Medium-term technical analysis (1 to 3 months)

Time-stamped: 4 Aug 2022 as at 3:30pm SGT

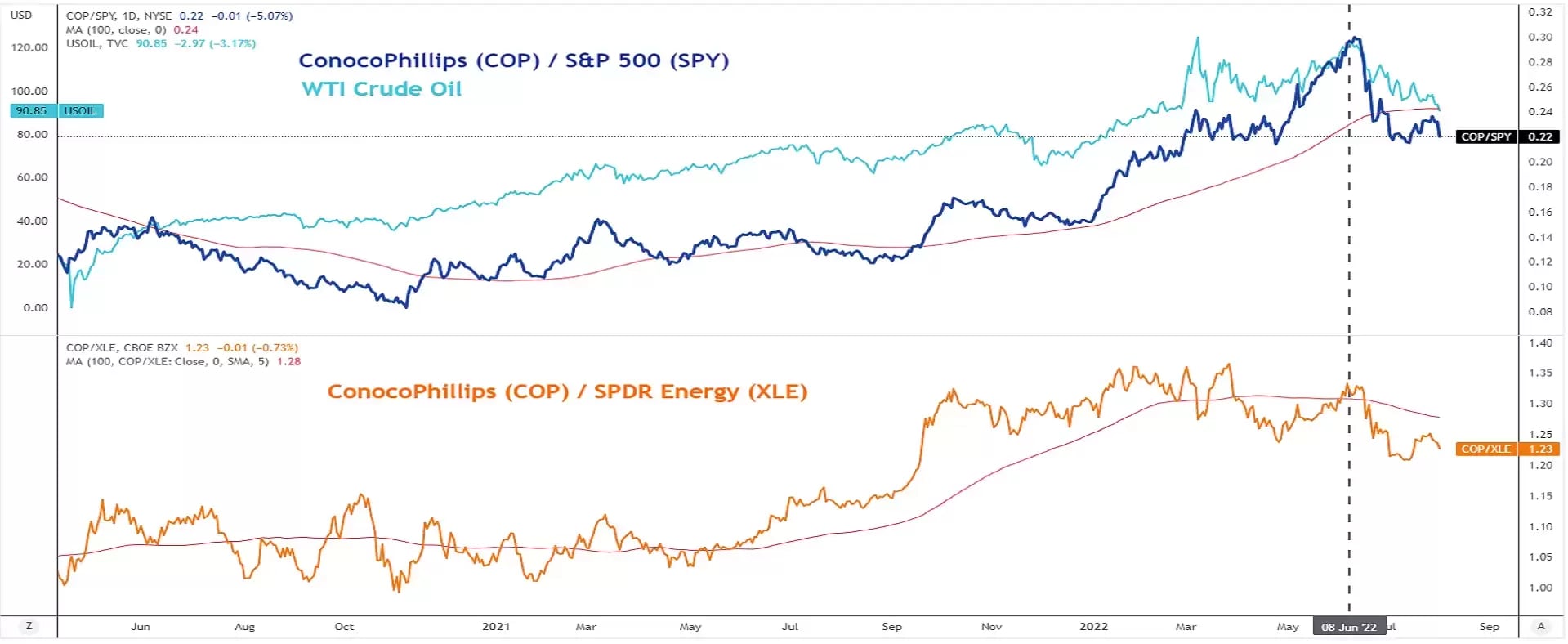

Source: CMC Markets & TradingView

ConocoPhillips (COP), a US Big Oil firm will report its Q2 2022 earnings today, 4 August before the US session opens. Consensus is expecting its earnings per share to come in at $3.86 which translates to a huge increase of 204% year-on-year in net profit over the same period on the backdrop of the major bullish run seen in the price of oil over the course of the past year.

Integrated technical analysis (graphical, momentum, Elliot Wave/fractals) suggests that another leg of corrective decline within its ongoing major uptrend phase in place since the March 2020 low may kickstart at this juncture. Since its 8 June 2022 all-time high level of 124.08, the share price of COP has declined by -37% to print a recent low of 78.31 on 14 July.

Key Levels (1-3 months/COP)

Intermediate resistance: 97.90

Pivot (key resistance): 101.85

Supports: 87.80 & 78.30/73.25

Next resistance: 124.00

Directional Bias (1-3 months/COP)

Watch the 101.85 key medium-term pivotal resistance for another potential corrective decline leg towards the 87.80 support and a break with a daily close below it reinforces a further slide towards the 78.30/73.25 medium-term support zone next.

However, a clearance with a daily close above 101.85 invalidates the bearish scenario for a squeeze up to retest the current all-time high area of 124.00

Key elements (COP)

- Recent push up in price actions have failed to surpass the 50-day moving average now acting as an intermediate resistance at 97.90 and it staged a bearish reaction yesterday, 3 August, and shed -3.6%, its steepest single-day decline since 5 July 2022.

- The daily RSI oscillator has staged a bearish breakdown below its key corresponding support and pierced below the 50% level. These observations suggest that the prior medium-term upside momentum has been exhausted where the rebound seen in the price actions from 14 July 2022 low to 29 July 2022 high (an accumulated gain of +25%) is likely to have reached a terminal point where the next probable path is a potential bearish move.

- Relative strength analysis of COP against the benchmark S&P 500 and its Energy sector is showing underperformance of COP. In addition, such underperformance of COP against the S&P 500 has moved in direct correlation with the recent medium-term bearish movement of WTI crude oil since 8 June 2022.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.