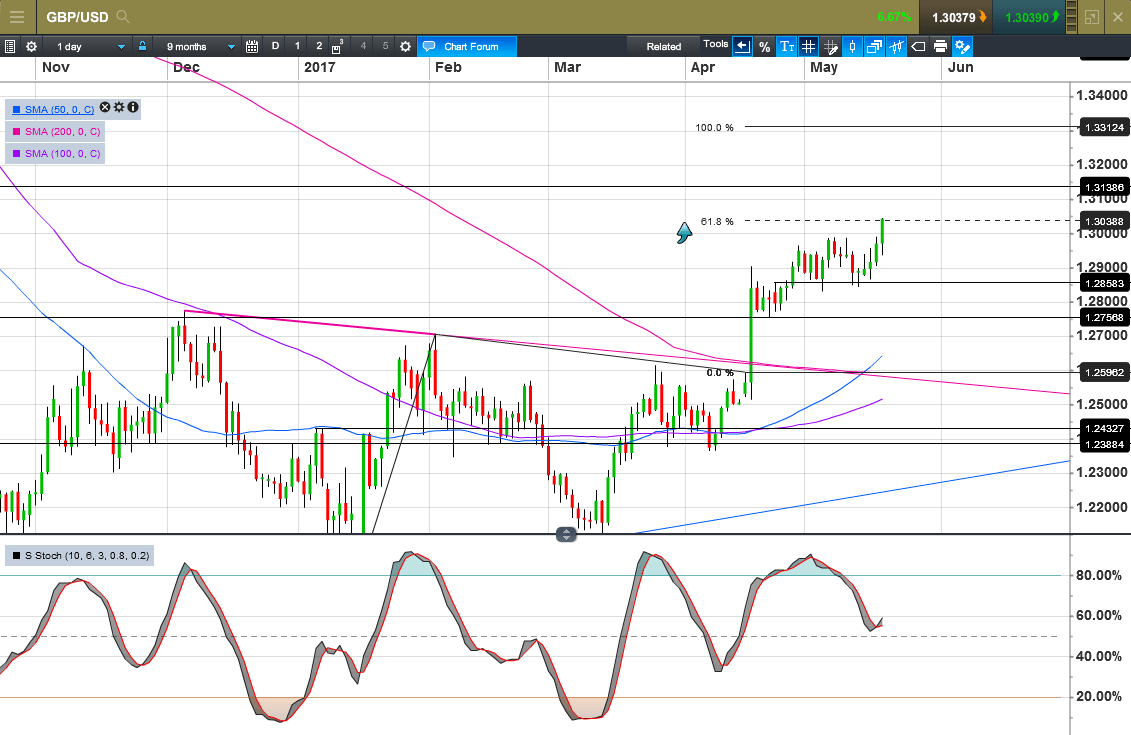

It’s taken a while but the pound has finally cracked the 1.3000 area for the first time since last September, something that we suggested might happen in April when the pound broke out of its triangular consolidation last month that it had been trading in since December last year.

So what now, having seen the pound finally hit the 1.3040 level which was the 61.8% projection initial target. Is there scope for further gains, in spite of continued bearishness surrounding the currency?

The short answer to that is yes, with 1.3310 the next potential target, while above the 1.2830 area, as a number of indicators align for a move higher, with a golden cross bullish signal also signalling a potential change of trend.

A golden cross is when the 50 day short term moving average crosses above the long term 200 day moving average, and while it is not an arbiter of a definitive move, used in conjunction with other signals it adds further weight to a possible long term change of direction.

Today’s retail sales numbers for April blew away expectations rising 2.3% for the month, as consumers reopened their wallets after reining back in March which saw a 1.4% decline.

The March revision from -1.8% to -1.4% is also likely to have a modestly positive effect on any Q1 GDP adjustment, while these April numbers will give a decent boost the Q2 numbers when they are released in July.

Inflation is also likely to remain on the high side and while the link between prices and average earnings could well weigh on the pound to some degree, with unemployment at 42 year lows, the pressure on wages is likely to be more to the upside than downside.

As we suggested in April the Trump reflation trade appears to be in trouble with a big decline in the US dollar in recent days, which may affect any decision in June by the US Federal Reserve about interest rate policy over the rest of the year.

Financial markets are still pricing a rate rise in June, and while that still remains a likely scenario it’s not the done deal markets thought it was a week ago, given the risk reassessment being seen amongst investors in response to events of the last 24 hours.

This would suggest that the US dollar could be vulnerable to further weakness, which can only help under pin the pound.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.