Despite Tesla revealing its intention to be “much more than an electric car company” at its recent AI Day on 19 August, the Tesla share price closed the day down 2.2%.

The company’s business has continued to expand from the automotive sector into energy and now artificial intelligence (AI), following the release of in-house chips and a humanoid robot.

Tesla share price dips on AI play

While the market’s reaction to the announcement was lukewarm, previous events have seen a similar reception. Tesla’s Autonomy Investor Day saw the stock fall 3.8% on 22 April 2019, while 2020’s Battery Day on 22 September saw Tesla’s share price slip 5.6%.

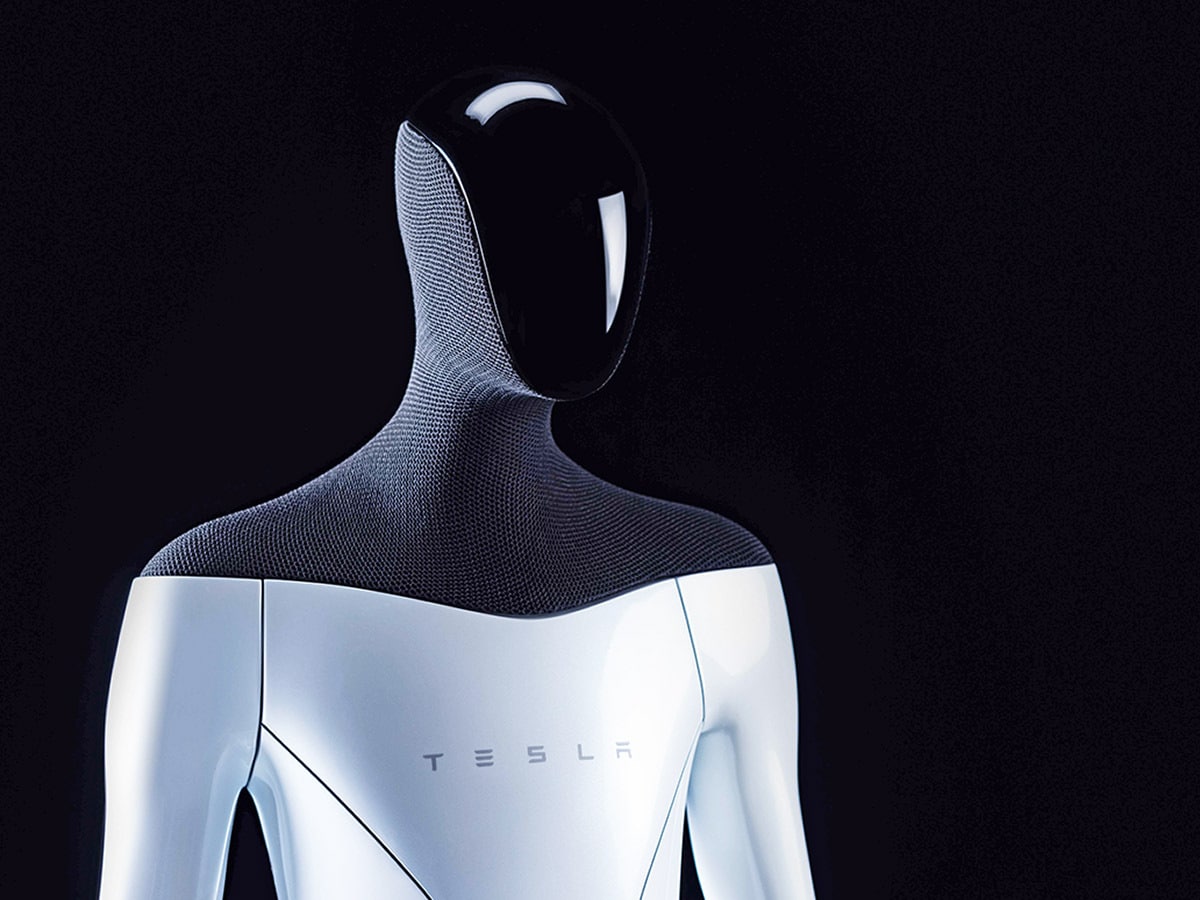

The most eye-catching part of the presentation was that of TeslaBot, an android that Tesla has engineered to one day take over what CEO Elon Musk calls “the work that people least like to do”.

The humanoid robot is “intended to be friendly, of course, and navigate a world built for humans,” Musk said. It can walk at five miles per hour and lift roughly 68kg. “We’re setting it such that at a mechanical and physical level, you can run away from it and most likely overpower it.”

A TeslaBot prototype is expected next year and should serve as a use case for the company’s work on neural networks and its Dojo supercomputer.

D1 chips to drive autonomous development

Tesla also revealed its computer chip, D1, which will run Dojo. Dojo is set to train the neural networks and AI software underpinning much of the company’s suite of products. By bringing its chip production in-house, this could help it navigate the global chip shortage and improve AI performance through higher bandwidth and decreased latencies.

Dojo will eventually underpin Tesla’s Fully Self-Driving (FSD) system, elements of which Tesla hopes to one day open up to other car and technology companies.

Ganesh Venkataramanan, senior director of Tesla’s Autopilot Hardware division, explained how 25 of the 7-nanometer D1 chips combine to make a “training tile”, 120 of which are then combined across multiple server cabinets to produce over an exaflop of processing power. “We are assembling our first cabinets pretty soon,” Venkataramanan added.

This processing power should steer Tesla closer towards fulfilling the potential of Full Self-Driving Capability, a $10,000 add-on that enables cars to change lanes and enter and exit parking spots autonomously.

Analysts set out positive expectations

Tesla’s website claims the package will be expanded later this year to allow Tesla cars to automatically navigate city streets, a feature originally slated for release in 2019. However, the company is currently facing a probe into 11 crashes since 2018, seemingly resulting from current iterations of its self-driving technology.

Despite this and the delays, Colin Rusch, an analyst at Oppenheimer, thinks Tesla is well-placed to beat the competition to fully driverless cars.

“Tesla is able to have over a million vehicles on the road, approaching 2 million by year-end,” Oppenheimer told Yahoo Finance . “That’s really running the technology in shadow mode, and so the learning cycle is much faster for Tesla versus their competitors.” Rusch maintained a $1,080 Tesla share price target, 52.9% above its 23 August close.

Daniel Ives, an analyst with Wedbush, also felt the Tesla share price will outperform, setting his price target at $1,000, according to Market Insider . He described reports that Tesla’s delayed Berlin plant is set to be operational by October as a “positive step”, adding: “With Tesla looking to further expand its global capacity over the coming years, Berlin and Austin are key manufacturing hubs that will be key in the long-term Tesla EV story.”

Spread bet or trade CFDs using our award-winning trading platform*.

*No.1 Web-Based Platform, Platform Technology and Professional Trading, ForexBrokers.com Awards 2021.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.