Canadian cannabis cultivator Cronos Group [CRON], has released its earnings for the third quarter, which saw revenue increase 186% to $3.8m from Q3 2017.

Cronos sold 213% more cannabis in terms of kg, up from 164 kg in Q3 2017 to 514 kg in the same period of 2018. The company, which is a mid-cap worth $1.5bn, made revenues totalling $1.3m in Q3 2017.

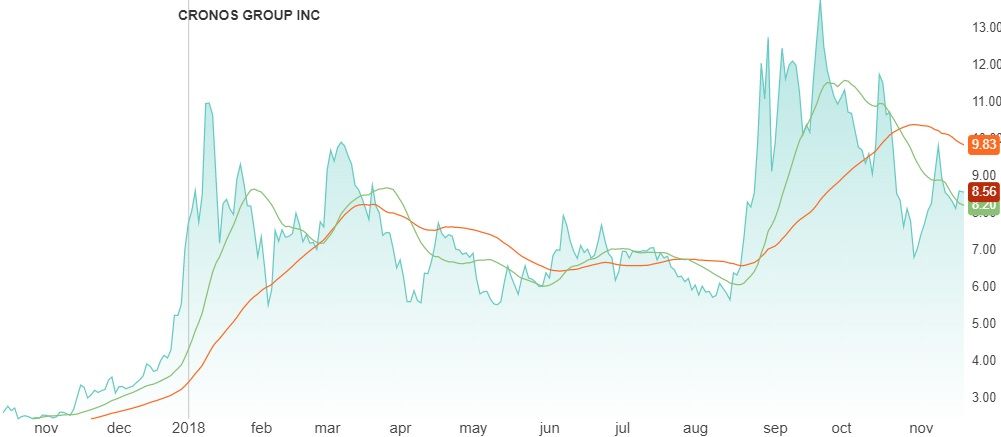

Cronos did however incur a net loss of $0.04 per share, versus a profit of $0.01 last year. Consensus estimates were a loss on $0.02. Its share price on Tuesday closed marginally lower than on Monday, following earnings. More widely, the stock has lost 40% since reaching its all-time high in September of this year.

Cronos Group Inc. share price performance, NASDAQ interactive chart, 19 November 2018

This lack of profitability is best explained by the vast expenditure needed in marketing and operations on the part of Cronos and other major cannabis companies, in order to take advantage of full legalisation in Canada. Sale prices of cannabis products have also marginally decreased.

The increase in product sold did however trigger year-on-year growth, driven by an increased production capacity and volume sold through domestic medical and international channels, as well as initial shipments into the Canadian adult-use recreational market.

| Revenue percentage change, Q3 YoY | +186% |

| Performance YTD | 10.7% |

| Market cap | $1.5bn |

| PE Ratio (TTM) | 808.57 |

Cronos Group Inc. stock vitals, Yahoo finance, as at 19 November 2018

Growth potential

In October 2018, Canada became the first G7 country and the second country in the world to legalise cannabis sales for adult recreational use. Going forward, with the increased demand of the Canadian market Cronos is opening new grow facilities to accommodate this, and the company senses further opportunity for revenue growth.

Cultivation is the industry’s biggest challenge, and to meet this, Cronos has built a new 286,000 sq. ft. purpose-built indoor production facility, known as Building 4. The first harvest from will be cultivated late this year.

“B-4 is our largest purpose built indoor cannabis facility in the world,” Cronos CEO Michael Gorenstein told investors on the Q3 earnings call. “It was licensed and populated shortly after our Q2 earnings call, and will have its first harvest this year… at full run rate, B-4 will have a harvest every three days.”

Cronos will also work with Ginkgo Bioworks to produce cultured cannabinoids. The company hopes that working with Ginkgo could lead to the development of a more cost-effective production method of oils in the hope it will provide a competitive advantage. They are currently expensive to make, though far more profitable than dried cannabis. Cannabis oil sales represented 29% of total revenue in the third quarter of 2018.

A new 850 square foot greenhouse is also in the offing, through a 50/50 partnership with Bert Mucci. Once fully operational in 2019, the greenhouse is expected to produce up to 70,000 kg of cannabis annually. Cronos has also entered into a supply agreement with one of the largest cannabis companies in the world by revenue, Cura Cannabis Solutions.

Cronos currently sells dried cannabis, pre-rolls and cannabis oils to Ontario, British Columbia, Nova Scotia and Prince Edward Island, which represents over 50% of the Canadian population. It expects to secure additional provincial listings as it gains more production capacity, which will mean access to more customers.

29%

Percentage of revenue made up by cannabis oil sales

A good investment?

With the legalisation of marijuana in Canada bringing high demand that is outstripping supply, and analysts predicting a shortage that could last for up to a year, Cronos is well-positioned to take advantage of the new recreational market with increased cultivation.

However, those numbers won’t show up until Cronos releases fourth-quarter results early next year. Currently, expectations are for revenue to approach the C$10m mark in Q4, which would be roughly triple its mid-2018 revenue.

The company is expected to record 0.15 total earnings per share during the next fiscal year, and its debt is on the decline. Yet Cronos may struggle to catch the likes of Aurora, Medleaf and Canopy, larger caps that have greater scope to take advantage of recreational use in Canada and growing international markets.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy