The Foley Trasimene Acquisition II Corp [BFT] special purpose acquisition company (SPAC) announced its first merger in December, with the fintech payments firm Paysafe.

SPACs — so-called “blank cheque” shell companies which raise funds through an IPO to take a private company public — have become an increasingly popular method of avoiding the traditional IPO route. The Foley Trasimene SPAC, backed by veteran investor Bill Foley, was created last year to discover companies with hidden potential or strong market positions in the fintech space, raising $1.3bn from investors last August, according to Reuters.

London-based Paysafe is a multinational online payments company, providing in-store and digital payment solutions to organisations globally. Its products enable businesses and consumers to connect and transact through payment processing, digital wallet and online cash solutions. The firm was actually taken private by Blackstone and CVC Capital Partners in 2017 for $4.7bn, making this the second time the company will have gone public.

How has the Foley Trasimene SPAC’s share price reacted?

Foley Trasimene’s share price has been volatile so far this year. Following its launch on the New York Stock Exchange on 9 October last year at $9.71, the stock traded flat until Foley Trasimene made the Paysafe deal public pre-market on 8 December. Foley Trasimene’s share price closed 6.94% higher on its first day’s trading after the announcement and, despite some volatility, it reached an intraday peak of $19.57 on 25 January, a jump of 63.76% from the pre-deal price. The stock had been on a downtrend since 5 February, but finished higher last Friday, closing out the week at $17.27.

63.76%

Foley Trasimene’s share price growth between its pre-deal price and 25 January

Who’s behind the Foley Trasimene SPAC?

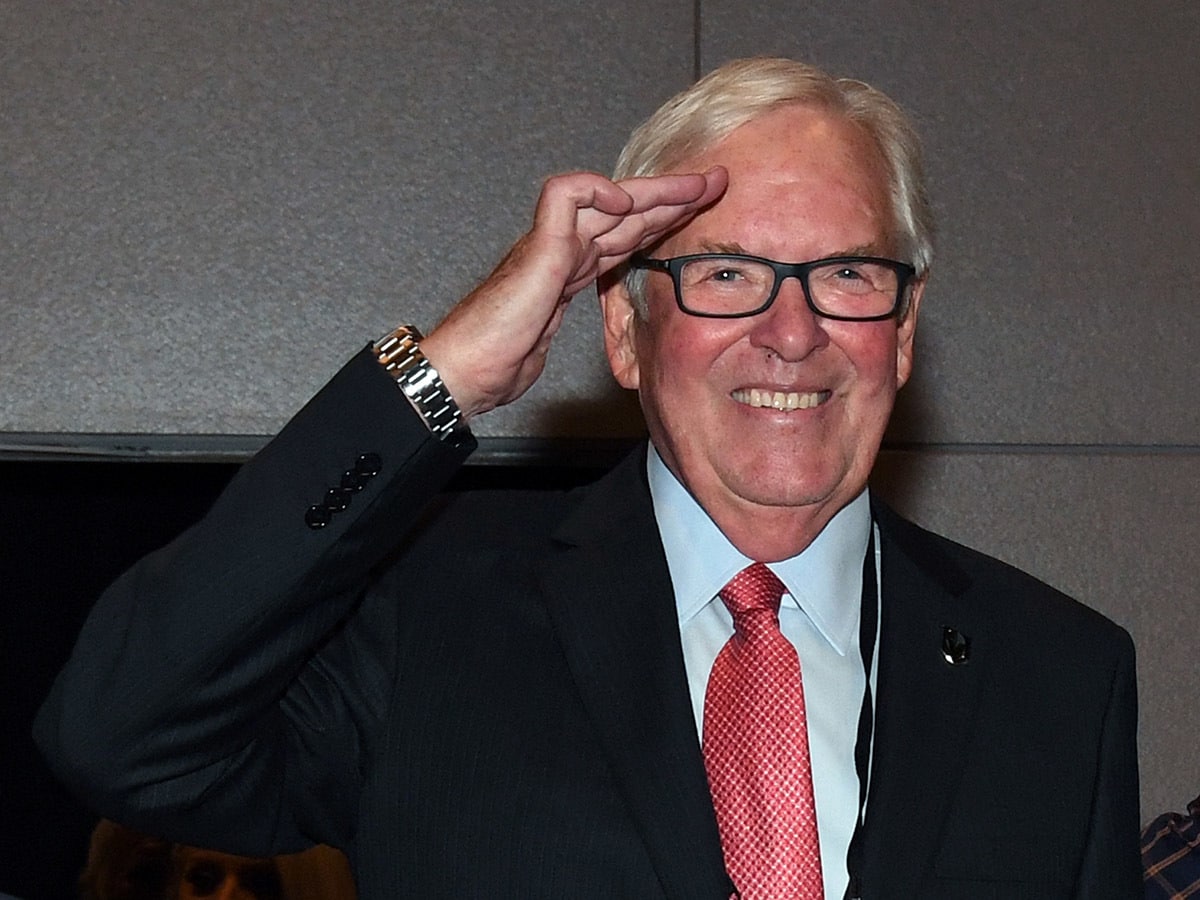

After the deal has completed, billionaire investor Bill Foley will become chairman, while Paysafe CEO Philip McHugh will continue to lead the newly-combined company.

Foley is a serial investor who has “been involved in more than 100 acquisitions and many spinoffs” according to James Deporre’s calculations in Real Money. Deporre cites Foley’s successes at Fidelity & Guaranty Life, which Foley turned into a Fortune 500 company, plus “Black Knight, Dun & Bradstreet, and Foley Family Wines”. He’s already “raised billions so far through multiple blank-check firms”, says Deporre.

Foley is clearly confident in the deal’s prospects, saying: "Paysafe delivers a unique value proposition in large and high-growth markets, such as gaming and e-commerce, enabling the company to generate strong organic revenue growth and margin expansion."

“Paysafe delivers a unique value proposition in large and high-growth markets, such as gaming and e-commerce, enabling the company to generate strong organic revenue growth and margin expansion” - Bill Foley

The new company, which will operate as Paysafe, will list on the NYSE under the symbol PSFE. The transaction gives Paysafe an enterprise value of circa $9bn. Existing Paysafe equity holders, including Blackstone and CVC, will remain the largest investors.

What’s next for Paysafe after Foley Trasimene SPAC?

According to Deporre, the potential of the deal, which is expected to be finalised in the first half of 2021, lies in “the payment platform sector. There are currently two main competitors — Square [SQ] and PayPal [PYPL], both of whom have made strong gains over the last three months.”

The broader fintech theme is performing well at the moment, rising 8.98% over the last month (as of Friday’s close), putting it in the top 10 themes on our ETF screener.

“Paysafe is in a hot and growing sector and it has projected very healthy gross profit and EBITDA margins going forward. The partnership with Bill Foley is the icing on the cake … I am bullish on the stock in the medium to long term” - Investment manager Michael A Gayed

Investment manager Michael A Gayed, writing recently in Seeking Alpha, is optimistic about the Foley Trasimene SPAC: “Paysafe is in a hot and growing sector and it has projected very healthy gross profit and EBITDA margins going forward.” Gayed adds: “The partnership with Bill Foley is the icing on the cake … I am bullish on the stock in the medium to long term.”

It appears there’s a lot to look forward to for the Foley Trasimene SPAC, and fintech investors will be keeping a close eye on Paysafe’s second foray in the markets later this year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy