Indices in North America and Europe rallied Tuesday, boosted by positive earnings reports and commodity price rallies. The big gains posted by stocks in the early part of 2017 had ramped up expectations dramatically. A number of major companies have stepped up to meet the challenge this quarter, beating the street handily to provide fundamental support to the market rally.

On Tuesday, Caterpillar rallied 5.6% after beating the street and raising guidance for both sales and earnings. McDonalds gained 5.1% and Dupont rose 1.3% after posting positive earnings reports. There were some disappointments, however. The NASDAQ underperformed its peers as Google fell 2.8% following its earnings report while Seagate technology plunged 16.5% following and earnings miss. More positive reports came out after today’s US close, led by Canadian National Railway.

The top performing sectors on the day were Energy, Financials and Materials, boosted by rising commodity prices. Crude oil soared for a second straight day as energy sector earnings reports indicated that US shale production may not come on a quickly as had been thought. Following on from comments about soft demand for oilfield services from Halliburton, Anadarko Petroleum cut its 2017 capital budget. With more Big Oil majors reporting this week, we may get a better idea of whether this is a one off cut or a sign of wider cutbacks in exploration spending. Late in the day, API reported a huge 10.2 mmbbl decrease in US oil inventories further supporting the rally heading toward tomorrow’s DOE reports.

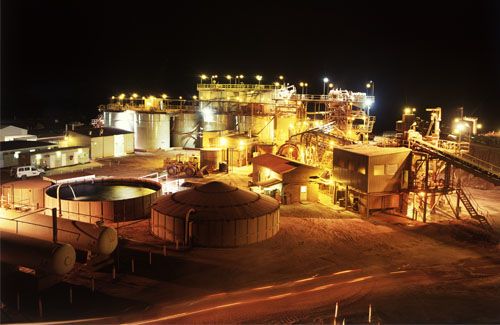

Copper also soared, with a 3.5% gain on the day igniting rallies in base metal stocks including Freeport in the US which spiked 14.5%, and First Quantum in Canada which gained 8.4%. Indices with higher resource weightings like the FTSE and S&P/TSX (up 0.75% and 0.55% respectively) outperformed, potentially setting the stage for positive sentiment toward the Australian market today.

Currencies have been steady with CAD and AUD both still hanging around US$0.8000. Australia inflation and New Zealand trade may attract some attention, although the main focus for currency traders remains on tomorrow’s FOMC meeting. No change is expected and the way the US dollar has dropped since the last meeting, it would appear the street is anticipating a less hawkish Fed this time around. With another rate hike unlikely until the US sorts out its budget and debt ceiling, comments related to shrinking the Fed’s balance sheet may attract the most attention.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.