The US dollar index fell 0.4% to 97.8 last night as trade tensions heated up again and US manufacturing PMI disappointed.

Sentiment swung to the bearish side as President Trump announced to resume tariffs on Brazil and Argentina steel imports. US equity indices registered their biggest single day loss in almost two months.

The volatility index, VIX, has again come to its relatively low level, paving way for sudden jumps in volatility should there be any negative news or surprises. From a historical perspective, volatility has never stayed at 12-13 for sustained periods of time.

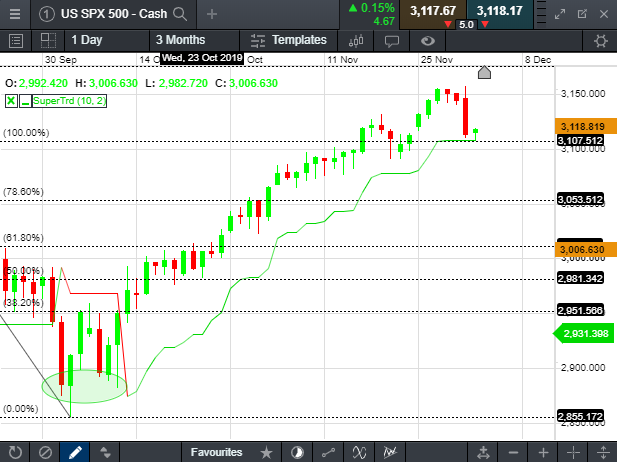

The Nasdaq Index has accumulated an astonishing 30% YTD gain, which renders the technology sector vulnerable to any form of external shock. The S&P 500 index, with a YTD gain of 24%, is perhaps also subject to profit-taking activities towards the year end. Technically, the S&P500 has retraced to test a key support level at 3,108 points (SuperTrend + 100% extension). A breakdown below this level might signal a deeper correction.

Important news overnight:

- President Trump slapped steel tariffs on Brazil and Argentina leading to broad risk-aversion sentiment. Trump’s hard stance on trade also painted a gloomy picture of the ongoing US-China trade talk, in which Beijing has insisted on a rollback of tariffs.

- US manufacturing PMI unexpectedly fell to 48.1, far below forecast of 49.2. It may infer that US manufacturing activities are lagging behind the broad stabilisation in China and other parts of Asia, adding to the uncertainty of global recovery.

- Beijing has said they will retaliate on President Trump’s signing of the Hong Kong bill.

- OPEC+ is considering further output cuts to support crude oil prices. News said they may deepen the cut by some 0.4 million bpd in the meeting to be held in Vienna later this week. Oil price rebounded mildly overnight.

Asian markets point to a lower open on Tuesday with the Nikkei 225 index falling 1.3% at open. Singapore market might follow a weak US and Japan session and open lower. The downside, however, is cushioned by relatively low valuation.

S&P 500 Index - Cash

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.