One of the best ways for investors to maximize returns is to pay close attention to emerging themes across each sector and then invest in companies that will benefit. Ideally, these will be themes that have considerable market potential with strong growth rates.

Often, I discover these emerging themes by reading company earnings calls and conference presentations. They provide the best live insight into shifting patterns within their given industry.

Other times, I discover a relatively unknown, small-cap company showing impressive revenue growth first, via fundamental stock screeners, and they lead me to the larger opportunity.

Such was the case with microgrids. This appears to be a potentially lucrative theme moving forward as we are on the cusp of massive transformational shifts across the much larger energy sector.

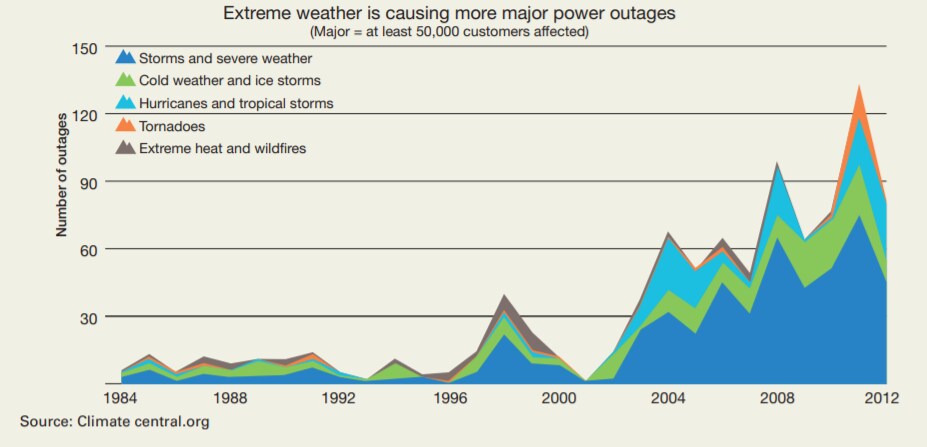

Grid instability has been in the news with recent weather events, and new projects and solutions are in high demand.

What is a microgrid?

The US Department of Energy defines a microgrid as a group of interconnected loads and distributed energy resources (DERs) within clearly defined electrical boundaries that acts as a single controllable entity with respect to the grid.

A microgrid can connect and disconnect from the grid, enabling it to operate in both connected or island-mode.

The EU research project describes a microgrid as comprising low-voltage distribution systems with DERs (microturbines, fuel cells, photovoltaics), storage devices (batteries, flywheels), energy storage systems and flexible loads.

Such systems can operate either connected to or disconnected from the main grid. The operation of microsources in the network can provide benefits to the overall system performance if managed and coordinated efficiently.

In a microgrid, energy storage can perform multiple functions, from ensuring power quality — including frequency and voltage regulation — to smoothing the output of renewable energy sources, providing backup power for the system and playing a crucial role in cost optimization.

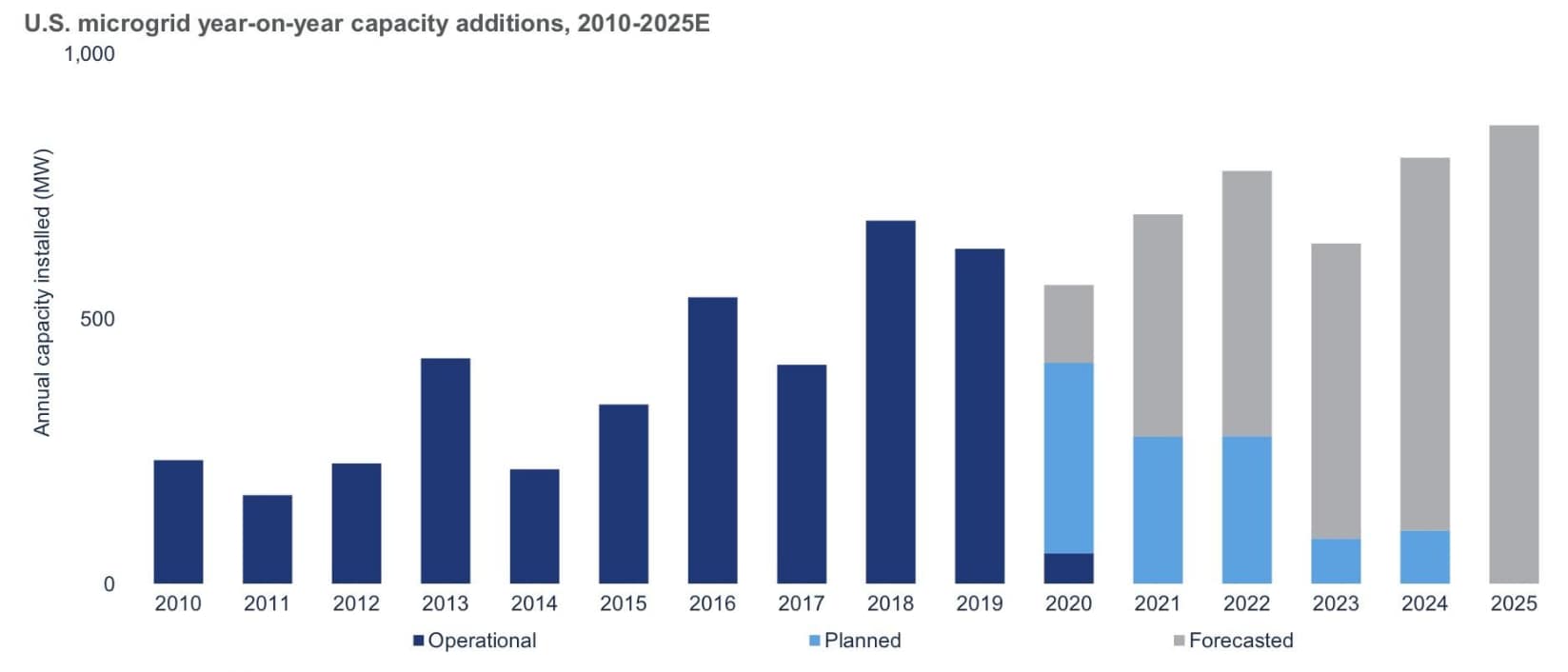

Examples include chemical, electrical, pressure, gravitational, flywheel, and heat storage technologies. Microgrid installations hit a record high in 2019 and, although some planned projects have been delayed due to the pandemic, growth is expected to continue.

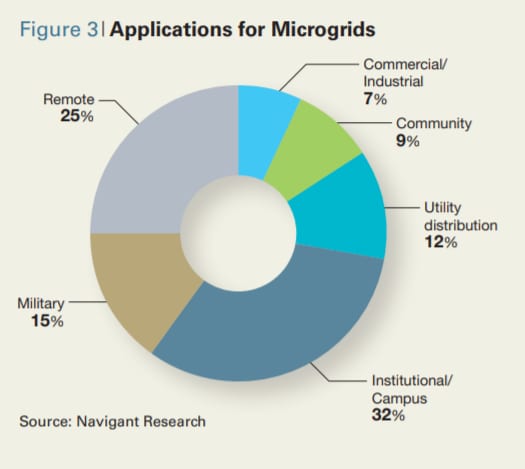

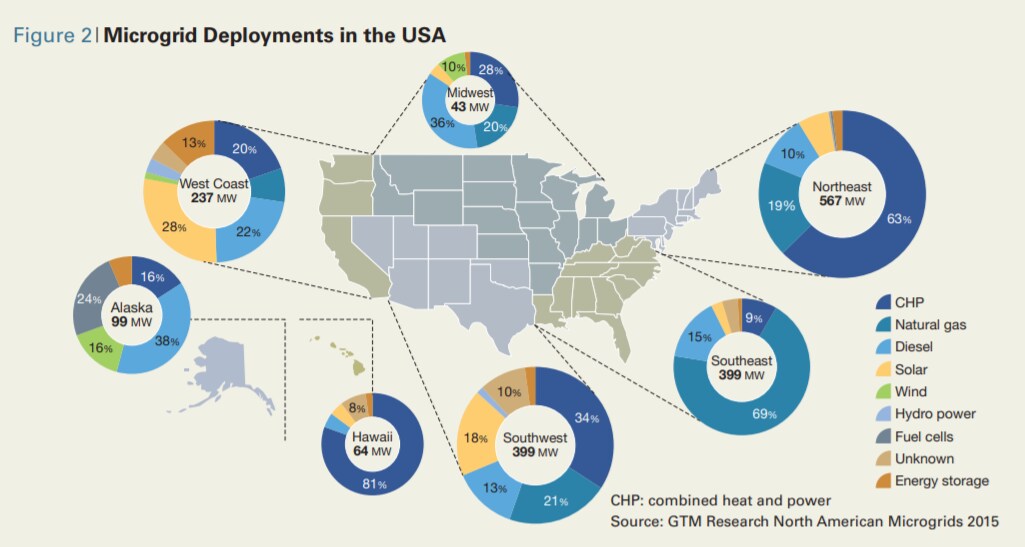

Microgrids tend to fall into the following categories: Campus Environment/Institutional, Community, Remote Off-grid, Military Base, and Commercial/Industrial. Microgrids are localized grids that can disconnect from the traditional grid to operate autonomously.

Because they can operate while the main grid is down, microgrids can strengthen grid resilience and help mitigate grid disturbances, as well as functioning as a grid resource for faster system response and recovery.

Microgrids support a flexible and efficient electric grid by enabling the integration of growing deployments of distributed energy resources such as renewables like solar. In addition, the use of local sources of energy to serve local loads helps reduce energy losses in transmission and distribution, further increasing the efficiency of the electric delivery system.

As we enter a more sophisticated era for utilities, microgrid solutions are becoming more attractive operationally and economically. To lessen the strain on grid operators, distributed energy resource management systems are needed to optimize performance.

Jeff St. John, senior editor at Greentech Media, recently noted that “microgrids, solar-plus-storage systems, electric vehicle (EV) chargers, dispatchable energy loads and other distributed energy resources are going to play an increasingly important role in shaping California’s electricity supply-demand balance as it seeks to reach its goal of 100 percent carbon-free energy by 2045.”

The Energy Storage Association says: “Strategic planning and operation of microgrids or a fleet of energy storage systems spread across the grid will vastly improve the grid’s resilience. As the cost of these outages continues to rise, the value of enhanced reliability and improvements in resilience will increase as well.”

It continues: “Microgrids are on the forefront of the emerging DER ecosystem that challenges the traditional power market. In the future, utilities will continue to forge partnerships with energy storage companies and other vendors active in the microgrid space. These companies will understand the technical control platforms required to provide interoperability and the ability to stack value and manage DER as well as legacy assets across an entire enterprise. A network of utilities and vendors will securely share data and insight to identify policy reforms needed to accelerate microgrid deployments, improving reliability and resilience.”

The global demand for energy is expected to increase by 30% between 2017 and 2040, with renewable sources of energy to contribute 40% of the increase in primary demand. To meet with the growing demand for energy, numerous new power projects are expected to be implemented across the globe, resulting in added concerns for grid stability.

The cumulative capacity of distributed storage and solar in North America, Europe and Oceania is expected to double by 2025, while EV charging points are set to grow sevenfold by this date, according to Wood Mackenzie. The majority of new bulk generation capacity will be variable renewable energy: wind, solar and battery storage.

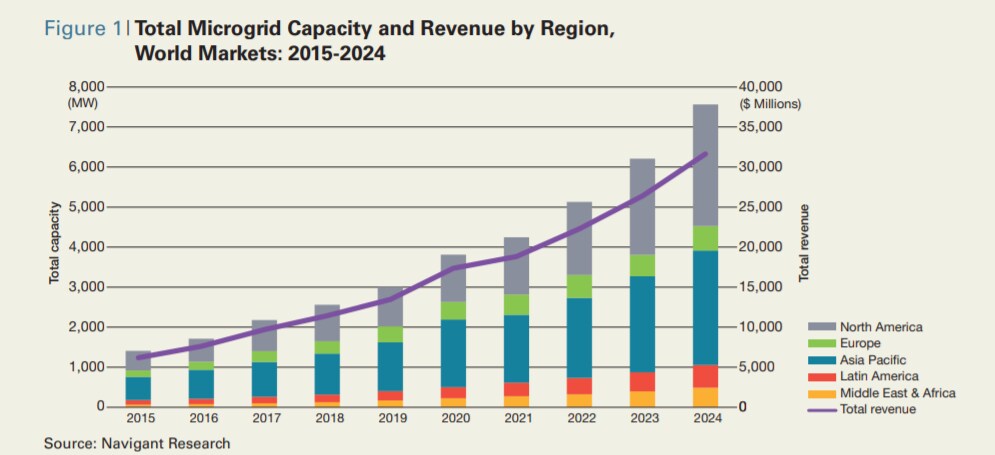

Total microgrid capacity is expected to increase from 3.5GW to 20GW over the next decade. The global market for microgrids is expected to experience 28% compound annual growth rate from 2020-2029, nearing $40bn according to Navigant Research, and these microgrids will require software.

In July, Hitachi completed a $7.8bn acquisition of ABB’s power grid unit to tackle the risk in renewable energy. A recent report from Hitachi notes: “Hitachi America’s Energy Solutions Division is aggressively pursuing the North American microgrid market as a one-stop service provider that can deliver a turnkey microgrid and then operate and maintain the system over the lifetime of the system. The market is currently emerging and projected for significant growth in the next 10 years, making this a promising business opportunity to establish Hitachi as a market leader in this industry.”

Schneider Electric has made a number of interesting moves in the microgrid industry, forming AlphaStruxure with Carlyle Group to bring microgrids to airports, ports and other large infrastructure projects. More recently it announced a new partnership with Huck Capital, targeting microgrids for small to medium-sized buildings, those with an electrical load under 5MW. Schneider has identified this as a massive market, representing 90% of buildings in the US and Canada.

All of my research into microgrids indicates several positive tailwinds from renewable energy deployment and improving economics make this a theme to pay attention to. This is especially true given concerns of grid stability and the surging need for power. Microgrids are also environmentally focused; an average commercial microgrid using renewable energy delivers over 10,000 tons of greenhouse gas savings over its lifetime.

Investment Opportunities

The main players in microgrids are large industrials, so it is not that much of a needle-mover. The major players include Hitachi [6501], Honeywell [HON], Emerson [EMR], Schneider Electric [SU], Siemens AG [SIE], General Electric [GE], and Toshiba [6502]. There are also interesting private players to keep an eye on for IPOs or SPACs that include Saft, Gridscape Solutions, BoxPower, Standard Microgrid, Princeton Power Systems, and S&C Electric.

Eaton [ETN] has a $40bn market cap and operates across multiple segments. Power systems is one and it has been active in new applications such as microgrids.

Bloom Energy [BE] and Fuel-Cell [FCEL] are two fuel-cell names with exposure to the microgrid theme. The former saw a lot of call option buying on 18 September. The Bloom Energy Server provides a critical foundation for building microgrids of varying complexity.

I have found a few interesting micro-cap names for more pure-plays on the microgrid theme:

CleanSpark [CLSK] is an intriguing $181m small-cap company with alternative energy in focus and is strong today. CLSK is in the business of providing advanced energy software and control technology that enables a plug-and-play enterprise solution to modern energy challenges. Its services consist of intelligent energy monitoring and controls, microgrid design and engineering and consulting services.

It also owns patented gasification technologies that convert any organic material into SynGas. This can be used as clean, renewable, environmentally-friendly warming fuel for power plants, motor vehicles, and as feedstock for the generation of DME (Di-Methyl Ether). CLSK has seen momentum grow over the last few months, with multiple new contracts in microgrid and EV. It is working off a small revenue base of $4.5m in 2019, which was +680%, and is set for 125% growth to $10.2m in 2020. The CLSK Software segment has 90% margins, Hardware 15%, and Consulting Services 60% margins.

VivoPower [VVPR] is an international solar and critical power services business with a market cap of $120m. Its main activity is the provision of critical energy infrastructure generation and distribution solutions to a diverse range of government, commercial and industrial customers throughout Australia.

VVPR provides critical energy infrastructure generation and distribution solutions including the design, supply, installation and maintenance of power and control systems to a customer base in excess of 700 active customers, and is considered a trusted power adviser.

VVPR posted 16% revenue growth in 2019 and 24.8% growth in 2020. It plans to enter the EV sector due to interest from its existing customer base, with an initial focus on the infrastructure and mining sectors.

Capstone Turbine [CPST] is a $48m company that develops, manufactures, markets and services microturbine technology solutions for use in stationary distributed power generation and distribution networks applications. Its full line of microturbine energy solutions target multiple vertical markets worldwide, including energy efficiency, renewable energy, natural resources, critical power supply, microgrid and transportation. CPST revenues peaked in 2014 but forecasts see a return to strong 25%+ growth in 2022.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy