A complete guide to short selling

Published on: 08/10/2021 | Modified on: 23/01/2023

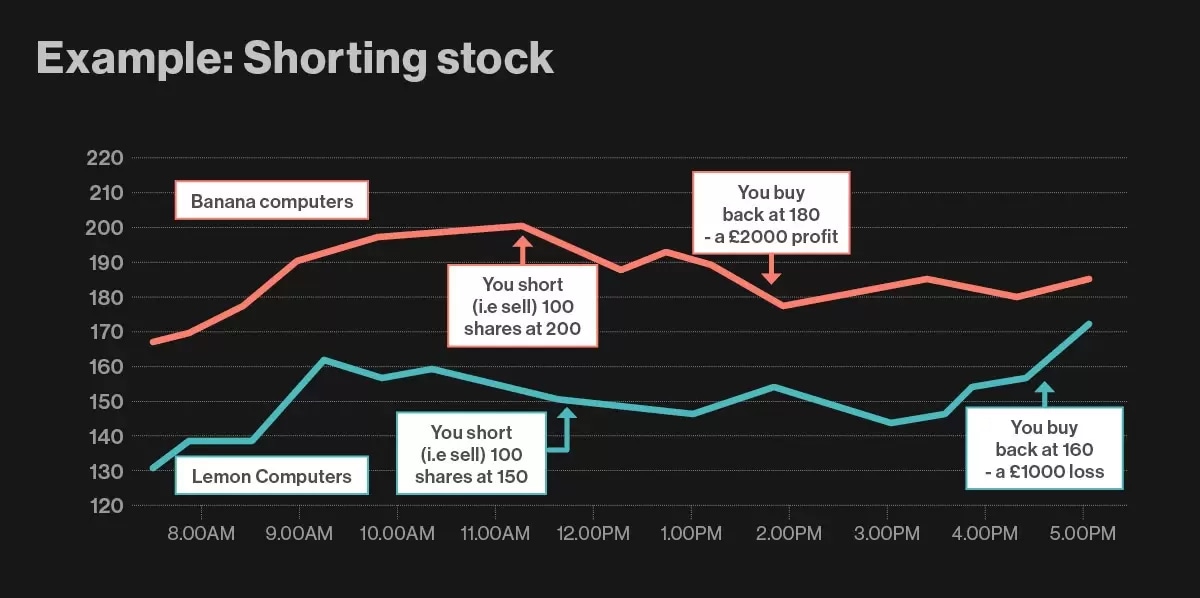

Most people understand the concept that traders make money through buying an asset and then selling it when its price goes up. However, it’s just as possible for them to make money when the value goes down. Traders can profit from declining individual share prices, volatile commodities or even an entire market crash by doing what is known as short selling. It's important for those who do it to understand fully how this type of trading works and the benefits and drawbacks. In this article, we explain how shorting a stock works, the potential implications for both traders and asset prices, and the factors traders look for that suggest an asset’s value is likely to go down.

KEY POINTS

- Short sellers are betting that a financial instrument is due to decrease in value

- The aim is to sell the asset at a higher price and buy it back when it has dropped to a cheaper price, locking in profit

- Shorting can be an effective way of hedging your bets against losing long positions

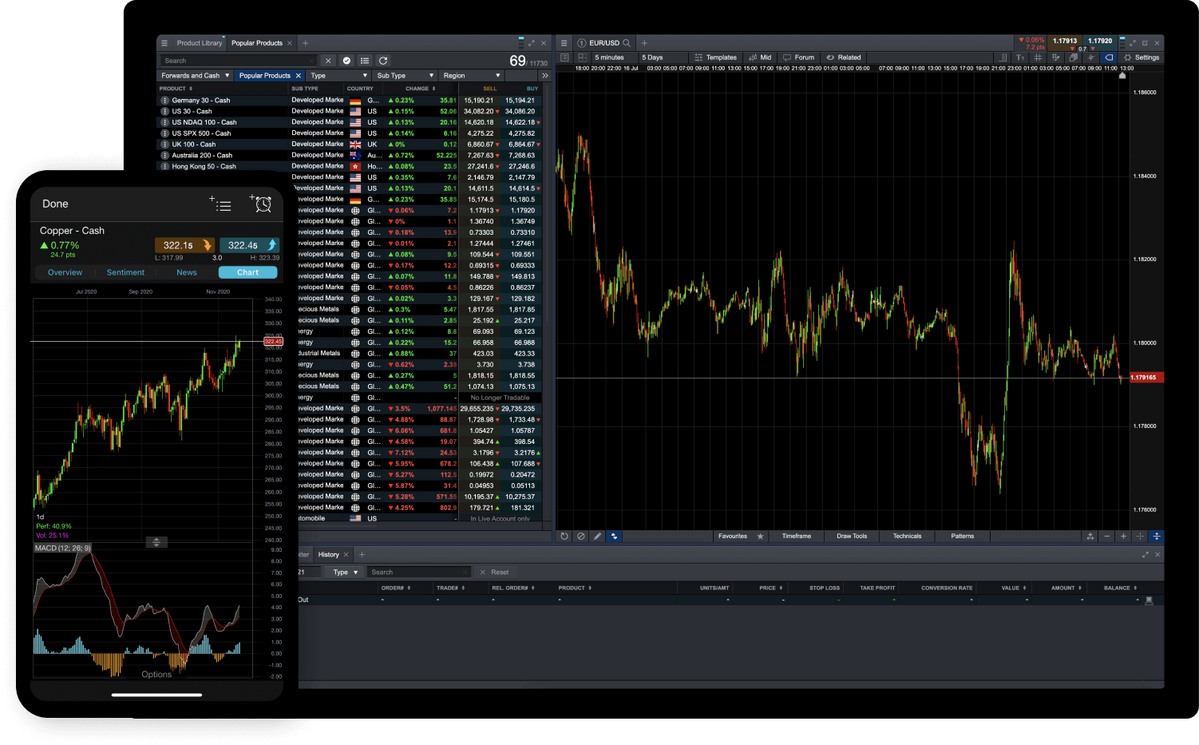

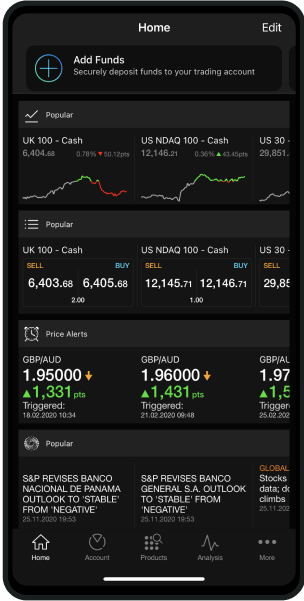

- Traders can use this technique for assets such as indices, currencies and commodities, although the stock market is perhaps the most popular

- This approach can bring profit for experienced traders but risks major losses