Although Alibaba’s [BABA] share price experienced a small glitch in March, the stock has gone on to soar to new heights this year. As of close on 2 November, Alibaba’s share price has recorded a year-to-date rise of 41.44%. As the ecommerce giant prepares to announce the results for the quarter ending 30 September on 5 November, analysts are exceedingly bullish on the stock’s twelve-month trajectory. What is it that has got analysts so bullish on Alibaba’s share price ahead of its earnings?

Alibaba’s share price took a tumble in March when, on its worst day of trading this year, it fell to an intraday low of $169.95 before closing at $176.34 — a 16.9% decrease since the start of the year. This was part of the broader reaction to investors’ fears over the coronavirus pandemic, something that has not phased Alibaba’s share price throughout this year.

It took Alibaba’s share price less than a month to recover most of its lost value since the slump, and it has since gone on to set itself a new all-time high during intraday trading on 27 October at $319.32, before closing at $317.14.

How has Alibaba’s share price been faring?

Alibaba’s share price shot up following the announcement of its first-quarter earnings for the fiscal year 2021 on 20 August, during which it posted revenues of $21.76bn for the quarter ended 30 June. This not only exceeded the Zacks Equity Research consensus estimate of $21.1bn by 3.1%, but also marked a 34% growth from the year-ago quarter, when the company posted revenues of $16.74bn.

Alibaba reported earnings of $2.10 per ADS, surpassing the Zacks consensus estimate of $1.97 by 6.6% and marking the fourth consecutive quarter in which it achieved this. This also marked an increase of 14.8% year-over-year.

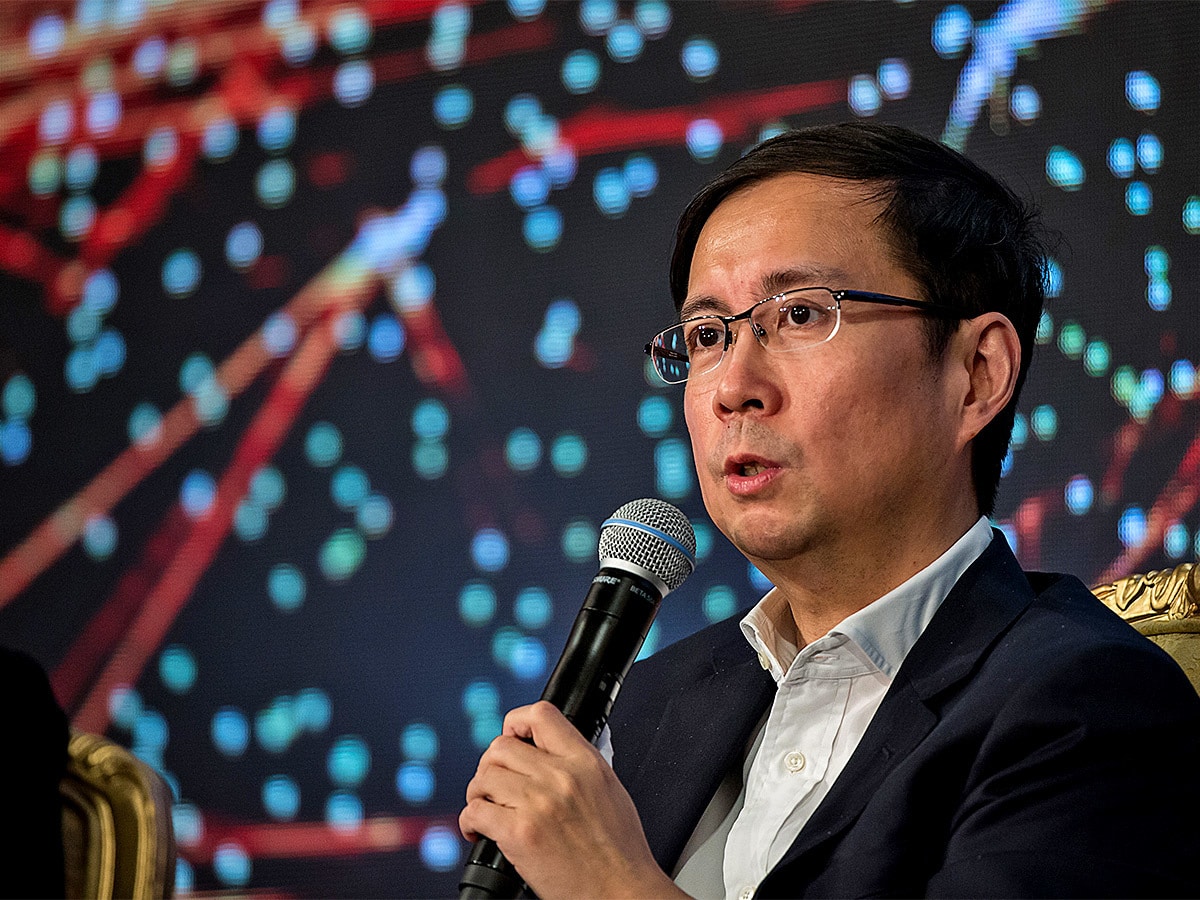

Daniel Zhang, CEO of the e-commerce company, pointed to Alibaba as being “well-positioned to capture growth from the ongoing digital transformation”, which he noted had been accelerated by the coronavirus pandemic.

“We mobilized our entire digital infrastructure to support the economic recovery of businesses across a wide range of sectors, while broadening and diversifying our consumer base by addressing their changing preferences in a post-COVID-19 environment,” Zhang explained.

“We mobilized our entire digital infrastructure to support the economic recovery of businesses across a wide range of sectors, while broadening and diversifying our consumer base by addressing their changing preferences in a post-COVID-19 environment” - Daniel Zhang, CEO of Alibaba

The strong performance was driven by robust growth in both Alibaba’s e-commerce and cloud computing businesses — which witnessed a year-over-year increase of 59% due to this digital transformation.

Looking ahead to the next earnings report, Zacks is expecting Alibaba to announce earnings of $2.06 per ADS, which would mark a growth of 1.9% year-over-year.

On the other hand, the Zacks consensus estimate is calling for quarterly revenue of $22.91bn, which would represent an increase of 37.6% from the same time last year.

$22.91billion

Alibaba's estimated revenue for Q1

Burgeoning software budgets excite the bulls

Oppenheimer analyst Jason Helfstein raised the firm's target for Alibaba’s share price to $335 from $325 and reiterated a Buy rating on the shares, reports Yahoo Finance.

“We see cloud’s future growth dependent on ARPU [average revenue per user] expansion (spending shifting from infrastructure budgets to software budgets), driving continuous margin improvement and rapid revenue growth,” Helfstein wrote in a note to clients, according to Yahoo Finance.

He added that a major advantage Alibaba had over its peers was diverse product supplies. “The recently launched Dollar Store (both online and offline) and duty-free JV, strategically target both less developed and travel retail markets, the fastest-growing sub-segments in China’s retail industry,” the analyst noted.

“The recently launched Dollar Store (both online and offline) and duty-free JV, strategically target both less developed and travel retail markets, the fastest-growing sub-segments in China’s retail industry” - Oppenheimer analyst Jason Helfstein

The consensus given on Zacks is to Buy the stock. This is also the consensus rating among 56 analysts polled by CNN Money. A huge majority of 51 of these analysts rate the stock a Buy, while four consider it an Outperform and one analyst recommends to Hold the stock

The average 12-month price forecast for Alibaba’s share price among 53 analysts polled by CNN Money is $2,344 while the high forecast for the stock is $2,610 and the low prediction is $1,984. The median price would represent a 654.1% increase on Alibaba’s share price as of close on 2 November, while even the low estimate would represent a 538.3% uptick on this price.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy