The US equity market had a volatile session on Friday as the US-China trade risk resurfaced to the top of the list of concerns.

Despite news that China’s Minister of Commerce had said a ‘constructive’ talk was being held and that cancellation of the visit to the US farm-belt had nothing to do with the trade negotiation, uncertainties that a meaningful trade deal could be reached any time soon remained high.

The next round of high-level trade talks is expected to be take place on 10th October, allowing a window period for the celebration of China’s 70th year anniversary.

Markets are walking on a tightrope now, with the fundamental outlook continuing to deteriorate globally but equity market valuations are elevated by central bank rate cuts and the prospect of restarting quantitative easing (QE). The volatility index VIX has come back to a relatively low level of 16.8, which rendered market sentiment fragile to another wave of shocks on the trade front.

Another factor that inhibits risk-taking is the Federal Reserve’s monetary policy. Last week’s Federal Open Market Committee (FOMC) delivered a widely-expected 25bps cut but Fed members are divided on future cuts and US economic outlook. The core personal consumption expenditure (PEC) inflation is expected to reach 1.8% on this Friday’s release, the number is moving closer to the Fed’s 2% long-term inflation target. Mild inflation and solid job market readings recently left the Fed little room to cut down interest rate further this year if there are really data-dependent.

AUD/USD is trading lower for a third day to 0.6772 as traders are expecting a Reserve Bank of Australia (RBA) rate cut to be delivered on the next policy meeting on 1st October and one more cut in December. A relatively strong US dollar and a clear RBA easing outlook will likely pave way for more AUD downside.

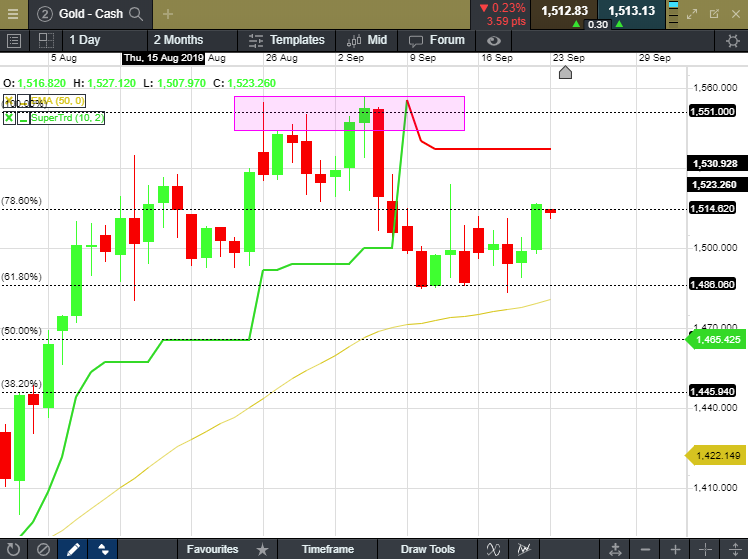

This morning, US equity futures edged higher and USD/JPY retraced lower to reflect a temporary relief of trade concerns. Gold price advanced to US$ 1,515 level last Friday and it is trading at the same level this morning. Technically, gold price is trading within a range between US$ 1,486 and US$ 1,514 and may face some selling pressure at the current traded level.

In Singapore, ‘defensive’ is likely to play out this week, with utilities, consumer staples and REITs outperforming cyclical industrials, banks and technologies. The Straits Times Index faces strong resistance at around 3,200 points.

Gold - Cash

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.