDP in Q2. To put this in context, the worst quarter of the financial crisis saw just an 8.4% decline. There is hope that the massive $2tn stimulus package approved by the US Congress and US President Donald Trump will help bolster both markets and the economy, however.

Rob Sharps, group CIO at T. Rowe Price is positive that better days will soon come. “We firmly believe, in time, the crisis conditions will ease, and markets will recover. In our view, there is a potential upside scenario where we come out of a bear market by the summer of 2020 as pent up demand and stimulus drive a rapid acceleration in economic activity and earnings growth.”

“In our view, there is a potential upside scenario where we come out of a bear market by the summer of 2020 as pent up demand and stimulus drive a rapid acceleration in economic activity and earnings growth” - Rob Sharps, group CIO at T. Rowe Price

He adds that in this scenario, the earnings growth rate in the fourth quarter could bring S&P 500 earnings per share up to $160 on an annualised basis, potentially pushing the index back above 2,700.

“Regardless of whichever scenario unfolds, it is important to focus on whether companies are positioned to make it in the long term. This will be challenging in certain industries until we know more about the extent of US government relief. The more staying power and flexibility, the better,” Sharps says.

“Also, do not focus on where prices have been. There are many technical factors impacting stock prices now and long-term investors should not waste energy beating themselves up for being early or late. In time, markets will sort out winners and losers, and investors need to try to anticipate those verdicts.”

Russ Mould, AJ Bell’s Investment Director, has a similar view. “The day-to-day swings in the S&P 500 are currently exceeding those seen in the days and weeks after the collapse of Lehman Brothers on 15 September 2008 as the financial crisis reached its height,” he says.

“A period of calm, even resignation, might not be a bad thing and chasing a market after it has just surged by 11% in a day is a risky strategy. For those who are prepared to take a contrarian view and start buying, then it would surely be better to do it after bad days of heavy falls than good days of big gains.”

“For those who are prepared to take a contrarian view and start buying, then it would surely be better to do it after bad days of heavy falls than good days of big gains” - Russ Mould, Investment Director at AJ Bell

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy