The relationship between work and technology has always been a complicated one, and it’s fair to say the ongoing COVID-19 crisis has complicated it further. Video conferencing apps like Zoom had been around for years before a deadly pandemic made them seem like a necessity, and other paradigm shifts are bound to come along in the near-future. But while Zoom may be an example of a technology that compliments human work, there are other tools out there that have the effect of removing the human element altogether.

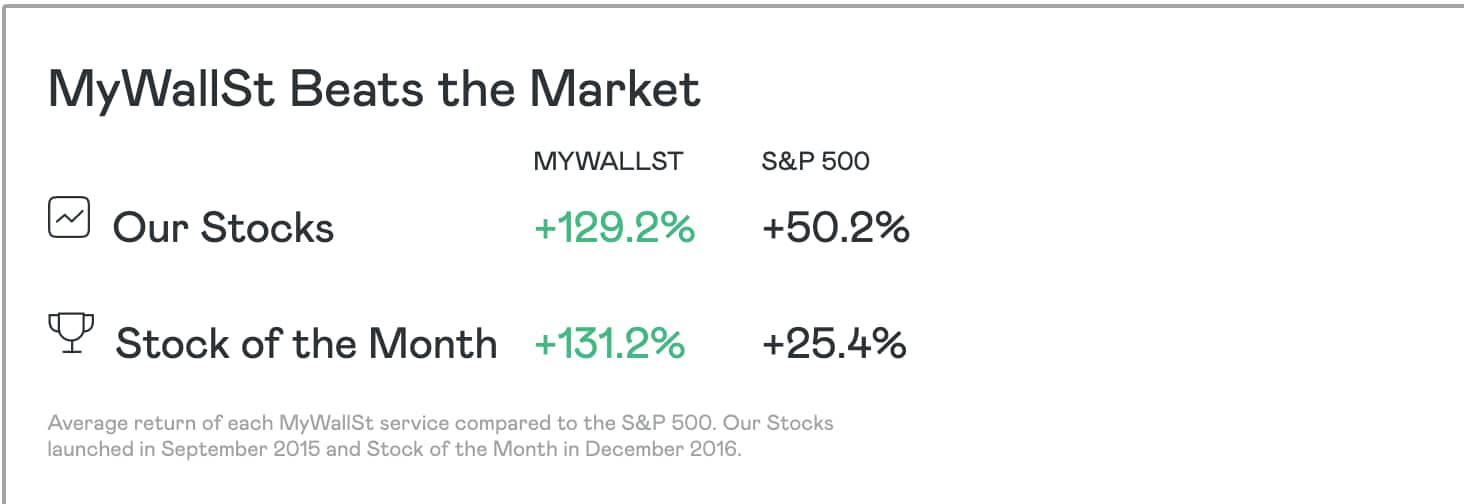

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Regardless of your feelings about the rise of machine-only work, there’s little arguing that it’s a global megatrend. Here are two ETFs that offer solid, diversified exposure to the overlapping markets of AI, robotics, and automation.

1. Global Robotics & Automation Index

The first benchmark index to track the robotics and automation industry, ROBO (NYSEARCA: ROBO) Global consists of more than 80 companies across a dozen or so countries, including robotics powerhouses like Germany and Japan. The largest companies represented are Nvidia and ServiceNow , which together comprise about 4% of the fund. Delve deeper into these companies and you’ll find almost every major automation trend accounted for, as well as forays into healthcare and military technicians.

Perhaps with the exception of Nvidia, none of the obvious tech giants are featured on the ROBO Global index. This was a deliberate exclusion on behalf of ROBO, as the fund is — in its own words — “carefully structured to capture the growth of rapidly developing robotics and automation companies around the globe.” In other words, ROBO offers investors a stake in an unusually diverse number of small- and medium-cap stocks in a market that seems to have nowhere to go but up.

2. Global X Robotics & Artificial Intelligence

Better known by its ticker symbol, BOTZ, Global X Robotics & Artificial Intelligence (NASDAQ: BOTZ) focuses on high-growth businesses in the automation field, especially those involved with industrial robotics. BOTZ is even more Nvidia-heavy than ROBO, with the tech company accounting for more than 9% of holdings, but the two indices are far from identical.

Take one of BOTZ’s mid-sized holdings, the UK-based Renishaw. The firm specializes in spectroscopy — that is, the study of the absorption and emission of light — as it applies to healthcare technology. One of the ETF’s main draws is that it allows the investor to buy into markets so technical and specific that their very existence might go unknown without a responsible, informed middleman.

For all of Google’s impressive work in the artificial intelligence space, or Tesla’s experiments with next-gen driverless vehicles, the truth is it’s impossible to predict which company will eventually “cross the line” in the struggle over AI and automation and enjoy winner-take-all profits. As with many ETFs, what both ROBO Global and BOTZ offer investors is a significant stake in a high-growth sector whose time, though it may linger awhile, will almost certainly come.

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy