There isn’t supposed to be much innovation in the low-tech world of pizza – after all, the first ones were delivered well over a hundred years ago.

But one company has bucked the trend, forging ahead with tech innovations that have left independents and smaller chains in its dust – and in doing so, posting larger growth than any of the FAANG stocks.

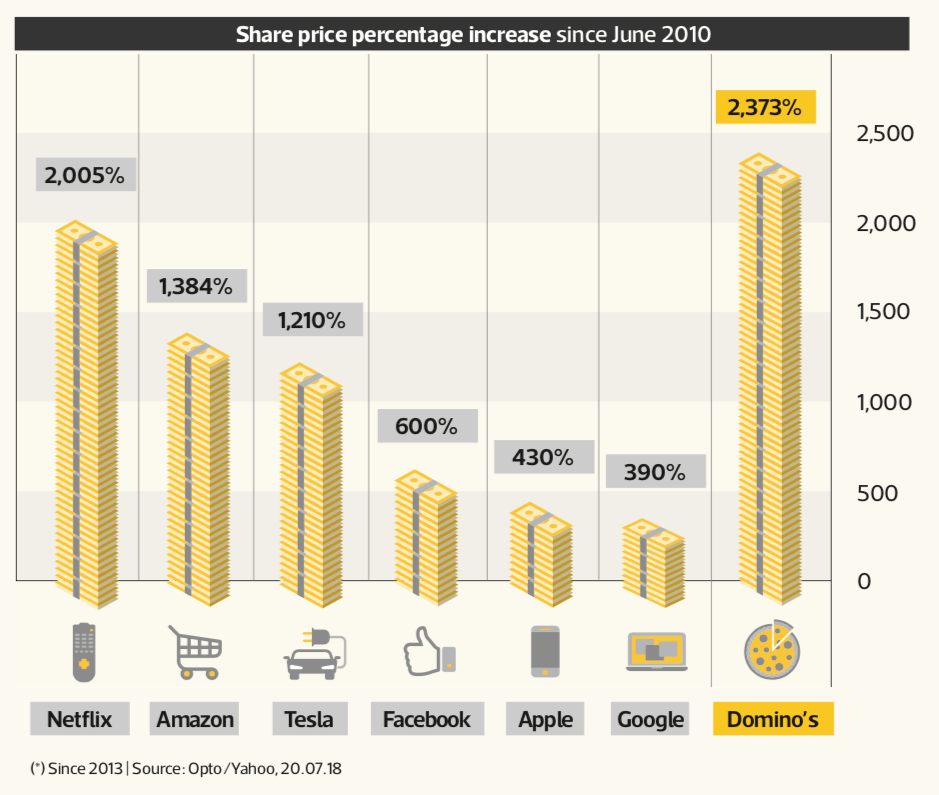

With a mammoth 2,421% increase in value since 2010, Domino’s [DPZ] has provided higher percentage returns than Netflix [NFLX] (2005%), Amazon [AMZN] (1384%), Apple [AAPL] (430%), Facebook [FB] (600%) and Google [GOOG] (390%), as well as Tesla [TSLA] (1210%).

2,421%

Increase in Domino’s share price since 2010

Sophisticated tech is widely credited with turning around Domino’s fortunes, from $10.6 per share in 2010 (and a momentary low of $3 in 2008) to a $293.81 high in June 2018. The US pizza company employs more people in IT than anywhere else in the company, and over half of sales come from digital platforms.

Customers can order Domino’s through most of the tech companies it’s been beating – via voice control with Amazon Echo or Google Home, Apple or Android smartwatches, smartphone apps or through a smart TV. Domino’s has even been testing drone and robot delivery, and has partnered with Ford to explore self-driving delivery.

But Domino’s isn’t the only unexpected stock to beat tech, it’s also been achieved by a dry cleaning company, a paint protection maker, a building merchants, and a Canadian pharmaceutical company, among others: BioSyent [RX] has gained 11738%; PatrickInds [PATK] 5765%; EnviroStar [EVI] 3600%; Trex [TREX]2554%; Tucows [TCX] 2054%.

*Data collected 20.07.18

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy