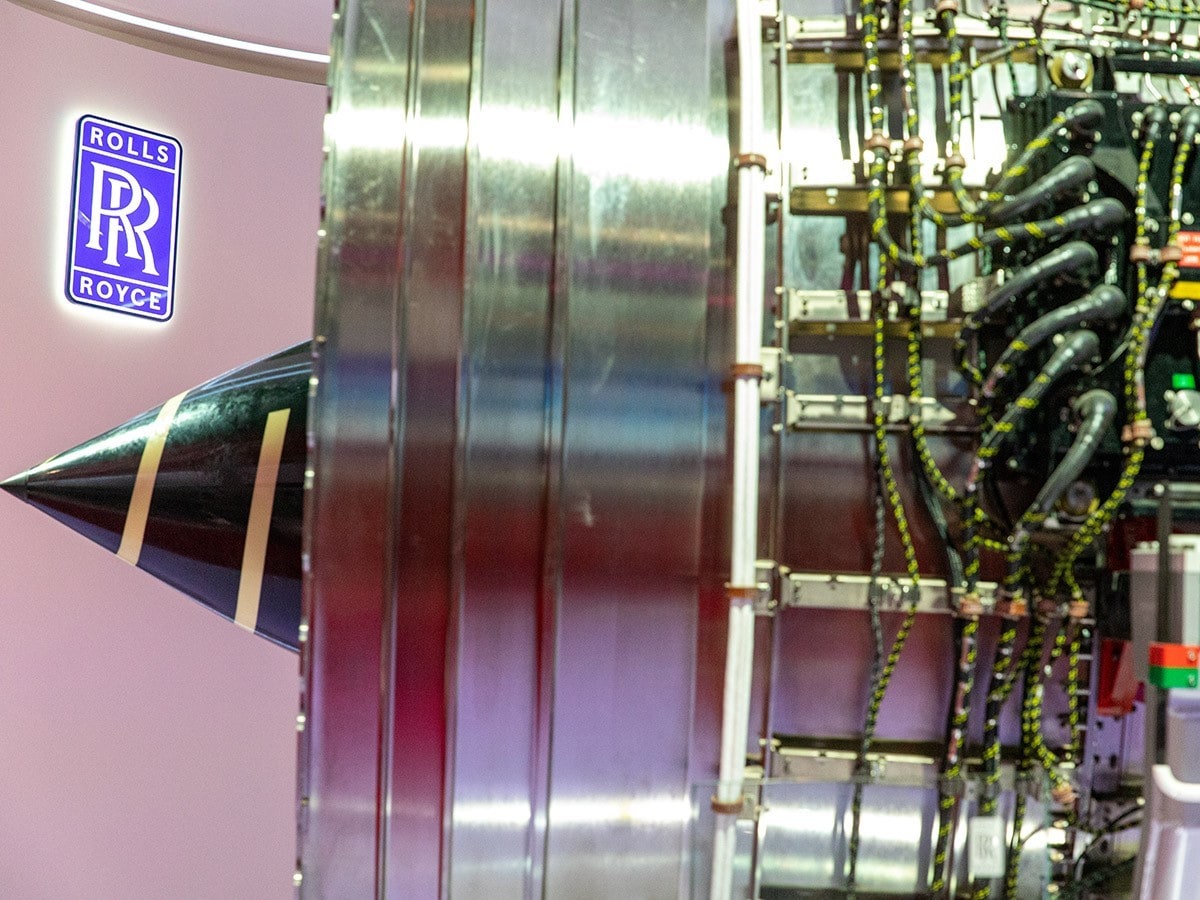

The Rolls-Royce share price was already in serious difficulty even before the pandemic came blowing in from China a year ago, well down from its 2018 peaks. Problems with its Trent 1000 engine, which powered the Boeing 787 Dreamliner, caused the company to post a £2.9bn operating loss in its 2018 full-year numbers, followed by a loss of £850m in 2019.

Today’s full-year results haven’t been any better, which isn’t too much of a surprise given the virtual grounding of civil air travel which almost delivered a final coup de grace to the business last year.

Rolls-Royce share price rebounds from 17-year lows

At one point there was some concern as to whether this iconic British brand would be able to survive the collapse in air miles as a result of the pandemic. Management has gone to great lengths to deal with the company's cash flow problem in order to get the business through to the other side of the pandemic.

The launch of a £1bn bond issue, as well as a £2bn 10-for-3 rights issue at a 41% discount to 130p, was eventually taken up by shareholders, and along with the progress on the vaccine rollout there's been a decent rebound in the Rolls-Royce share price from the 17-year lows of September last year. The Rolls-Royce share price has been rising steadily since mid-February, currently sitting just below 117p.

The company still isn’t out of the woods yet, announcing that it is likely going to have shut its factories in the summer for two weeks to help stem the losses.

Huge operating loss reported

This morning’s operating loss of £2.1bn is almost identical to the amount we saw in 2018, and while the size of that loss is certainly sobering, unlike last year optimism is probably in shorter supply due to the uncertainty about when air travel is likely to return to any kind of normal.

If the operating loss wasn’t bad enough, when other costs are added the loss balloons to an even bigger £4bn due to the addition of other charges, including a £1.7bn underlying finance charge related to its FX hedge book, due to lower US dollar receipts in 2020, as well as future years.

This morning’s full-year results only serve to reinforce the scale of the challenge facing the civil aerospace side of the business. However at least revenues have been a little bit better than was expected, coming in at £11.76bn, still well below the £15.45bn of 2019, but certainly much better than had originally been feared back in the late-summer of last year.

Rolls-Royce's free cash outflow remains high

Free cash outflow for the last tax year came in at an eye-wateringly high £4.18bn.

At its last trading update the company estimated a free cash outflow of £2bn for 2021, which was based on wide-body engine flying hours at 55% of the levels of 2019, with an expectation of turning cash flow positive at the end of the second half of this fiscal year, with positive free cash flow of £750m in 2022, based on engine flying hours at 80% of 2019 levels.

This expectation hasn’t changed, even though it comes across as very optimistic. Since Rolls-Royce made that assessment, air travel has remained very much in the doldrums due to the Europe-wide lockdowns that have been in place since the beginning of January and is unlikely to return to even a semblance of normal, given the government's slow repopening policy.

Rolls-Royce brand takes a hit after three years of losses

This morning’s numbers are a sobering reminder of how much damage the pandemic has done to an iconic brand, and also illustrate how hard the long road back will be. With normal service in civil aviation likely to take years to return to normal, it will be more important than ever that Rolls-Royce steps up in other areas of its business to offset the revenue hit to civil aviation over the next few years, and get greater returns there.

The hope is that investors and shareholders retain the patience seen so far in terms of the rally in the share price off last year's multiyear lows. Initial indications would appear to be that perhaps the worst is behind the Rolls-Royce share price, and that after three years of huge losses that in the words of the song by D-Ream, "things can only get better".

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.