2020 has seen some big moves within the semiconductor industry. Nvidia’s [NVDA] share price has recorded the biggest shift, soaring 126.6% year-to-date through 4 December. The stock is up 200.06% since bottoming out at a 52-week low of $180.68 during the March market sell-off. Nvidia’s share price is 7.93% below its all-time intraday high of $589.07, recorded on 2 September.

AMD’s [AMD] share price, meanwhile, has rallied 91.53% year to date and 155.07% since dropping to a 52-week intraday low of $36.75 on 18 March. It also peaked on 2 September, closing at $92.18 before going on to hit a new 52-week high on 2 December.

As of 4 December’s close, Intel’s [INTC] share price sits 19.19% above its 52-week intraday low of $43.61, recorded on 30 October. However, the stock is 25% down on its 52-week intraday high of $69.29, set on 24 January, and is still 14.56% down for the year to date.

126.6%

Nvidia's YTD share rice rise

The semiconductor industry has been one of the biggest movers on ETF Database’s Industry Power Rankings recently, alongside software, internet and broader technology exchange-traded funds (ETFs). Ranked on the average three-month return rate in November, semiconductors jumped 13 places to fifth place, behind solar energy, clean energy, lithium and automotive. While the latest rankings from 30 November show it has since dropped again to 13th place, the volatility alone suggests this is a sector to watch closely.

Diverging paths

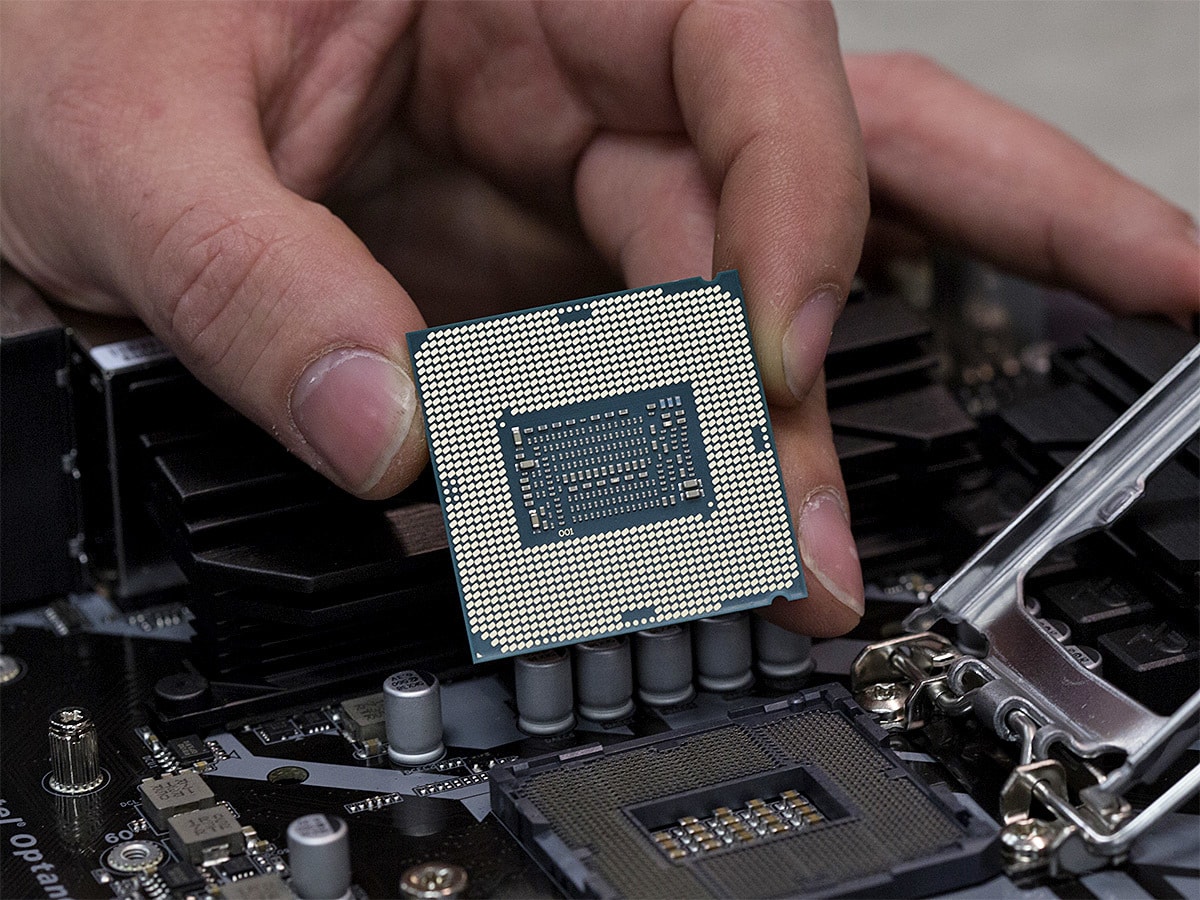

Intel’s share price fortunes have been blighted this year. Long considered the king of chips, the Santa Clara company has been toppled by Nvidia, which has been consolidating its position with an aggressive acquisition strategy, including the purchase of Israeli-American chipmaker Mellanox for $6.9bn and UK chip designer Arm for $40bn.

There have been serious production problems that have forced Intel to push the manufacturing of its 7nm (nanometre) chips back to 2022. The company has recognised that it might have to break from its tradition of manufacturing in-house and outsource production of the chips, most likely to Taiwan Semiconductor Manufacturing Company [TSM].

Intel’s data centre business had enjoyed positive revenue growth for four consecutive quarters, before posting a decline of 7.8% in the three months to the end of September. Q3 data centre chip sales totalled $5.9bn compared with $7.1bn in Q2. Total revenue declined 4% year-over-year and 7.1% sequentially.

AMD fared better on the data centre segment front. Its computing and graphics segment, which includes graphic chip sales to data centres, was up 30.8% to $1.67bn from Q3 2019. In total, AMD brought in $2.8bn, a year-over-year increase of 56% and up 45% quarter-over-quarter.

$2.8billion

AMD's Q3 sales - a 56% YoY rise

The record earnings, which blew past analysts’ expectations and the guidance AMD issued, were ramped up by pre-orders of the PS5 and Xbox Series X consoles, for which it supplies chips.

In Nvidia’s Q2, its data centre segment overtook its gaming segment for the first time in its history thanks to the work-from-home pivot. Data centre sales brought in $1.75bn, a 54% increase over the year-ago quarter. In Q3, however, there was a slight reversal.

While the data centre segment of $1.9bn marked a 162% year-over-year increase, it was up just 8.5% sequentially. By contrast, the gaming segment revenue of $2.27bn was a 37% increase both year-over-year and sequentially, boosted by sales of next-generation chips.

$2.27billion

Nvidia's Q3 gaming revenue - a 37% YoY rise

Nvidia expects its data centre segment to deliver the greater slice of revenue in quarters to come. Its share price became volatile in after-hours trading following the announcement of Q3 results on 18 November.

What comes next?

Jensen Huang, founder and CEO of Nvidia, has been on a charge this year, but some analysts think the bull run could come to an abrupt halt.

“While [Nvidia] continues to hit on all cylinders in an otherwise challenging macro environment, we believe much of this goodness is reflected in its share price … and at such a valuation, fear that an inevitable pause in growth...appears to be insufficiently discounted," Ross Seymore, analyst at Deutsche Bank, wrote in a note to clients seen by Tipranks.

“While [Nvidia] continues to hit on all cylinders in an otherwise challenging macro environment, we believe much of this goodness is reflected in its share price … and at such a valuation, fear that an inevitable pause in growth...appears to be insufficiently discounted” - Ross Seymore, analyst at Deutsche Bank

Following Intel’s Q3 earnings, Bank of America MD Vivek Arya said in a note that there was not a quick and easy fix to its manufacturing struggles.

“[T]he uncertainty of roadmap execution could continue to erode Intel’s 80% to 85% value share in [the] PC [and] data centre markets and constrain EPS growth,” wrote Arya, according to MarketWatch.

In a separate note, Arya was more bullish on AMD’s prospects: “We believe AMD's pipeline, management execution, and opportunity set are significantly enhanced by slip-ups at key rival Intel, which sets AMD up for material share gains.”

“We believe AMD's pipeline, management execution, and opportunity set are significantly enhanced by slip-ups at key rival Intel, which sets AMD up for material share gains” - Bank of America MD Vivek Arya

As of 1 December, the consensus rating for AMD among 37 Wall Street analysts polled on MarketBeat was Buy, held by 25 analysts, while 11 rated a Hold and one a Sell. The same consensus was given for Nvidia, with 29 of 37 analysts rating it as such, and four apiece rating it a Sell and a Hold. Intel, meanwhile, was given a consensus Hold rating among 41 analysts, with 17 offering this rating, 15 rating it a Buy and nine a Sell.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy