Sentiment across Asian markets showed signs of fragility, as the prospect of a ‘final throes’ trade deal have been gradually baked-in

Traders are looking for what the next positive catalyst might be to accelerate a catch-up rally to the seemingly ‘unstoppable’ US market.

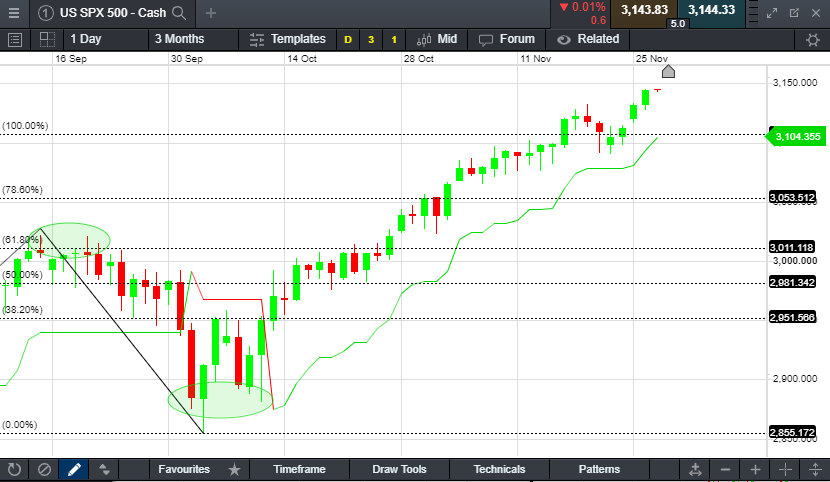

S&P 500 extended its ‘one-way’ rally and closed at a record high of 3,140 points. Sector wise, real estate (+1.44%), consumer staples (+0.82%), consumer discretionary (+0.81%) and materials (+0.52%) were leading the gain, whereas energy (-1.01%) was lagging. Technically, the trend remains bullish as its SuperTrend (10, 2) and 10-Day SMA both remain firmly upward-sloped. Immediate resistance level could be found at around 3,176 points (127.2% Fibonacci Extension).

The strengthening in CNH versus the dollar overnight suggests the likelihood of a trade deal to be struck soon is on course for rising. USD/CNH fell to a one-week low of 7.0185 area this morning. Being one of the most sensitive and accurate trade indicators, USD/CNH is widely watched by not only forex traders, but also index and stock investors recently.

Gold price re-tested a key support level at around US$ 1,448 and then rebounded to US$ 1,460 area. The overall trend of gold remains bearish, due to improved market sentiment and the prospect that the Fed might not cut interest rate until July 2020. Technically, gold price will find its immediate support at US$ 1,448, and then US$ 1,415.

Several key US data will be released tonight to keep traders busy. Those include US durable goods, unemployment claims, Q3 GDP preliminary forecast and DoE petroleum status report. US economy was expected to expand at the pace of 1.9% in the third quarter, according to the preliminary forecast. The US commercial crude inventory is forecasted to fall by half a million barrels last week. A larger-than-expected decline is likely to give energy prices a boost whereas a large build in stockpile is likely to have the reverse impact.

US SPX 500 - Cash

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.