US dollar index fell nearly 0.4% after the Fed’s decision to cut policy rates for a third time this year, and expect to maintain the current rate for an extended period of time.

Fed chairman suggested the current monetary policy is ‘in a good place’ and risks associated with trade tensions and Brexit show signs of improving.

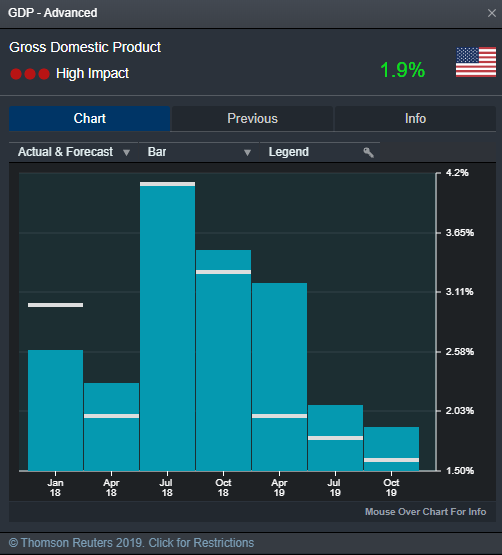

A hawkish-biased rate cut gave markets much needed clarity of the Fed’s future path, and equities advanced to record highs overnight. In the macro picture, a 1.9% GDP growth in the third quarter further boosted investor’s confidence, defying fears of an immediate recession.

Even though the advanced 3Q GDP estimate came above consensus forecast of 1.6%, it still marks the slowest pace of growth for the US economy in more than three years. This is largely attributed to lower non-residential fixed investment and private inventory investment, which were underpinned by robust consumer and Federal government spending.

The S&P 500 index rebounded 0.32% to close at record high of 3,046 points. Sector wise, utilities (+0.87%), healthcare (+0.78%) and real estate (+0.62%) were leading whereas energy (-2.12%) was the main drag as oil prices fell 0.8% last night.

A weekly report from the Energy Information Administration (EIA) suggested that US commercial crude inventory added a whopping 5.7 million barrels last week, far more than the forecasted 0.5 million barrels increase. This put weight on crude oil prices, which fell for a third day.

Markets has assumed the demand side to remain weak in the foreseeable future as global cyclical slowdown deepens. Fading optimism over a US-China phase-one deal further weighed on oil prices as trade risks set to rise.

Chile has cancelled the November APEC meeting last night and investors put a question mark over the possibility of a Trump-Xi meeting next month. Nonetheless, I believe that if the leaders are serious about signing an interim trade deal, they could always create an opportunity to meet. The occasion is less of a major factor when it comes to a US$40-50 billion deal.

Against the backdrop of African swine fever, which led to soaring pork price in the Greater China area, Beijing is perhaps more willing to sign an agricultural deal with Washington than six month ago, to meet its domestic meat demand. As we approach Chinese New Year, the urgency of purchasing from overseas markets is set to rise as the seasonal peak for food and meat arrives.

US GDP – Advanced

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.