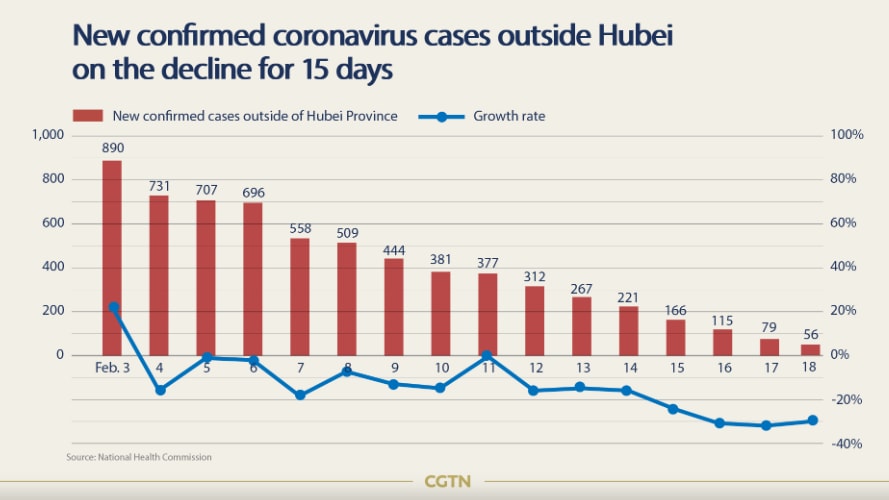

Asian equities rebounded on Wednesday as newly confirmed Covid-19 cases outside of Hubei declined for 15 consecutive days, with only 56 confirmed cases added on Tuesday.

This suggests that the spread is contained in major parts of China, which points to a faster recovery in business activities and the consumer market. Even so, the situation within Hubei province remains pivotal.

The US dollar index extended its rally due to resilience in the US economy versus the rest of the world as well as the monetary disparity created by central banks in the region that are getting hurt by Covid-19. This has strengthened the dollar’s status as a safe-haven currency.

US markets took a hit last night on Apple’s revenue warning and this is one of the very few early evidences of real impact on US corporate earnings. This serves as a ‘wake-up call’ to investors who previously overlooked the impact of Covid-19 or believed that the impact would be limited to the Greater China region.

Expectations may also needs to be revised for Apple’s massive network ofsuppliers, including semiconductor, optical devices, and manufacturing sites around the world. A ‘knock on’ effect may be seen in companies like Qualcomm, Samsung, Sunny Optical, Hon Hai Precision Industry, Intel, Micron and more.

Other companies with significant exposure to China’s consumer market may also see a turbulent quarter ahead.

Covid-19 has distorted consumer’s behaviour in the short-term but this could well prove to be temporary just like what happened during SARS back in 2003. Demand rebounded sharply in the months following the end of the SARS crisis and the employment market went back to normal levels.

This time around, investors are expecting a fiscal boost to be carried out by Chinese policymakers. However, doubt remains on the effectiveness of such a boost in the short term as there is no guarantee that anyone would take on extra borrowing at a time when consumer activity is on the cautious side. And corporate leverage is at a much higher level compared to 2003.

Chinese banks may have to extend credit facilities to those vulnerable companies with their margins likely squeezed by lower interest rates. Asset quality is under pressure as well.

While the overall impact is negative, Covid-19 has brought opportunities to healthcare and digital services, such as grocery delivery, gaming, e-learning and remote-work software.

New confirmed coronavirus cases outside Hubei on the decline for 15 days

Source: CGTN

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.