The rally on Wall Street came to a pause as investors navigated the inflation data and the Fed policy. The US July producer price index (PPI) declined by 0.5% m/m, more than a drop of 0.2% expected, which again helped the "cooled inflation" optimism. Notably, while the long-dated bond yields rose strongly, the short-dated bond yields stayed flat, leading to a steepened yield curve, which suggests that the economic outlook has been improved. But this may only be due to strengthened odds for a “Fed pivot”.

Asian markets may start strongly despite an expected lower open in ASX

Most Asian major indices are set to open higher as indicated in the futures markets. Optimism towards cooled inflation could be carried over to today’s session. The recent positive Chinese tech giant’s earnings also fuelled the Chinese market’s rebound, with all the mainland major indices finishing strongly. China’s new loan and M2 money supply data will provide more clues to the economic trajectory later today. Meantime, companies’ half-year earnings reports in both Australia and New Zealand also offer a bullish moment to the local markets.

The S&P/ASX 200 futures were down 0.29%, pointing to a lower open in ASX. While the price comeback in resources may provide a rebounding opportunity for miners, banks, and energy stocks are also expected to perform strongly following Wall Street's overnight movements. The S&P/NZX 50 dipped 0.12% in the first hour of trading.

The bullish bets may continue despite a mixed close on Wall Street

A steepened yield curve may continue to support further rally in broad markets despite a mixed close in the US stocks. The Dow Jones Industrial Average rose 0.08%, the S&P 500 was down 0.07%, and Nasdaq slipped 0.58%.

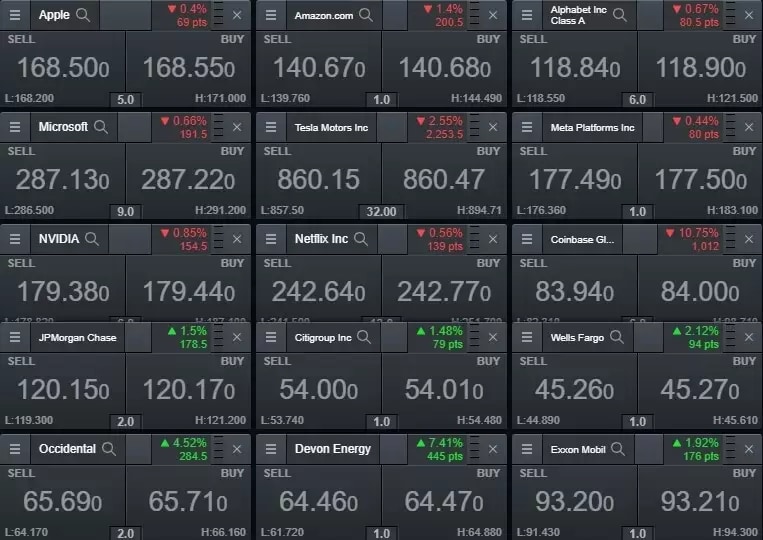

6 out of the 11 sectors in the S&P 500 ended lower. While growth stocks eased a surge, the energy stocks gathered gains on a jump in crude oil prices. The energy sector rose more than 3%, with all the major oil producers finishing higher. Devon Energy surged 7.4%. All the mega-cap companies were lower. Amazon shares fell 1.4%, and Tesla Motors was down 2.6%.

Rivian’s shares slumped 5% in after-hours trading after the company disappointed investors with a miss on earnings per share, which is recorded at -$1.62, short of the estimate of -$1.61. The electric car start-up business lost $1.7 billion in the second quarter, which nearly tripled the amount in the first quarter.

The major companies’ performance overnight (12 August 2022)

US dollar weakens further as “Fed pivot” bets grow

The US dollar index fell 0.10% to 104.98, the lowest close since 5 July. All the other major currencies were slightly up against the greenback. If the Fed meets the expectation to only raise the interest rate by 50 basis points in September, which will mark a peak of its aggressive hike cycle, the other central banks may keep pace on tightening, especially the ECB seems to just started its aggressiveness in raising rates, which may cause a further softening USD and the strong Eurodollar.

Also, the comeback in commodities’ prices supported a further bounce in the commodity currencies, including the Australian dollar, New Zealand dollar, and Canadian dollar.

Commodity prices rise, supported by a weakened USD

In general, China’s recovery optimism, faded recession fears, and a weakened USD boosted commodity markets again.

Crude oil prices rose for the second straight trading day due to the production outage of the US major oil producers according to Reuters. The WTI futures prices have been consolidated above 88 dollars per barrel since Monday as the two-month decline in prices makes a bargain for the oil markets where the undersupply issues remain. The WTI futures and Brent were up more than 2%, to US$94.08 and US$99.60, respectively.

Despite a drop in gold prices, the precious metal was resilient on Thursday as short-dated bond yield moderated gains, which is seen as a negative correlation with gold. The COMEX gold futures fell 0.67%, to $1,801 per ounce.

Copper prices were also higher, highlighting an improved economic outlook, though this could be only for the near term. The COMEX Copper futures rose 1.55%, to $3.68 per ounce.

A steepened yield curve in US bonds

The bond yield inversion between the 10-year and 2-year treasury notes has finally narrowed amid a strengthened expectation of a “Fed Pivot”. While long-dated government bond yields started to rise, the short-dated bond yields stayed flat or edged lower. The reverse movements in bond yields indicate that a slowdown in rate hikes by the Fed is on the table.

Ethereum approaches 100-day MA

The crypto markets extended gains on broad rebounding optimism. The second largest market cap digital coin, Ethereum, has been outperforming bitcoins lately, up 1.9% to 1,884in the last 24 hours, approaching the 2,000-mark, which confluences with the 100-day MA.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.