Intel Corporation’s [INTC] chips were down in 2020, mainly due to manufacturing issues. Will Q4 earnings, due 21 January, give an indication as to whether Intel’s share price can turn a corner this year?

Intel’s share price dropped 14.7% last year after closing at $49.82 on 31 December 2020. It had peaked at a 52-week high of $69.29 during intraday trading on 24 January 2020 and fell to a 52-week low of $43.61 on 30 October.

By contrast, rival chipmakers Nvidia [NVDA] and Taiwan Semiconductor Manufacturing Co (TSMC) [TSM] gained 122% and 92% respectively in 2020.

However, Intel’s share price performance since the start of this year suggests things could be on the up. It had gained 16.4% year-to-date as of close on 19 January.

Production issues

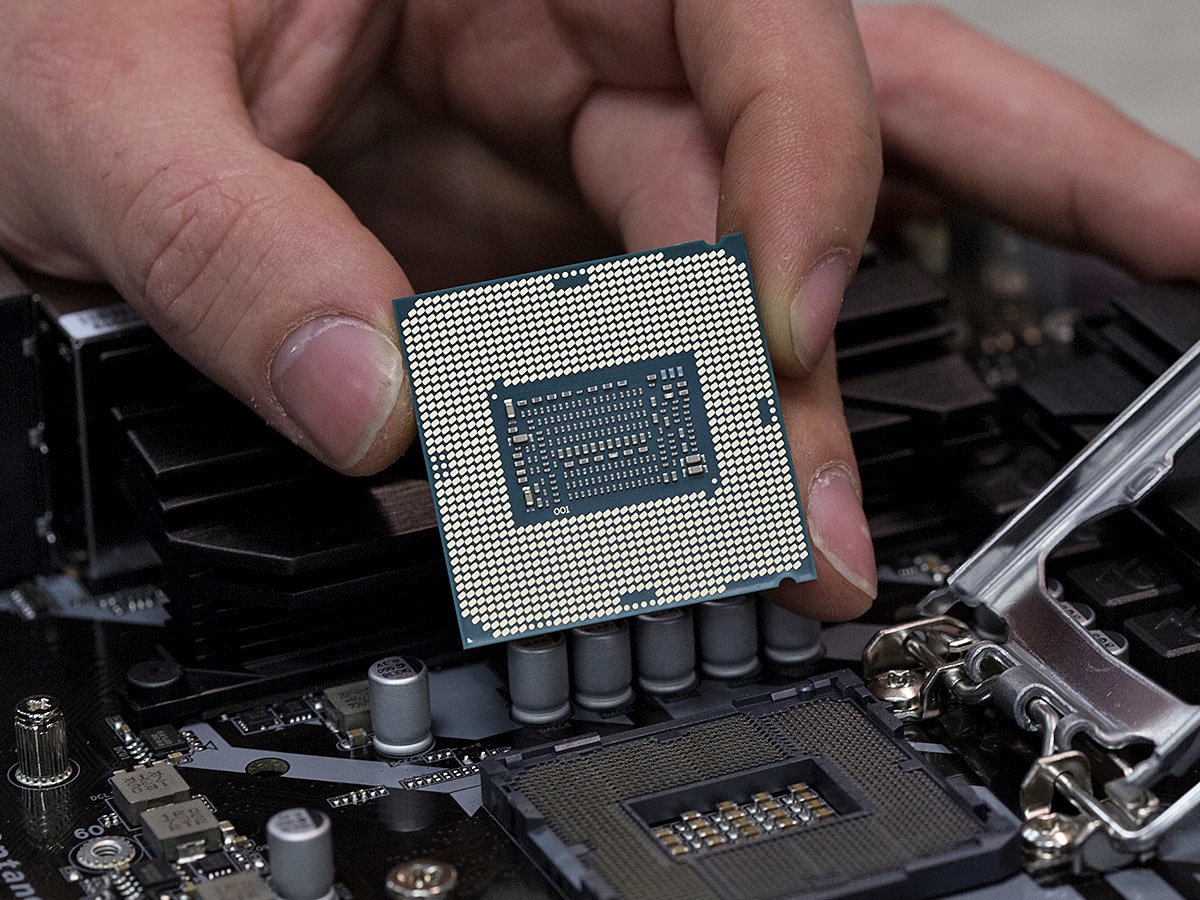

Intel’s share price was dragged down partly because the company was forced to delay production of its next-generation 7nm (nanometre) chips due to manufacturing issues. Intel is one of the only chipmakers to rely predominantly on in-house manufacturing.

The most recent quarterly report indicated that the company was considering transferring much of its manufacturing to TSMC.

Intel’s data-centre business showed signs of weakness in the Q3 report — revenue was $5.9bn in Q3 2020, down almost 8% from the $6.4bn reported in Q3 2019, and down nearly 17% on the previous quarter’s data-centre revenue of $7.1bn.

$5.9billion

Intel's Q3 2020 revenue - an 8% YoY drop

The Client Computing Group (CCG), which includes sales from PC chips, continued to be boosted by people needing computers to work and study from home. Revenue for the segment grew 1% year-over-year from $9.7bn in Q3 2019 to $9.8bn. It was up 3.2% on the $9.5bn revenue reported in Q2 2020.

Total revenue for the three months to the end of September was $18.33bn, down 4.5% from the $19.19bn reported in the year-ago quarter — this marked the firm’s first year-over-year decline since Q2 2019. Earnings per share were $1.11. These figures were more or less in line with what analysts polled by Refinitv had been expecting, according to CNBC.

Despite meeting expectations, Intel’s share price fell by as much as 10% during after-hours trading as investors contemplated what impact a continuing decline in data-centre revenue might have on future growth.

With regard to Q4 2020 earnings, Intel has issued guidance of $17.4bn revenue, which would be a 13.9% fall year-over-year; earnings per share are forecast to be $1.06. The latest analyst estimates, according to Zacks Equity Research, are revenue in the range of $17.4bn and $17.66bn, and earnings per share between $1.09 and $1.11.

$17.4billion

Intel's Q4 2020 revenue guidance - a 13.9% YoY drop

Looking ahead

The movement Intel’s share price will make following the upcoming earnings report will not only depend on whether it beats its forecast and expectations. Investors will also be looking to see if the company gives any indication as to the future performance of its data centre group, as well as any updates on the manufacturing of its 7nm chips.

A Bloomberg report earlier this month confirmed that Intel was considering outsourcing production to TSMC, supporting comments Intel CEO Bob Swan made last year. The publication also named Samsung [005930] as another potential manufacturing partner. Other recent reports suggest an outsourcing partnership may have already begun.

At the end of December, Dan Loeb, CEO of Third Point, wrote to Intel’s executive team, asking them to consider splitting its chip manufacturing business from its chip design and development business. Loeb also suggested that the company consider strategic alternatives. Intel lags behind its rivals in terms of cutting-edge chip manufacturing technology.

“Without immediate change at Intel, we fear that America’s access to leading-edge semiconductor supply will erode, forcing the US to rely more heavily on a geopolitically unstable East Asia to power everything from PCs to data centers to critical infrastructure and more” - Dan Loeb, CEO of Third Point

“Without immediate change at Intel, we fear that America’s access to leading-edge semiconductor supply will erode, forcing the US to rely more heavily on a geopolitically unstable East Asia to power everything from PCs to data centers to critical infrastructure and more,” Loeb wrote in a note seen by Barron’s.

On the other hand, Stacy Rasgon, analyst with Bernstein Research, has said that spinning off the chip manufacturing business “doesn’t fix anything”, according to a Reuters news report. Rasgon reiterated a sell rating and price target of $40.

In total, Intel currently has 43 Wall Street ratings, MarketBeat data shows: 19 buy, 14 hold and 10 sell. The consensus price target is $60.47, which would be a 4.3% increase on its current price (through 19 January’s close).

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy