A stalemate on the additional US fiscal stimulus package stole the punchbowl from the earlier jubilant risk-on behaviour during yesterday’s Asian session, triggered by positive economic data from China (Q3 GDP, retail sales and industrial production) and regulatory approval being granted for Alibaba’s Ant Group’s mega IPO listing in Hong Kong.

The S&P 500 and Nasdaq 100 declined by -1.5% and -1.8% respectively, the steepest slide in the past two weeks. Selling can be seen across the board, with the worst sector performers in energy (-2.1%), communication services and information technology (-1.9%), while defensive utilities outperformed (-0.9%).

Negotiations continued between the various stakeholders on the second US fiscal stimulus package, without any breakthrough so far, with a Tuesday deadline imposed by house speaker Nancy Pelosi. On the other hand, we did have positive news flow on coronavirus vaccine developments; AstraZeneca’s vaccine candidate could be available soon after Christmas.

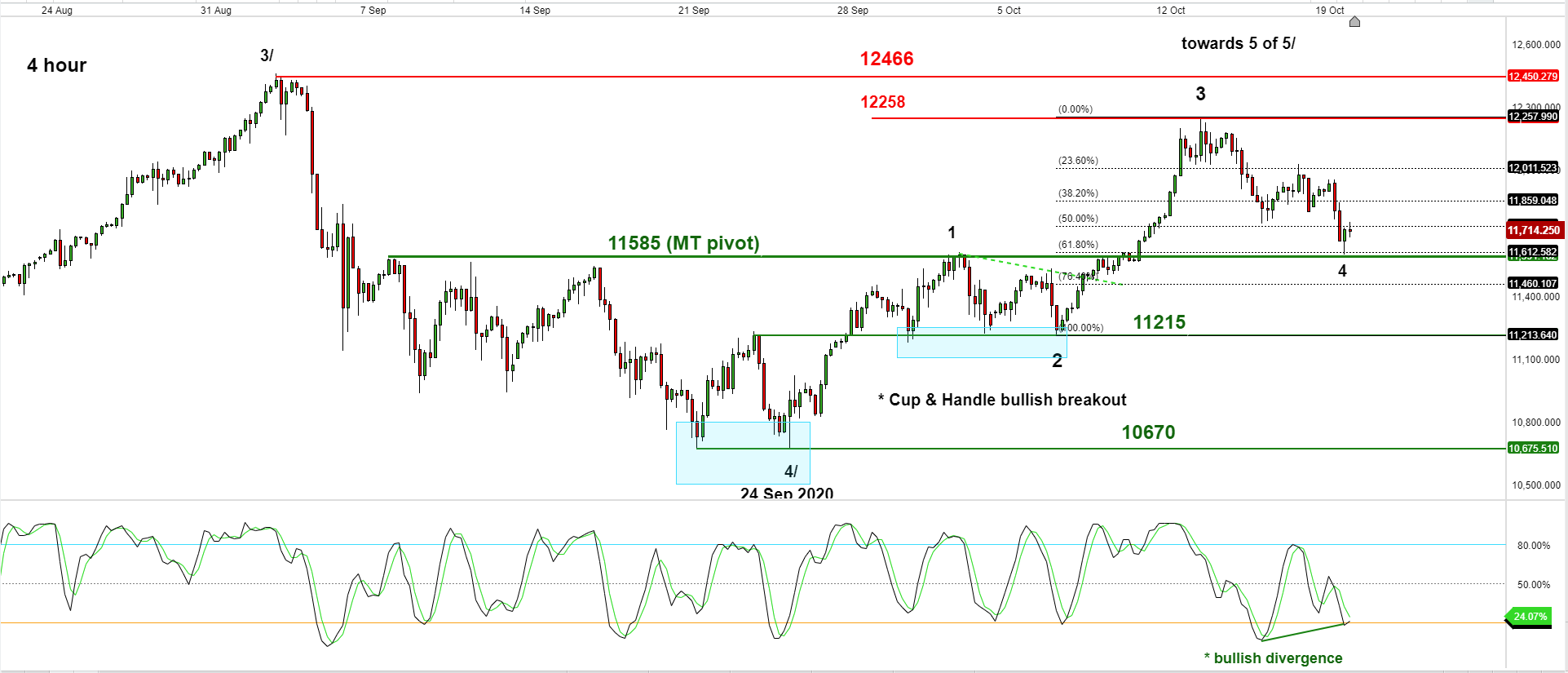

From a technical analysis perspective, the short-term uptrend in place since the 24 September low remains intact for the US stock indices futures; S&P 500 and Nasdaq 100 with key supports holding at 3,390 and 11,590/85 respectively.

Over to the foreign exchange market, the US dollar ended yesterday’s US session on a weaker footing against the major currencies. The US Dollar Index declined by -0.3%, but still remained above the 12 October swing low of 93.01. Also, Brexit deal optimism where, EU Brexit chief negotiator Michel Barnier commented that the EU remained “available to intensify negotiations in London” had failed to trigger a rally in the GBP/USD above the 1.3020 key short-term resistance, and downside pressure set in for the pair to erased its earlier gains and ended the US session at 1.2940.

Officials from Opec+ had painted a precarious outlook on oil demand due to rising pandemic infections across the globe and dropped hints about a potential change of policy next month. The coalition is set to add almost 2 million barrels a day from January 2021. WTI crude oil futures continued to trade sideways below a key short-term resistance at 41.72.

Events to watch

Netflix Q3 earnings after the close; revenue growth is expected to be at 22% from a similar period last year to nearly US$6.4 billion after a 25% growth rate seen in the June quarter. Consensus estimate for earnings per share is expected to be US$2.13. Another focus will be its guidance on its outlook and titles release schedules for late 2020 and early 2021.

US housing starts for September; consensus estimate is at 1.457 million above 1.416 million recorded in August and its 3-month average.

Chart of the day: Potential bullish reversal on US NDAQ 100 (Cash)

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.