The second-largest Chinese e-commerce giant after Alibaba, JD.com is a US and Hong Kong dual-listed Chinese tech giant whose share price has spiralled downwards significantly in the past year due to regulatory crackdowns. However, its supply-chain and logistic businesses were more resilient than other Chinese e-commerce peers during the recent Covid lockdowns in China’s major cities.

Shrinking profit margin supported by growth of active users

JD.com managed to beat earnings expectations in the December 2021 quarter, reporting 275.9bn yuan in revenue, an increase of 23% over the same period from a year ago. However, the company has recorded a loss of 15.7bn yuan in the full year of 2021, a loss of more than 4bn yuan in 2020, where its gross profit margin shrank to 5.5% from 8.6% over the same period. While its retail income is still the primary contributor to total revenue, JD.com’s loss in its new business segment has widened in the prior quarter due to a reduction in government subsidy, rising expenses incurred in new hires, storage in warehouses, and transportation.

In the final quarter of 2021, the e-commerce giant has increased its annual active users by 20.7% to 569.7 million, 70% of which were from third-tier cities in China. At the same time, the total number of new third-party suppliers has outpaced the first three quarters of 2021. In addition, JD.com has added more than 25,000 new product brands, which translated to a growth of 150% in 2021.

To increase its profit margin, JD.com has reduced its Jingxipinpin’s coverage; a group shopping app to four provinces from more than 20. All in all, whether the revenue generated from the retail business can pay off its new business investments is going to be a key gauge for its upcoming earnings report. Analysts expect JD.com’s earnings will be at US$0.34 per share, down 10% from a year ago, with net sales of US$36.5 billion, up 18% annually.

A resilient logistic business during Shanghai’s lockdown

According to Goldman Sachs, JD.com’s sales have slumped by 3% in March due to the recent Covid lockdowns in China which may have negatively affected its revenue for the first quarter. On a positive note, JD.com’s daily delivery volume has gone back to 80% of its pre-lockdown level in Shanghai at the end of April, much more resilient than its retail-wholesale peers, thanks to the 1P+3P (Direct sales + Market Place) business model which could indicate positive guidance for the second quarter.

Technical analysis – Mixed elements for JD.com, watch 41.60 & 66.65

Since hitting a 52-week low of 41.63 on 14 March, the share price of JD.com ADR (JD) has traded within a sideways range configuration. Technical elements are mixed at this juncture; on a positive note, the recent price decline since 6 May has been accompanied by a declining volume reading, which is lower than the previous down leg from 3 March to 14 March and indicates an absence of significant downside pressure.

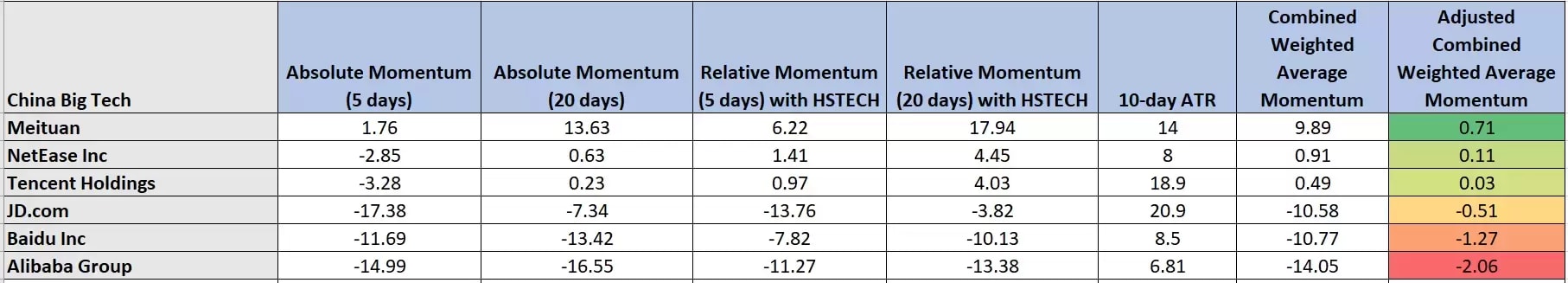

On the other hand, the daily RSI oscillator has remained capped below the key corresponding resistance at the 58% level. In addition, its adjusted combined weightage average momentum score has remained lackluster at -0.51 versus the rest of the major China big tech platforms/gaming firms based on data as of 13 May.

Some investors may prefer to adopt a neutral stance at this juncture between 66.65 and 41.60. Only a clearance above 66.65 may ignite a potential multi-week push up towards the next resistance at 80.65 in the first step (the descending trendline from its 17 February 2021 ATH and swing highs of 9 December 2021 & 20 January). On the flip side, a break with a daily close below 41.60 opens up scope for another impulsive down move, towards the next supports at 31.60/27.90 and 27.90/25.80.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.