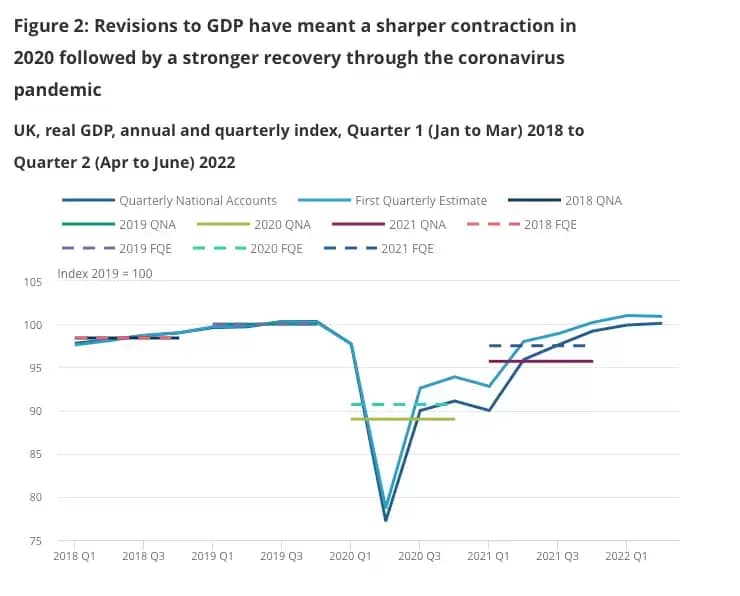

UK gross domestic product (GDP) fell by 0.3% in the three months to August 2022, with Bank of England (BoE) governor Andrew Bailey warning last week that the country faces its longest recession in 100 years – estimating that it is likely to last until mid-2024.

We spoke to forex trading mentor, Patrick Reid, co-founder of the FX consultancy firm the Adamis Principle, about the implications for the UK’s economy, especially how assets such as the FTSE 100, the pound against the dollar, and UK bond yields could respond.

Reid expects movements in all three areas to be “choppy and noisy … the key thing on every trader’s radar is: ‘how bad can it get?’”.

Much is riding on chancellor Jeremy Hunt’s Budget announcement slated for 17 November, which bond traders will be watching closely. “I fear the worst in austerity,” Reid said, “but I’m hoping for the best.”

Hunting for balance

“We need the books to balance,” Reid says, adding that government spending “will be in laser focus …the markets will be all over [the budgets] because of the last statement”.

While 10-year and 30-year treasury yields have calmed to near pre-mini budget levels, Reid has concerns. The FX consultant considers that “the £40bn to £65bn shortfall” could allow yields to rise to levels seen when the mini-budget was in effect.

Public spending cuts are expected to form a significant part of the plug that fills the shortfall. If it proves to be higher than already estimated, Reid expects “markets will react badly in the short term, but longer term will gain confidence because credibility will return, especially in gilt markets”.

Investors will also be looking to 30-year gilts as the initial temperature gauge of the Budget and, to some degree, 10-year gilts. “If yields scream higher, it’s really bad. In a normal environment, higher yields are good for sentiment and good for growth. But in the UK, we’ve flipped into an emerging-country currency environment. So, when yields rise, it’s bad for the currency.”

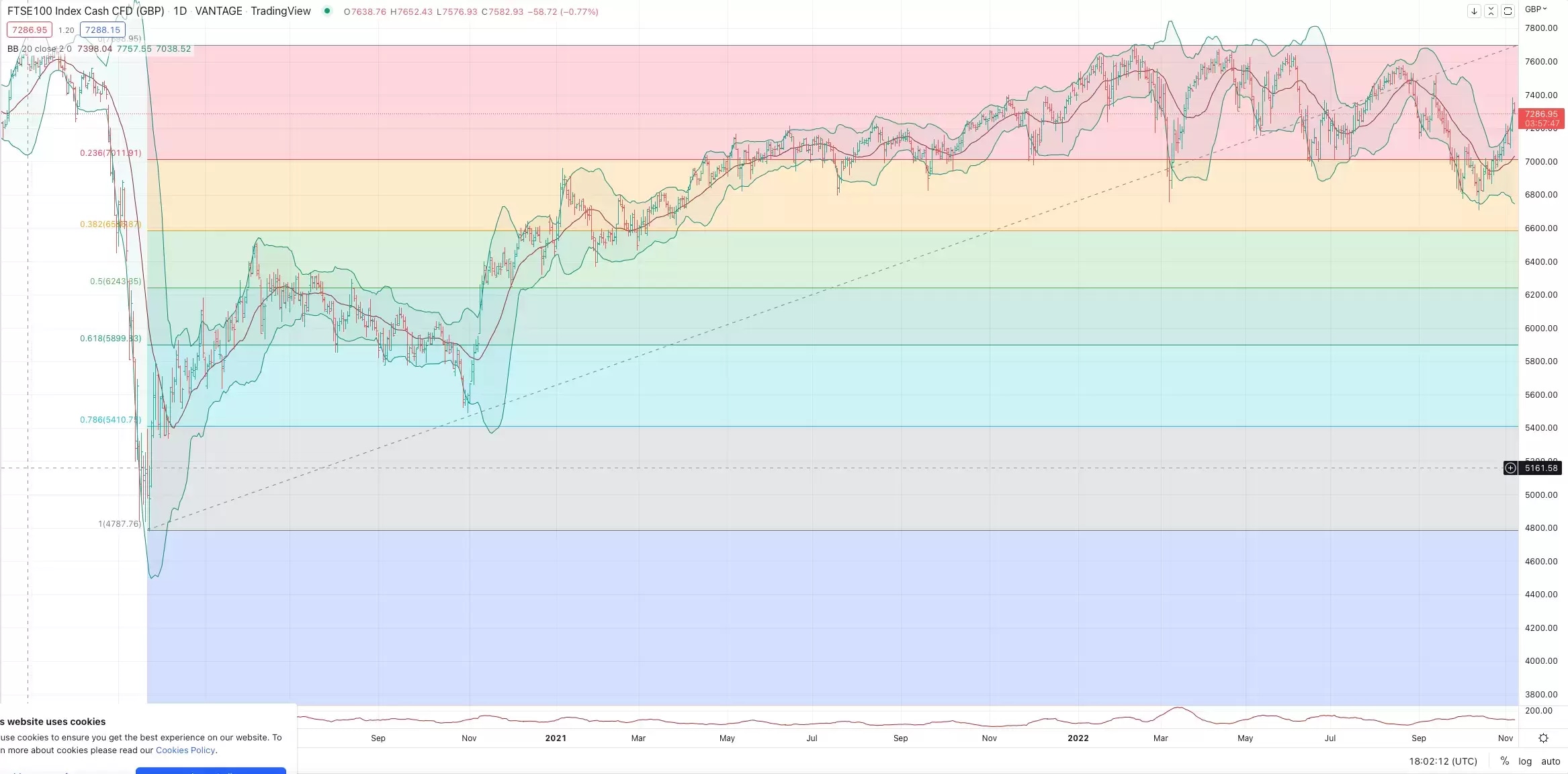

Reid also expects the market’s attention to turn to the FTSE 100. Referencing the above chart, he sees the index finding support at the 7,000 level and resistance at 7,700. “I see this [going] higher just as long as the next Jeremy Hunt statement on 17 November addresses the fiscal problems.”

Sterling movements

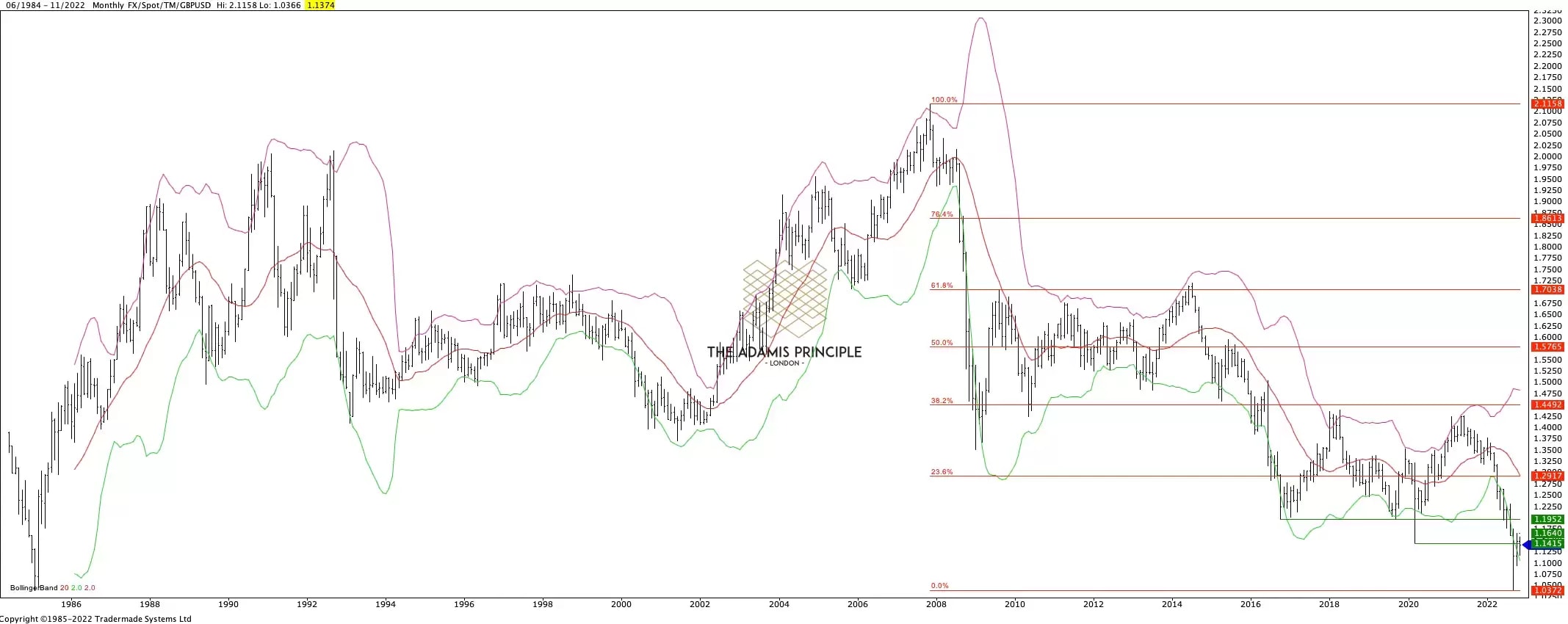

The pound is another asset class that is in focus. Reid identifies an ideal range for the GBP/USD exchange rate as being between 1.1415 and 1.1952, with the latter being a “key level” – he noted that “we kissed it during the middle of 2022”.

Reid feels that negative GDP news has already been priced in. “If we get a really good GDP, then you could potentially see sterling rise to 1.19.”

A Budget that manages to balance the UK’s books could also boost sentiment and regain credibility in gilt markets. “That would mean the BoE doesn’t actually have to raise interest rates to the tune of what they’d planned.” This should be supportive of sterling, because it would allow market recovery without the pain of increased rates.

There is also the prospect of the dollar’s strong run ending. If the dollar decreases in value, risk will increase, and equities will rise in value, which would be “quite jubilant for the UK as well”. Part of that jubilation could be the subsequent performance of the FTSE and bond prices, which could be set increase as well.

Volatility ahead

Reid anticipates an “incredible amount” of volatility ahead for UK markets. The question that all of his clients have been asking lately is how to hedge their risk in the face of it. “In simple terms, you’ve got to hedge, you’ve got to diversify.

“The key thing to remember is don’t over-leverage. Have some kind of diversification. For example, if you want to go long on GBP/USD, then go short on another dollar pair. That’s a good hedge out.” He also recommends that investors familiarise themselves with dollar activity, given how closely partnered it is with sterling.

The Sterling Overnight Index Average (SONIA) curve, which reflects the interest rates that banks pay to borrow sterling has softened since the mini-budget, but “massive issues” remain.

“The biggest issue really is the price of mortgages and how volatile that’s been. That really needs to calm down.” Compounding that, Reid says, is the energy crisis, potential tax rate increases and public spending cuts. All of those things spell volatility.

A phoenix from the ashes?

Markets won’t, according to Reid, see a repeat of the V-shaped recovery that followed the Covid-19 pandemic. “This is going to be long, protracted, very painful, and could be quite miserable.”

However, markets are currently pricing in doom and gloom. “We’re now looking for the phoenix to rise out of the ashes.”

Chancellor Hunt’s statement could provoke a return to new growth – as long as it satisfies gilt markets. “If [30-year gilts] remain calm,” says Reid, “that means the perception of balance is fine. That’s when the sun starts to shine just slightly because everything else stems from that.”

If that happens, the horizon for a recession projection could be closer than previously thought. And if that comes about, Reid expects that the BoE would reduce its interest hikes, which should be positive for risk and for sterling.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.