Cloud Monitoring, which offers monitoring and analytics for development, operations, and business in the cloud era, as well as its sub-segments — application performance monitoring (APM), log management software and infrastructure monitoring — offer many opportunities to those looking for exciting stocks.

There has been consolidation is the industry with Cisco acquiring AppDynamics, Splunk acquiring SignalFx and Omnition, and New Relic acquiring IOpipe and SignifAi.

The market is shifting from on-premise deployment in large organizations to on-cloud, due to the changing application usage, increasing awareness among smaller enterprises, and the demand for cost-effective systems.

The importance of monitoring

Monitoring software is at the foundation of an organization’s IT stack. Without monitoring, organizations are blind to factors that impact performance, reliability, scalability and availability of systems in which they have invested large amounts of resources.

Once installed, monitoring becomes integral to an organization’s performance and deeply embedded into business and operational workflows. Companies across all industries are heavily investing to digitally transform their businesses and enhance the experience of their customers. At the same time, companies are significantly growing their investments to monitor this digital transformation.

According to Gartner, enterprises will quadruple their use of APM due to increasingly digitalized business processes from 2018 through 2021 to reach 20% of all business applications. Software is increasingly embedded throughout the enterprise to manage business critical systems such as payments processing, inventory and supply chain management, logistics, and many other front- and back-office operations.

The shift to cloud

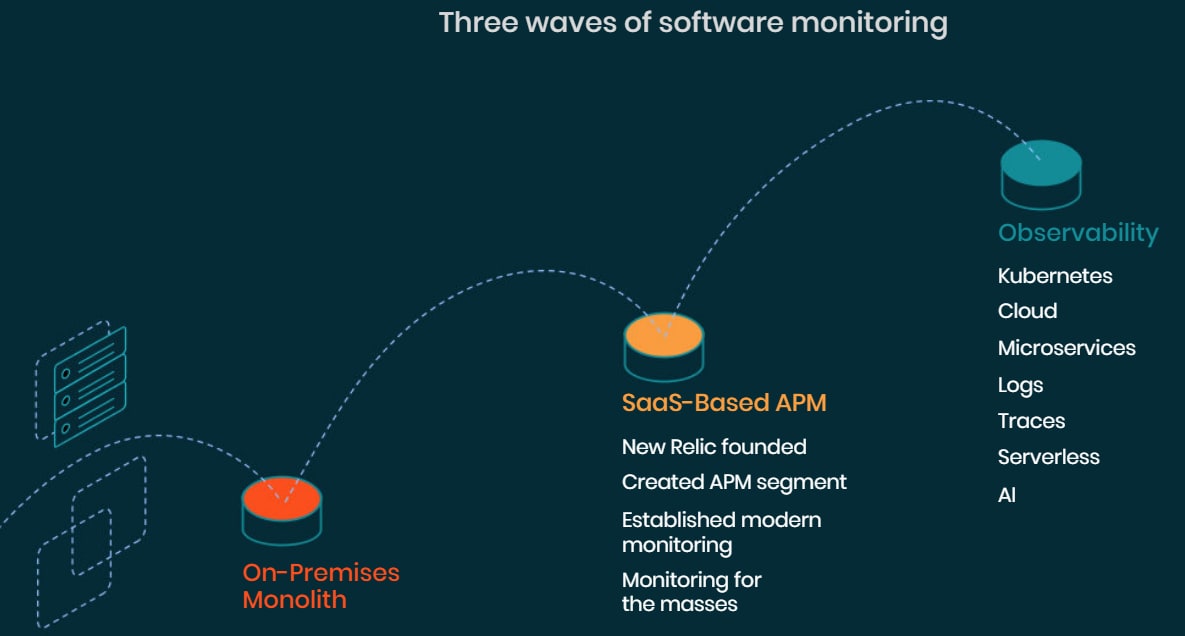

There is a seismic shift from static on-premise IT architectures to distributed, dynamic multi-cloud and hybrid cloud architectures. Ephemeral technologies such as containers, microservices and serverless architectures are becoming increasingly common.

As the cloud becomes increasingly mainstream from 2018 to 2022, it will influence greater portions of enterprise IT decisions, with more than $1trn in enterprise IT spend at stake in 2019, according to Gartner.

When companies migrate to the cloud and their underlying infrastructure changes, so does the monitoring of this infrastructure. Only 5% of applications were monitored as of 2018, according to Gartner. However, the number of SaaS platforms and open source tools available to IT organizations has exploded. The scale of computing resources required in the cloud has increased exponentially and is often called upon in quick, sometimes unpredictable, bursts of expanded computing capacity.

The rate of change of application development in the cloud has increased dramatically. These challenges have made it extremely difficult to gain visibility and insight into application and infrastructure performance and legacy monitoring tools have struggled to adapt.

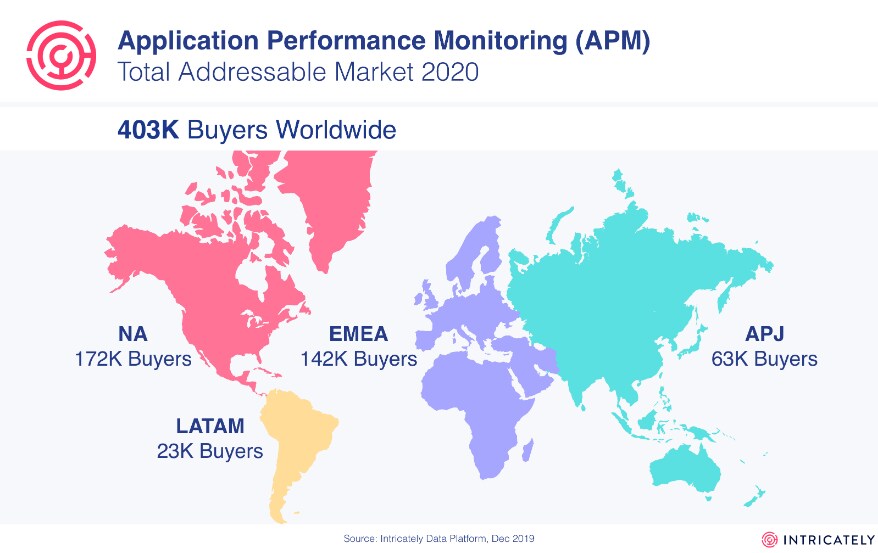

The global IT operations software market in 2019 is estimated to be $29bn and is expected to grow at a compound annual growth rate of 6.7% to $37.5bn in 2023, according to Gartner. The global APM market is projected to grow at a CAGR of 12% from 2019 to 2025.

The infrastructure monitoring market is estimated to grow from $1.48bn in 2018 to $3.38bn by 2023, at a CAGR of 17.93% between 2018 and 2023. Global Log Management Market is expected to grow from $1.9bn in 2020 to $3.7bn by 2025, at a CAGR of 14.1% during the forecast period.

The log management market

The primary factors driving the log management market are the increasing need to secure IT infrastructures from advanced cyberattacks.

Developing and operating software has become more difficult than ever due to cloud transformation, application complexity, user experience expectations and increased frequency of software releases. Traditional monitoring solutions were developed in an era in which applications were monolithic, updated infrequently, and run in static data center environments.

These monitoring solutions — including APM, infrastructure monitoring, incident and alert management, and user experience monitoring — are difficult to deploy, narrow in scope, and were designed to operate in a simpler, siloed environment. Environments have become dynamic. Applications are no longer monolithic and are fragmented into dozens to potentially thousands of microservices, written in multiple software languages.

These enterprise cloud environments sprawl from traditional backend applications run on relational databases and mainframes to modern IaaS platforms run on Amazon Web Services, or AWS, Microsoft Azure, or Azure, and Google Cloud Platform. All these factors result in an environment that is web-scale, extremely complex, and dynamic at all layers of the new computing stack.

Top stocks to watch

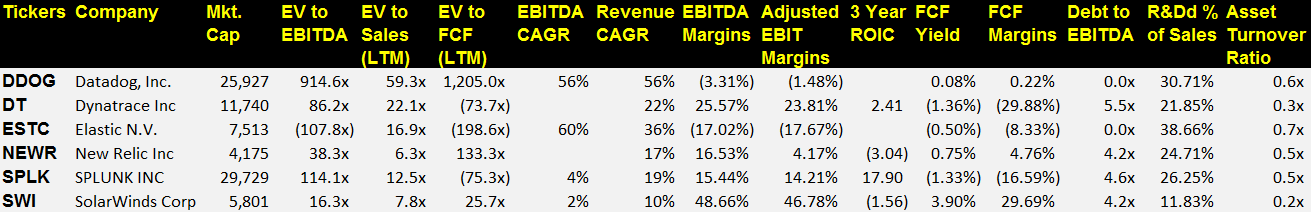

Datadog (DDOG) has emerged as a top performer in 2020. It posted very strong revenue growth numbers but also carries a demanding valuation of 33X FY21 EV/sales.

The software company provides cloud monitoring applications for analytics across a company’s servers, databases, tools, and services. The dashboard offers a view of alerts and visualisations as well as full-text search for events and discussion tools.

Datadog integrates with a number of other cloud packages out of the box, so enterprise IT teams can work without interruption, and cover AWS, Azure, OpenShift, and OpenStack. The company see a massive opportunity to provide insight into cloud infrastructure.

Datadog differentiates from peers as it is built for modern cloud environments including multi-cloud or hybrid environments, which helps opens it up to wider vendor acceptance. It also stands out as its data platform is fully integrated with metrics, traces, and logs which allows for better correlation analysis, while utilizing machine learning for quicker and better results. Finally, Datadog has an edge as its scalable with more than 10T events a data under observation.

The company sees growth from further market penetration, new production adoption by its existing base, and international expansion. It is targeting a major opportunity driven by key secular tailwinds with a unified observability platform. The company charges per usage and per volume so price charged is commensurate with the size of the customers’ infrastructure, which can vary over time.

At the recent JPMorgan Tech Conference Datadog revealed that its big new product is security — a large opportunity to add to its suite.

Dynatrace (DT) is a software intelligence company that provides APM, AI for operations, cloud infrastructure monitoring, and digital experience management, designed for information technology departments and digital business owners.

Dynatrace's full-stack solution has the breadth and depth to not only show the experience of a user as they access applications but also with pinpoint precision diagnose problems down to a single line of code. Its platform allows customers to modernize and automate IT operations, develop and release high-quality software faster, and improve user experiences for better business outcomes.

As enterprises shift to cloud, undergo DX, and adopt Kubernetes, IT architectures are becoming more complex and distributed. As such, IT departments need tools that monitor across the entire tech stack. Gartner estimates enterprise usage of application monitoring will increase by four times by 2021. Dynatrace offers very strong revenue growth and a demand valuation of 19X FY21 EV/sales. However Dynatrace, unlike Datadog, carries debt and has a weaker FCF profile.

Elastic NV (ESTC) focuses on data visualisation, search and analytics across various sources and formats. It operates within a massive $45bn total addressable market that taps into some mega-themes in tech like IoT, cloud, and AI/machine learning.

Elastic NV has seen momentum posting back-to-back quarters of 50%+ billings growth. It makes the power of search — the ability to instantly find relevant information and insights from large amounts of data — available for a diverse set of applications and use cases. When you hail a ride home from work with Uber, Elastic helps power the systems that locate nearby riders and drivers. When you shop online at Walgreens, Elastic helps power finding the right products to add to your cart. When you look for a partner on Tinder, Elastic helps power the algorithms that guide you to a match.

Multiple trends are driving increased demand for search technology across an expanding array of applications, as well as improving the capabilities of search technology and the value that it is able to generate.

These trends include users demanding more applications, the increasing complexity in enterprise IT, the growing need for data-driven insights, and the increasing supply of data. Based on IDC’s sizing of the market for search systems, content analytics, and cognitive/AI software platforms, this represented a total addressable market of $3bn in 2012.

Since then, Elastic NV estimates that its total addressable market has grown to $45bn in 2018 based on the sum of four market segments. The search, content analytics, and cognitive/AI software market was estimated to be $8bn 2018. The IT operations management market was estimated to be $9bn in 2018. The big data and analytics market was estimated to be $23bn market in 2018, and the security analytics market to be $5bn in that year. All of these markets are seeing significant growth.

Elastic NV’s valuation is cheaper than many peers at 13.4X FY21 EV/sales and the company offers rapid growth, no debt, and a large 38% R&D as a percentage of sales ratio. It is one of the more compelling value for growth names in the group.

New Relic (NEWR) trades at the most depressed valuation of the group at 5.7X FY21 EV/sales. Unlike many of its peers it is profitable, but concerns linger around its slowed revenue growth as competing products seem to be gaining more momentum.

The New Relic One Platform collects and correlates various types of critical telemetry data, such as APM data, logs, metrics, events and trace data. It provides customers with the visibility needed to troubleshoot and analyze their applications and infrastructure. New Relic One offers prebuilt dashboards and visualisations, the ability to search across data types, create customized dashboards and build applications that can be shared and customized by other users.

Splunk (SPLK) is not a pure-play on the cloud monitoring theme, but its acquisition of SignalFX positioned it among the leaders despite it having a core focus in data analytics.

Splunk is a leader in cyber infrastructure tools (namely data/log analytics) offering both on-premise and cloud-based versions of its core product as well as premium add-on solutions covering a growing list of niche use cases. It has been making strategic acquisitions to expand its platform while also transitioning to the cloud model.

The company has been benefitting from strong growth is usage and consumption of data from its customers. Its Data-to-Everything platform enables users to investigate, monitor, analyze and act on data regardless of format or source. Data is produced by nearly every software application and electronic device across an organization and contains a real-time record of various activities, such as business transactions, customer and user behavior, and security threats. Splunk has partnerships with mega tech companies like Google, AWS, and Cisco. It is valued quite attractively at 12X FY21 EV/sales and is delivering impressive growth and margins.

SolarWinds (SWI) does not have the same kind of revenue growth as peers and its software feels inferior to its many. But at 6.7X FY21 EV/sales, has revenue growth that is expected to accelerate in 2021 and is profitable, SolarWinds does have some appeal on valuation.

Its products give organizations worldwide, regardless of type, size or IT infrastructure complexity, the power to monitor and manage the performance of their IT environments, whether on premise, in the cloud, or in hybrid models. Organizations across industries are using technology and software to drive business success and competitive differentiation. As the landscape for IT infrastructure and software deployment worldwide rapidly changes to meet businesses’ evolving needs, the performance, speed, availability and security of IT has become critical to business strategy.

SolarWinds has one of the broadest software portfolios for hybrid IT management across the industry, adding 16 products over the last three years. As a result, it addresses large and growing markets across IT operations, security, and backup & storage management. In aggregate, IDC, estimates that global software revenue for these markets will grow at a compound annual growth rate of 6% to approximately $60.0bn in 2022 (from the approximately $47.6bn estimated by IDC in 2018).

SolarWinds predicts this market sizing underestimates the size of the market opportunity beyond the enterprise and mid-market. It sees an annual recurring revenue market opportunity across its markets of more than $75bn.

Other key players

There are a number of other important companies within this space including AppDynamics [CSCO] and Broadcom [AVGO] that provide application performance and infrastructure monitoring, and Rapid-7 [RPD], Nagios, Stackify and Smartbear offering log management. Meanwhile, cloud providers such as Google [GOOG], Amazon [AMZN] and Microsoft [MSFT] also compete with native solutions.

Sources: Datadog (DDOG) S-1; Dynatrace (DT) S-1; Gartner; Splunk (SPLK) 10K

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy