In the US stock market this past week, many investors incorrectly used the term “capitulation” as the reason to pile into indices.

These investors thought capitulation related to the huge outflow of money from stocks that took place the week before. The “fear index” hit extreme levels. Furthermore, analysts highlighted the sharp increase in cash holdings, as cash reserves reached levels not seen since the period following the 9/11 attacks.

Initially, that looked like a promising sign for the market. The market rallied about 8% off the lows early in the week, but has already given a lot of those gains back. The below chart illustrates the S&P 500’s recent dip.

Bet on the monkeys

Financial planners tell passive investors to hold on for dear life, advising them to buy and hold because the market always comes back. But as Warren Buffett recently said, “you can have monkeys throwing darts at the page, but take away the management fees and everything, and I’ll bet on the monkeys”.

Looking at the macro picture, fewer than 30% of the S&P 500's constituent stocks have hit a one-year low, compared with nearly 50% during the growth scare in 2018 and 82% during the global financial crisis in 2008.

Those who mind their macros could infer we haven’t seen anything yet.

Moreover, junk bonds and high yield debt have not participated in any bounce since early April, as the below chart shows. To add insult to injury, US long bonds [TLT] are becoming a flight to safety after 10 months of decline, and despite a rising interest rate environment – now that’s capitulation.

Genuine concerns

The concerns over inflation and quantitative tightening are real. The recent retail sales report, which put annual growth in retail sales at 8.2%, was deceptive at best, as petrol stations accounted for 36.9% of that number. That’s hardly surprising considering the price of gasoline right now.

If one adjusts the retail sales number to the current consumer price index, retail sales growth would be negative year-on-year. Then add to the mix the dismal earnings and subsequent dive in the share prices of Walmart, Target and Costco, and you get a sense of the real issue. The consumer can’t be expected to save US gross domestic product, which contracted 1.4% in Q1.

Fed chair Jerome Powell, along with other committee members, were extremely talkative this past week. On Tuesday, Powell said: “What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that”.

He went on to say that the economy is strong – though retail and transportation sector ETFs may beg to differ. But my favorite line of Powell’s was that the USA is feeling “some pain”. Stagflation is clearly painful. One almost expected him to add, “there will be blood”.

US market outlook

Looking ahead, the market during stagflationary periods typically becomes a trading range market. Extreme lows are bought, while resistance levels are tougher to pierce.

Although the stampede to open new brokerage accounts by retail investors has waned, retail trading activity remains well above pre-pandemic levels. Retail investors continue to buy more stocks than they sell.

Technically, our target for the low end of the range in the S&P 500 ETF [SPY] has been 380. The recent low is 385. Should that level hold, we could see another attempt to rally the market from the buy-the-dip crowd. If SPY clears 420, perhaps the picture will change. Nevertheless, given the current macro context, should the 380-level break, 360 is the next likely target.

Further afield

Looking elsewhere, China is coming back from a strict Covid lockdown. President Xi continues to call for an easing of restrictions on tech companies, and quantitative easing is in progress. The China Large-Cap ETF [FXI] bottomed out in mid-March, and could represent a better place than the SPY to park money in the longer term.

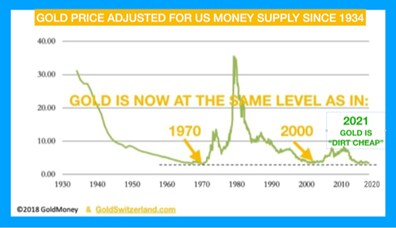

Speaking of parking money, although precious metals are under pressure, we could still get to the point where the ultimate safety play is in gold and silver. If food and oil prices continue to rise, precious metals may prove, as they have done historically, to be a good investment relative to the devaluing of fiat currencies.

Additionally, as the chart below illustrates, gold is as cheap today relative to US money supply as in 1971 when the price of gold was $35, and in 2000 when gold was $290.

Mish Schneider is MarketGauge’s director of trading education and research. Read more of her market analysis here, or visit marketgauge.com.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.