5 most traded currency pairs

Published on: 26/01/2022 | Modified on: 16/09/2022

The most traded currencies in the world come from multiple continents and they belong to some of the strongest economies. These include major forex pairs, as well as "safe haven" currencies and those with historically stable trade links. This article is a guide to five of the most traded currency pairs on our platform.

The foreign exchange market is the largest and most liquid market in the world. It offers exchanges between any two nation’s currencies and includes major, minor and exotic currencies. The result is a market that offers hundreds of possible currency pairs to trade. At CMC Markets, we offer 300+ pairs to trade, so continue reading to learn more.

KEY POINTS

- The foreign exchange market is the largest and most liquid market in the world

- The United States dollar (USD) is the most commonly traded tender

- Some of the most traded pairs include GBP/USD, USD/JPY and EUR/GBP

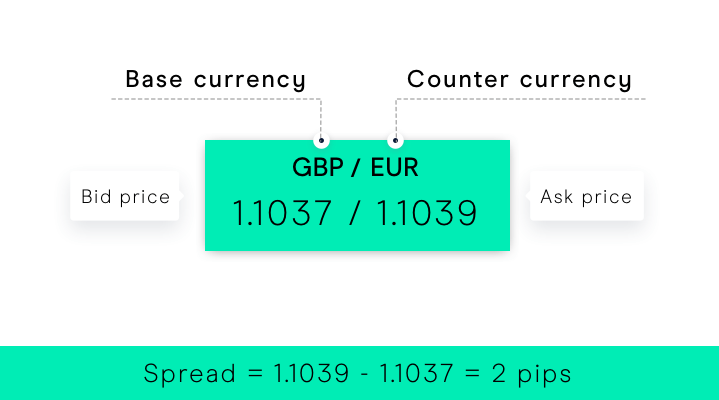

- Major forex pairs in particular provide more liquidity and come with lower spreads and margin rates

- We offer the highest number of currency pairs in the industry available to trade*